Pseudonymous analyst VisionPulsed suggests that despite a potential short-term rebound in Bitcoin, Dogecoin might be poised for a significant downturn. He points out that a familiar pattern resembling that of 2022 is re-emerging among major cryptocurrencies and memecoins.

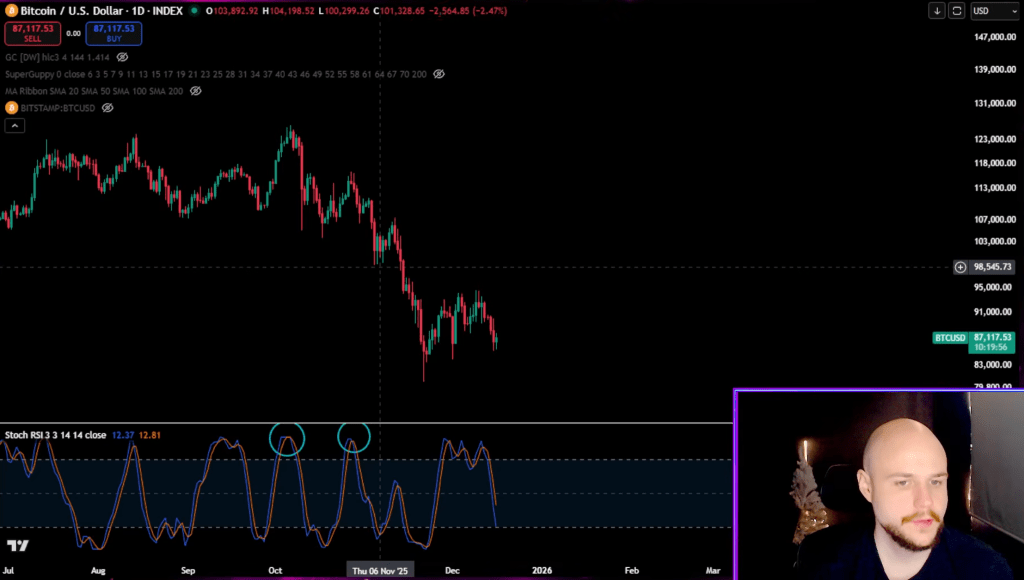

In a video released on December 16, the analyst discusses the near-term dynamics involving Bitcoin’s daily stochastic RSI, which is transitioning from overbought conditions back toward oversold. He notes that every reset on the daily chart within the past two months has resulted in new price lows. However, he indicates that the current setup is slightly different, which is crucial for Dogecoin’s upcoming price action.

Dogecoin Bulls Should Monitor Bitcoin’s Stochastic Reset

According to VisionPulsed, the daily stochastic RSI for Bitcoin is now “approaching oversold” after being elevated for a period. Previously, during October, November, and early December, similar cycles from overbought to oversold on the daily timeframe coincided with Bitcoin forming new lows.

“This marks the first instance of the stock RSI moving from overbought to oversold, and we might not see a new low this time,” he stresses, noting that it remains “too early” to confirm this. Should prices form a higher low during this oscillator reset, he believes that would indicate a short- to medium-term trend reversal rather than a significant macro shift, which could lead to a relief rally.

Related Reading

“If a higher low emerges on the price as the stock RSI resets, that should clear the way for a relief rally,” he adds. Conversely, if the current low is breached, the outlook “dips down to hell where you belong,” he emphasizes, highlighting that the bullish argument depends on maintaining that higher-low formation on the daily chart.

In VisionPulsed’s assessment, Dogecoin’s scenario appears precarious. While Bitcoin attempts to establish a higher low, Dogecoin continues to record lower lows within the same timeframe. He relates this to a comparable divergence in 2022, when Doge declined throughout the month while Bitcoin quietly established higher lows.

“This is strikingly similar to 2022,” he notes, adding that Bitcoin, during the recording, is making “a higher low while Dogecoin is not.” He argues that this pattern could allow Doge to experience a relief move if Bitcoin rallies, albeit from a significantly weaker position.

What Is the Potential Downside for DOGE?

If this scenario unfolds, he envisions a rally “possibly to grab the peanut,” with this so-called “peanut zone” expected to hover around the $0.20 mark in January. He describes that level as “probably your last chance to decide your course of action” before Dogecoin, in his core scenario, returns to its downtrend, ultimately plunging “down to feed the pig pen”—a term he uses for a further capitulation to new lows in the $0.05 to $0.06 range.

The fundamental outlook for Dogecoin suggests a deeper pullback. “We’re heading down to nourish the little piggies. Oink oink,” he remarks. Until Doge breaks its current downtrend, he sees “no rationale to consider it bullish.”

Related Reading

The timing of these developments, in his analysis, is correlated with Bitcoin’s position within the lower band of a 7–8 day Gaussian channel and the behavior of various moving averages. He highlights that Bitcoin has already lingered in this “peanut gallery” region for nearly four weeks, in contrast to around 63 days during the 2022 accumulation phase.

Should Bitcoin remain near the upper limit of the current structure by late January, he suggests, “you’re essentially recreating 2022,” which he believes would likely lead to another capitulation leg downward.

A critical indicator to monitor, according to him, is the convergence of a white and a green moving average, which in the 2022 blueprint was indicative of the “point of no return” before Bitcoin fell. These lines are forecasted to converge in late January or early February.

Once they intersect, his core outlook is that Bitcoin may “be pushed through the blue moving average” to test a red moving average situated in the $50,000–$60,000 range as a base downside goal. Under that scenario, he anticipates Dogecoin will eventually drop to the $0.05 range.

As of now, DOGE is trading at $0.12974.

Featured image created with DALL.E, chart from TradingView.com