This week, Binance founder Changpeng Zhao (CZ) attended the fifth anniversary celebration of BNB Chain in Tokyo.

In parallel, Japan Post Bank is set to activate its ¥190 trillion ($1.29 trillion) in deposits by launching a digital currency for trading blockchain-based financial products.

CZ from Binance Claims DeFi Will Surpass Centralized Trading as Japan Embraces Web3

During his fireside chat, Changpeng Zhao highlighted that the driving force behind BNB Chain’s achievements is its community, not just one individual.

“The chain is supported by a small tech team and is largely community-driven. My role is minimal; I just post tweets and encourage development. I serve as a cheerleader,” he stated.

With over 4,000 decentralized applications currently operational, including PancakeSwap and Aster, BNB Chain has established itself as one of the largest ecosystems in the field.

CZ remarked that stablecoin adoption has almost doubled this year. At the same time, real-world assets (RWAs) are emerging, despite facing regulatory and liquidity hurdles.

While he acknowledged possessing a significant quantity of BNB tokens, CZ expressed his belief that decentralized finance (DeFi) will outpace centralized exchanges.

“DEX volumes are likely to surpass CEX in the future. DeFi represents our future. Additionally, normal trading should prioritize privacy,” he mentioned.

If starting anew today, CZ declared he would concentrate on creating an AI-driven trading agent and a privacy-preserving perpetual DEX. He also identified RWAs and stablecoins as significant opportunities.

“Securities, treasuries, and commodities possess enormous potential. Yet, regulation, KYC, and liquidity remain substantial challenges,” he acknowledged.

Amidst these developments, the Binance executive showcased BNB Chain’s investment in partnerships with issuers such as Securitize and Backed.

He argued that Japan is well-equipped to take a leading position in the upcoming phase of Web3.

“I would love to see a dedicated BNB Chain team situated here, and more initiatives that merge robotics, AI, and Web3,” CZ expressed.

Japan Post Bank’s Initiative for Digital Currency

While CZ contemplated the future landscape of global DeFi, Japan’s financial sector is gearing up for a transformation of its own.

Japan Post Bank announced plans to launch the DCJPY digital currency in fiscal 2026. This initiative will allow depositors to instantly convert their savings into digital currency for trading blockchain-based assets.

According to local media, the bank manages ¥190 trillion ($1.29 trillion) in deposits across 120 million accounts. By integrating blockchain technology into its core services, the bank aims to revitalize inactive accounts and attract a younger clientele.

The DCJPY, developed by DeCurret DCP, will be pegged 1:1 to the yen and will be used for purchasing security tokens and NFTs (non-fungible tokens).

This move could greatly enhance trading efficiency through the facilitation of instantaneous settlement of tokenized securities. Japan Post Bank also envisions utilizing DCJPY for distributing government subsidies and grants, further embedding digital currency into everyday life.

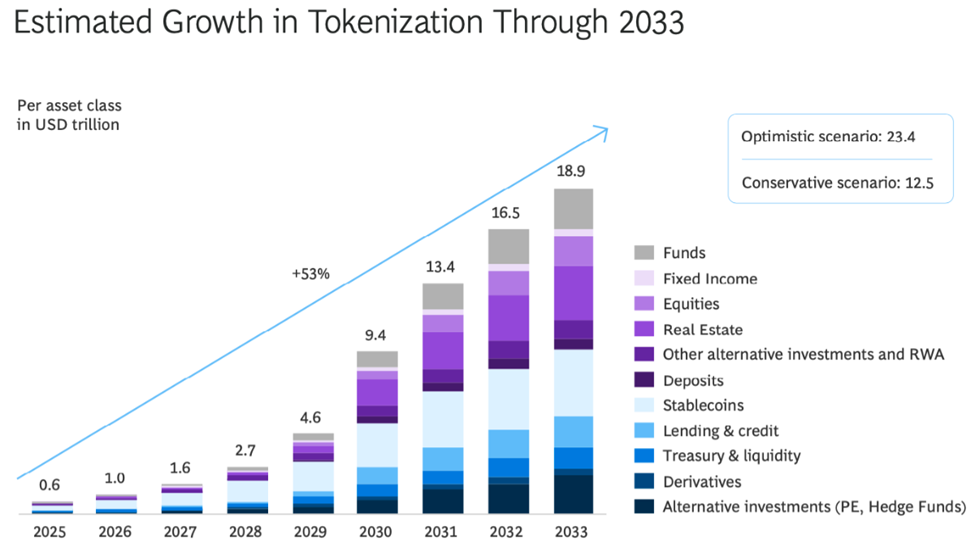

Additionally, a report from the Boston Consulting Group and Ripple indicates that the tokenized RWA market could grow from $600 billion in 2025 to $18.9 trillion by 2033.

Based on these insights, both CZ and Japan Post Bank are poised to seize this opportunity.

From the decentralized community of BNB Chain to Japan’s government-backed digital currency, Tokyo is evolving into a hub where Web3 principles and institutional innovation merge.

Disclaimer

In alignment with the Trust Project guidelines, BeInCrypto is dedicated to impartial, transparent reporting. This news article aims to provide precise, timely information. However, readers are encouraged to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.