In July 2025, U.S. President Donald Trump signed a significant piece of legislation focused on cryptocurrency, marking the culmination of a prolonged effort to establish specific rules for the crypto sector. The president’s endorsement on July 18, 2025, initiated a federal regulatory process aimed at defining and enforcing regulations related to stablecoins, a minor yet notable component of the expansive crypto landscape.

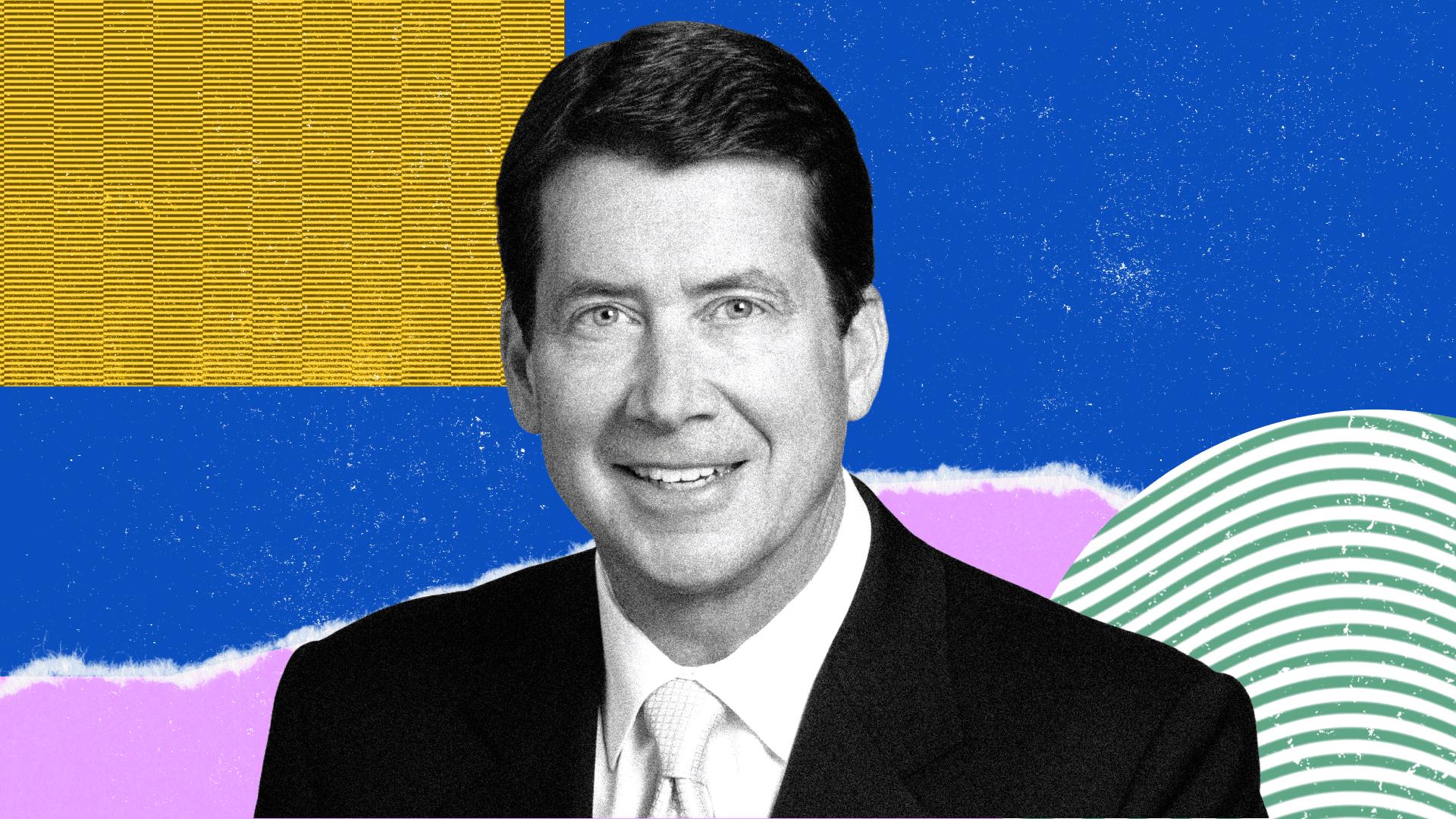

Senator Bill Hagerty, a Tennessee Republican, proposed the Guiding and Establishing National Innovation for U.S. Stablecoins Act — commonly referred to as the GENIUS Act — in February. This legislation set out regulations for stablecoin issuers seeking to operate in the U.S. and instructed federal banking and financial authorities to formulate precise guidelines for these entities.

Hagerty was part of a bipartisan group of lawmakers, including both Republicans and Democrats, who worked on the bill, advancing it through committee discussions, the Senate, and finally the House of Representatives, which had initially sponsored its own stablecoin legislation before adopting the Senate’s version.

During his address at Bitcoin 2025 in Las Vegas earlier this year, Hagerty described the bill as one of the most bipartisan outcomes from the Senate Banking Committee in the last ten years.

“It required an enormous amount of effort,” he noted during a panel discussion prior to the bill’s passage. He asserted that the legislation would mitigate counterparty risk, lower transaction costs, and reduce the working capital needed for managing accounts receivable.

“When I consider the main advantages for my colleagues—the cost efficiencies—it’s all beneficial,” he remarked about the legislation. “However, considering its impact on dollar supremacy globally, the dollar has been the world’s reserve currency, and we have observed a gradual decline in that status. This will reverse that trend and restore our position.”

As stablecoins rapidly gain traction in the crypto market, new issuers are continuously entering the space, and projections suggest a potential market cap nearing $2 trillion by the decade’s conclusion, according to various analyses.