Changpeng Zhao (CZ), the founder of Binance, attended the BNB Chain’s fifth-anniversary celebration in Tokyo this week.

In addition, Japan Post Bank is set to utilize its ¥190 trillion ($1.29 trillion) in deposits by launching a digital currency aimed at facilitating the trading of blockchain-based financial products.

CZ from Binance Claims DeFi Will Surpass Centralized Trading Amid Japan’s Web3 Expansion

During his discussion, Changpeng Zhao highlighted that the BNB Chain’s achievements stem from its community efforts rather than any one person’s contributions.

“The chain operates with a compact tech team and is heavily community-oriented. My role is minimal; I primarily tweet and motivate people to build. I consider myself a cheerleader,” he stated.

With over 4,000 decentralized applications active, including PancakeSwap and Aster, BNB Chain has established itself as one of the dominant ecosystems in the sector.

CZ observed that stablecoin utilization has nearly doubled this year, while real-world assets (RWAs) are beginning to develop despite regulatory and liquidity hurdles.

Although he admitted to holding a significant number of BNB tokens, which represent a considerable part of his wealth, CZ expressed his belief that decentralized finance (DeFi) will ultimately surpass centralized exchanges.

“The volume on decentralized exchanges (DEX) is very likely to outstrip centralized exchanges (CEX) in the future. DeFi is the direction of the future. Additionally, traditional trading should uphold privacy,” he remarked.

If he were starting anew, CZ mentioned that he would concentrate on creating an AI-driven trading agent and a privacy-focused perpetual DEX. He highlighted RWAs and stablecoins as significant opportunities.

“Securities, treasuries, and commodities harbor immense potential. However, regulation, KYC, and liquidity present considerable challenges,” he recognized.

In this context, the Binance executive pointed out BNB Chain’s investments in partnerships with organizations like Securitize and Backed.

He argued that Japan is well-equipped to take on a significant role in the forthcoming evolution of Web3.

“I would like to see a dedicated BNB Chain team established here, along with more projects that integrate robotics, AI, and Web3,” CZ shared.

Japan Post Bank’s Digital Currency Initiative

While CZ looks forward to the future of global DeFi, Japan’s financial sector is preparing for its own advancements.

Japan Post Bank has revealed that it will launch the DCJPY digital currency in fiscal 2026. This initiative will allow depositors to seamlessly convert their savings into digital currency for trading blockchain assets.

Local sources report that the bank oversees ¥190 trillion ($1.29 trillion) in deposits spread over 120 million accounts. By incorporating blockchain technology into its primary services, it aims to rejuvenate inactive balances and draw in younger clients.

DCJPY, created by DeCurret DCP, will have a 1:1 peg to the yen and can be utilized for purchasing security tokens and NFTs (non-fungible tokens).

This initiative could significantly enhance trading efficiency by enabling immediate settlement of tokenized securities. Japan Post Bank also foresees government subsidies and grants distributed via DCJPY, further embedding digital currency into everyday activities.

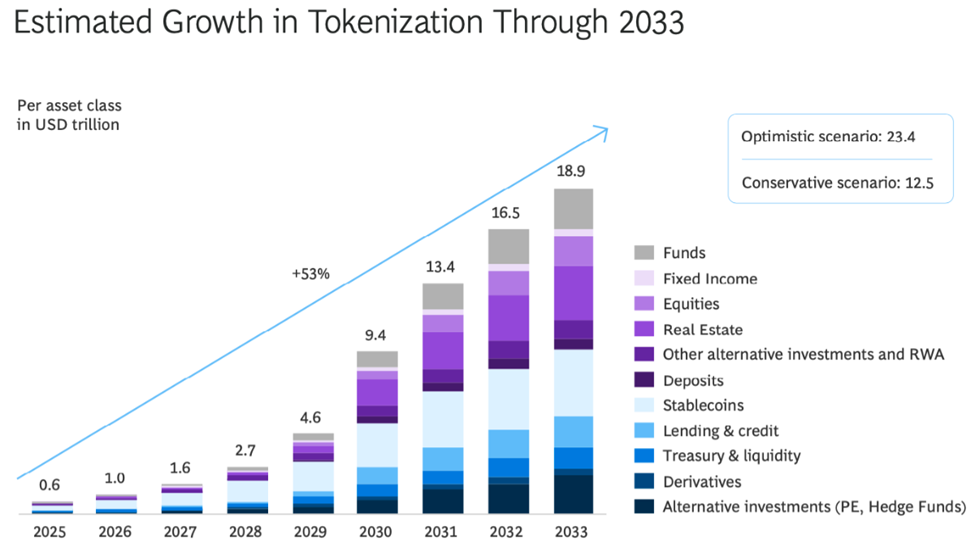

Meanwhile, the Boston Consulting Group and Ripple predict that the tokenized RWA market might grow from $600 billion in 2025 to $18.9 trillion by 2033.

In light of these developments, both CZ and Japan Post Bank are focused on seizing this opportunity.

From the community-centric approach of BNB Chain to Japan’s government-backed digital currency, Tokyo is emerging as a focal point where Web3 principles and institutional innovation collide.

Disclaimer

In line with the Trust Project guidelines, BeInCrypto is dedicated to providing unbiased, transparent reporting. This news article aims to deliver accurate, timely information. Nonetheless, readers are encouraged to verify facts on their own and consult a professional prior to making any decisions based on this content. Please be informed that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.