This week, the capacity of the Lightning Network reached a new peak as major exchanges increased their Bitcoin holdings in off-chain channels, enhancing the total liquidity of the network and altering the way users transact with BTC.

Related Reading

Exchange Support Fuels Capacity Growth

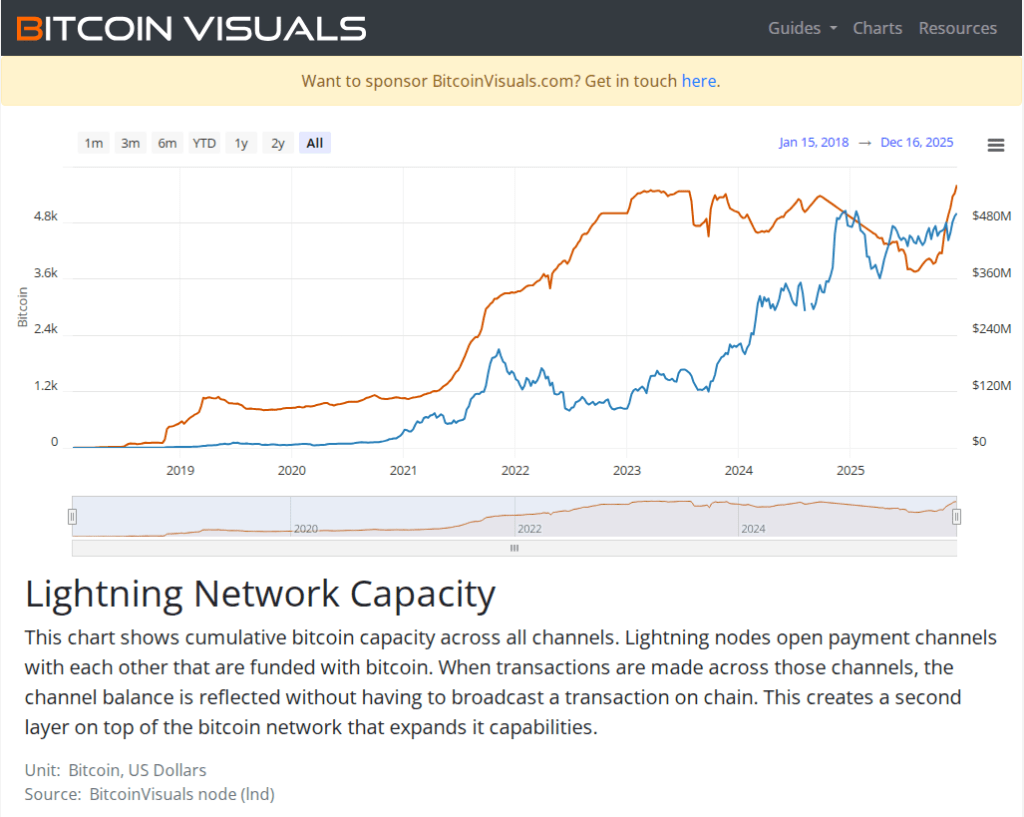

As per reports, the public capacity of the Lightning Network surged to approximately 5,606 BTC, with certain trackers even recording a peak close to 5,637 BTC. This marks a significant increase from previous levels and stands as the highest total documented to date.

Exchanges such as Binance and OKX have been identified as key players in adding Bitcoin to Lightning channels, while other platforms like Kraken and Bitfinex are expanding their support as well. These additional resources are intended to expedite deposits and withdrawals while reducing fees for customers.

Activity in the Network vs. Public Nodes

Despite the increase in capacity, there hasn’t been a significant rise in the number of public nodes or channels, according to reports. The count of public nodes is around 14,940, while public channels total approximately 48,678.

This implies that while more Bitcoin is accessible within the network, the amount of participants managing this traffic hasn’t grown similarly. Much of this additional liquidity is concentrated in larger custodial channels operated by exchanges, capable of transferring significant amounts without establishing many new public routes.

This scenario complicates the interpretation of on-chain metrics. While transaction volumes and on-chain fee savings indicate tangible user benefits, the node graph appears stable.

An alternative metric demonstrating real utilization is the percentage of exchange traffic routed through Lightning. According to reports, one exchange has funneled approximately 15% of its Bitcoin transactions via Lightning after implementing Lightning integrations, highlighting significant operational shifts at major platforms.

Emerging Use Cases and Investment

As capacity expands, funding and protocol developments are also on the rise. Tether spearheaded a funding round that secured around $8 million for a startup specializing in payments through Lightning, reflecting heightened interest in stablecoin transactions on the network.

We are excited to announce Taproot Assets v0.7, which includes reusable addresses, an auditable asset supply, and improved transaction reliability. ✅

This update lays the groundwork for facilitating trillions of dollars in Bitcoin and Lightning transactions. 💸

Learn more below and upgrade today!

— Lightning Labs⚡️🌐 (@lightning) December 16, 2025

Protocol enhancements—such as those addressing Taproot-related asset handling and overall reliability—are being introduced to support a wider variety of payments and token types. These advancements indicate that Lightning is evolving beyond just microtransactions, encompassing remittances, merchant payments, and stablecoin transfers.

Related Reading

Analysts suggest that this combination of exchange liquidity, developer improvements, and increased platform usage could position Lightning as a more practical solution for daily BTC transactions.

Nonetheless, some critics caution that increased dependence on custodial channels could lead to centralization concerns and obscure the visibility of genuine peer-to-peer routing. Others argue that the enhanced user experience, reduced costs, and quicker transaction finality will be the primary benefits noticed by everyday users.

Featured image from Unsplash, chart from TradingView