Chainlink (LINK) has emerged as a strong contender in the market, experiencing a rally of over 109% in the past year. In the last three months, the LINK price has surged approximately 68.5%.

However, the past week has shown some weaknesses, with the token dropping over 9%. On-chain metrics and technical charts indicate that the year-long uptrend may be losing momentum, at least temporarily.

Profit-Taking Pressures Increase As Holders Benefit

One evident sign is the percentage of LINK supply currently in profit, which remains at historically elevated levels.

As of August 29, nearly 87.4% of the circulating supply is in profit, close to the recent high of 97.5% reached on August 20. This peak corresponded with the LINK price climbing to $26.45, which quickly retraced over 6% to $24.82 the following day.

A review of earlier data reveals a similar trend. On July 27, the percentage of supply in profit was 82.8%, just before LINK corrected from $19.23 to $15.65, marking a 19% drop. The current level near 87% is again alarmingly high, suggesting increased risks of profit-taking.

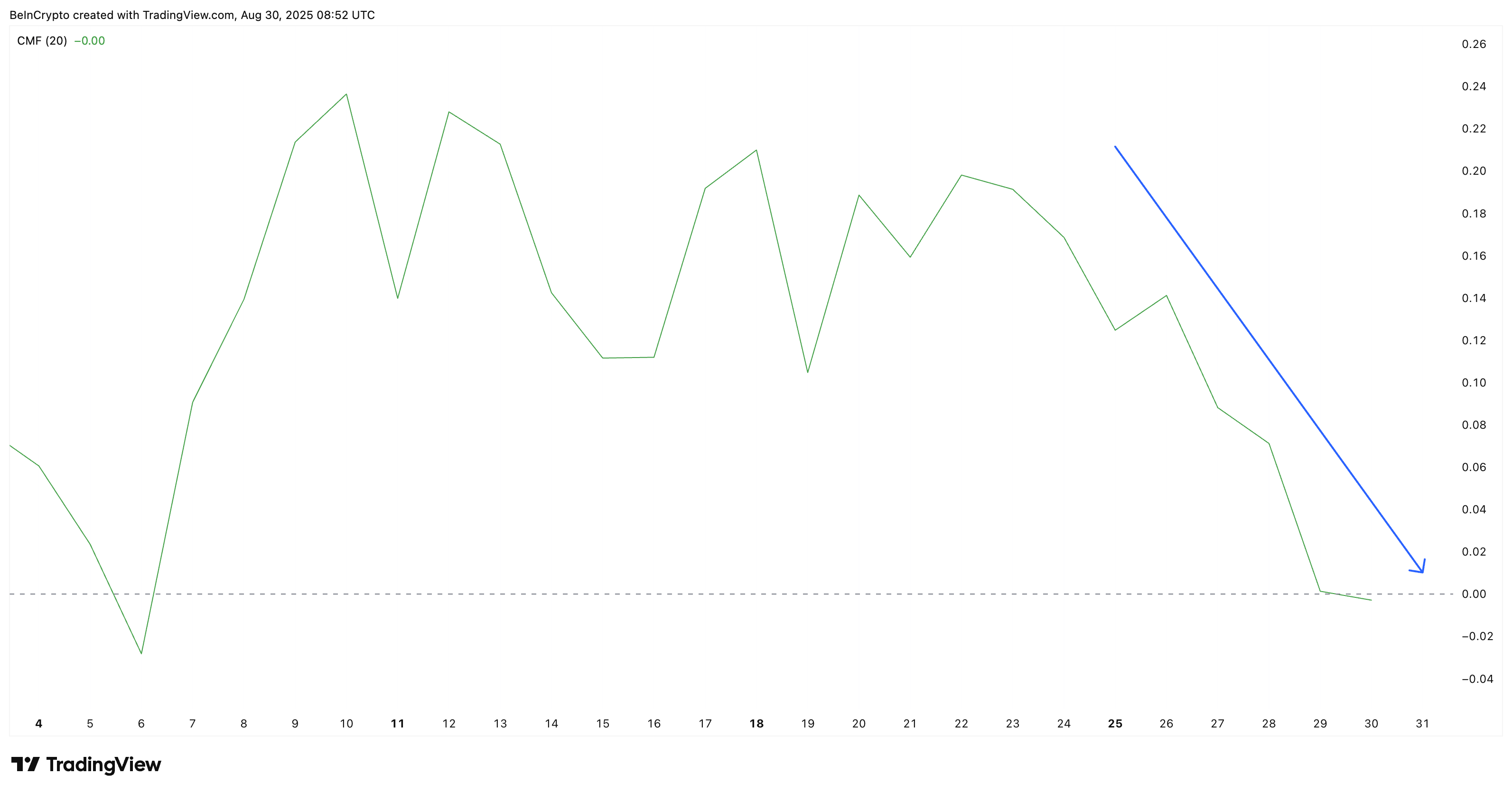

Additionally, the Chaikin Money Flow (CMF), which monitors capital inflows and outflows, has been declining since August 22 and dipped below zero on August 29 for the first time since August 6. This negative shift indicates diminishing buying pressure and capital inflows, further supporting the possibility of a pullback.

For token TA and market updates: Interested in more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Chainlink (LINK) Price Action Suggests Bearish Exhaustion

The daily chart reinforces this caution. The LINK price is currently at $23.31, positioned within an ascending broadening wedge pattern—a structure often linked to a loss of upward momentum towards the end of a bullish trend. This “megaphone” pattern is notorious for triggering bearish reversals, a risk that currently hangs over LINK.

The crucial support to monitor is $22.84. A decisive break below this level would expose the next downside target at $21.36, and falling below that could lead to a deeper retracement, potentially ranging from 6% to 19%, similar to previous “Supply In Profit” peaks.

Conversely, if the LINK price succeeds in reclaiming $25.96, it may attempt another upward move.

However, even such a recovery would not fully negate the broader exhaustion signs unless the token convincingly breaks above $27.88.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article serves informational purposes only and should not be seen as financial or investment advice. BeInCrypto is dedicated to accurate, unbiased reporting, but market conditions can change without notice. Always perform your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.