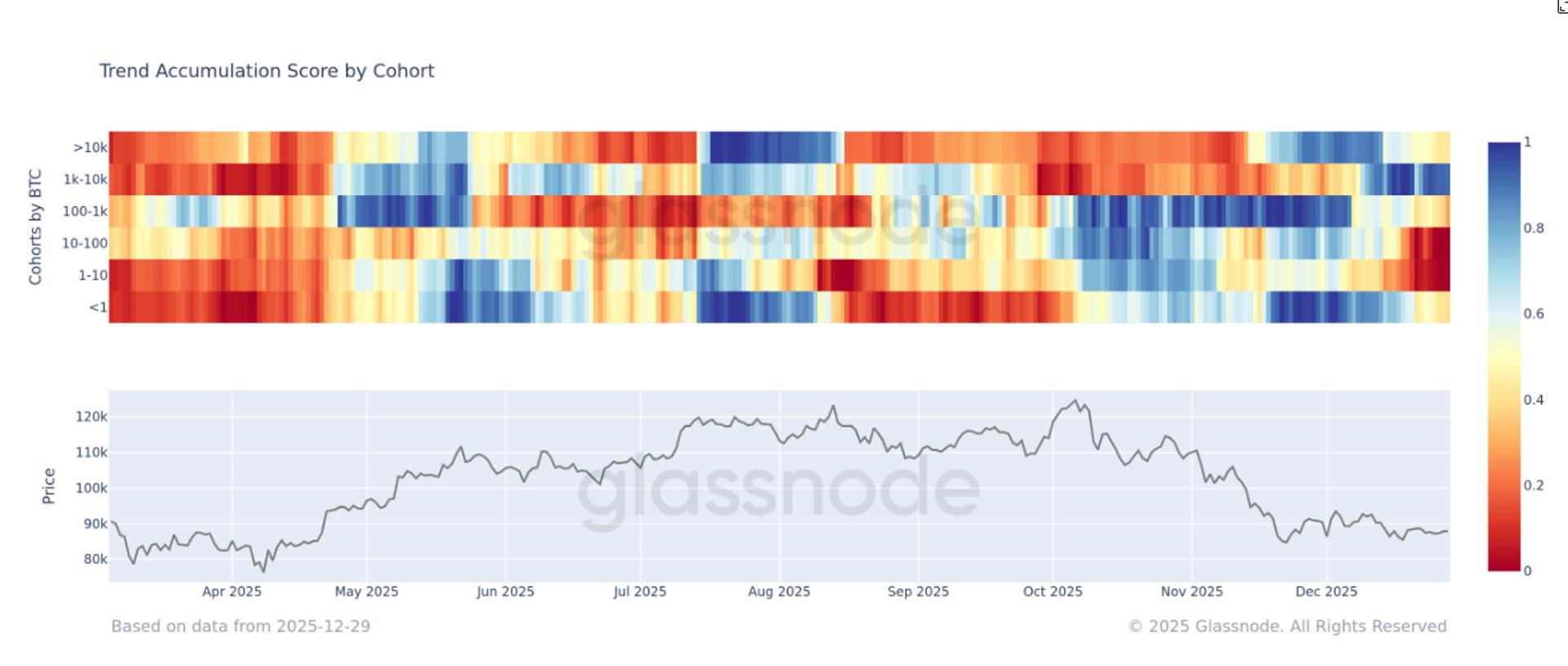

Bitcoin whales, defined as holders possessing at least 1,000 BTC, have emerged as the primary purchasers since the leading cryptocurrency hit a low of around $80,000 at the end of November, based on Glassnode data. They continue to be significant accumulators as bitcoin hovers just under $90,000.

According to the same data from Glassnode, the 1,000-10,000 BTC category is the only segment displaying consistent accumulation, boasting an Accumulation Trend Score nearing 1.

This metric analyzes purchasing and selling patterns across various wallet groups, assessing both the entity sizes and the net quantity of bitcoin they’ve gained over the last 15 days. A score trending closer to 1 indicates accumulation, while a score near 0 points to distribution.

Indicators imply that large holders have been amassing bitcoin in the $80,000 range, a pricing tier that bitcoin has not frequented for an extensive time relative to other price brackets.

This activity sharply contrasts with that of smaller holders, who exhibit varying levels of distribution.

With the Crypto Fear and Greed Index remaining in “fear” or “extreme fear” for about the last 30 days, selling pressure from smaller entities likely indicates capitulation.

On the other hand, the 10,000-plus BTC whale category was aggressively acquiring when bitcoin was priced near $80,000 in late November, though their buying activity has started to decelerate recently. Still, this group has not engaged in selling, which was the prevalent trend when BTC peaked above $100,000 mid-year.