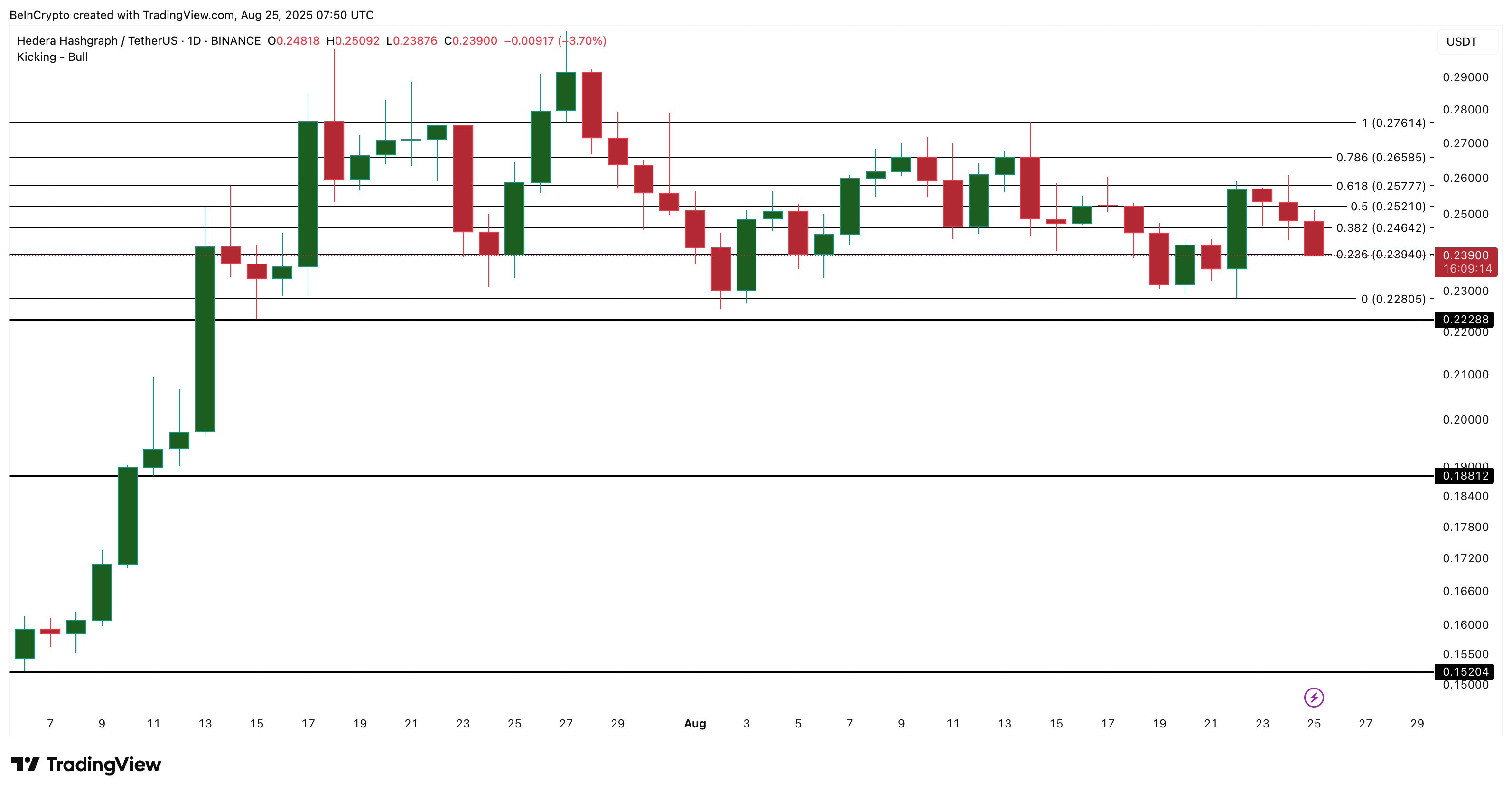

HBAR price has decreased by more than 3% in the last 24 hours, falling to $0.239. The weekly chart is now almost 2% in the red, reversing much of the recent gains. However, yearly increases remain above 300%, indicating that the overall trend is still intact.

The issue is that the bullish trend is precariously positioned, and a single breach could alter everything.

Social Attention Drops Sharply

A significant reason for caution stems from HBAR’s declining visibility in the market. Since mid-July, HBAR’s social dominance has plummeted nearly 90%, dropping from a peak of 2.41% on July 13 to 0.93% currently. This marks a substantial decrease in discussions and interest.

Past trends indicate this is significant. In June, a similar dip in social dominance coincided with a local price bottom around $0.129, leading to a robust rally. The current decline could suggest a repeat — either HBAR finds a new support level soon, or traders further lose interest and the price deteriorates.

Social dominance measures how much of the overall crypto conversation a token captures. A decline often indicates reduced chatter among traders, which can diminish short-term enthusiasm.

Interested in more token insights? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Traders Stay Engaged, But Risks Remain

Despite waning attention, derivatives traders are still highly active. Open interest surged from $387 million on August 22 to $421 million by August 24, a notable 9% increase within two days.

This scenario presents a double-edged sword. Increasing open interest often indicates new capital entering the market, potentially promoting substantial movements.

However, it also raises the likelihood of squeezes. If shorts build up, a sudden price surge could trigger liquidations, pushing HBAR higher. Conversely, if longs dominate and the price falls below $0.222, that same leverage could amplify losses.

Open interest reveals the amount of money invested in futures contracts for a token. A rise indicates more traders speculating on price fluctuations — but this can have opposing effects if the market shifts.

HBAR Price Levels And Money Flow Hold The Key

Hedera (HBAR) is trading near immediate support at $0.239. Dropping below $0.222 would be perilous, as no robust support exists until $0.188 and subsequently $0.152.

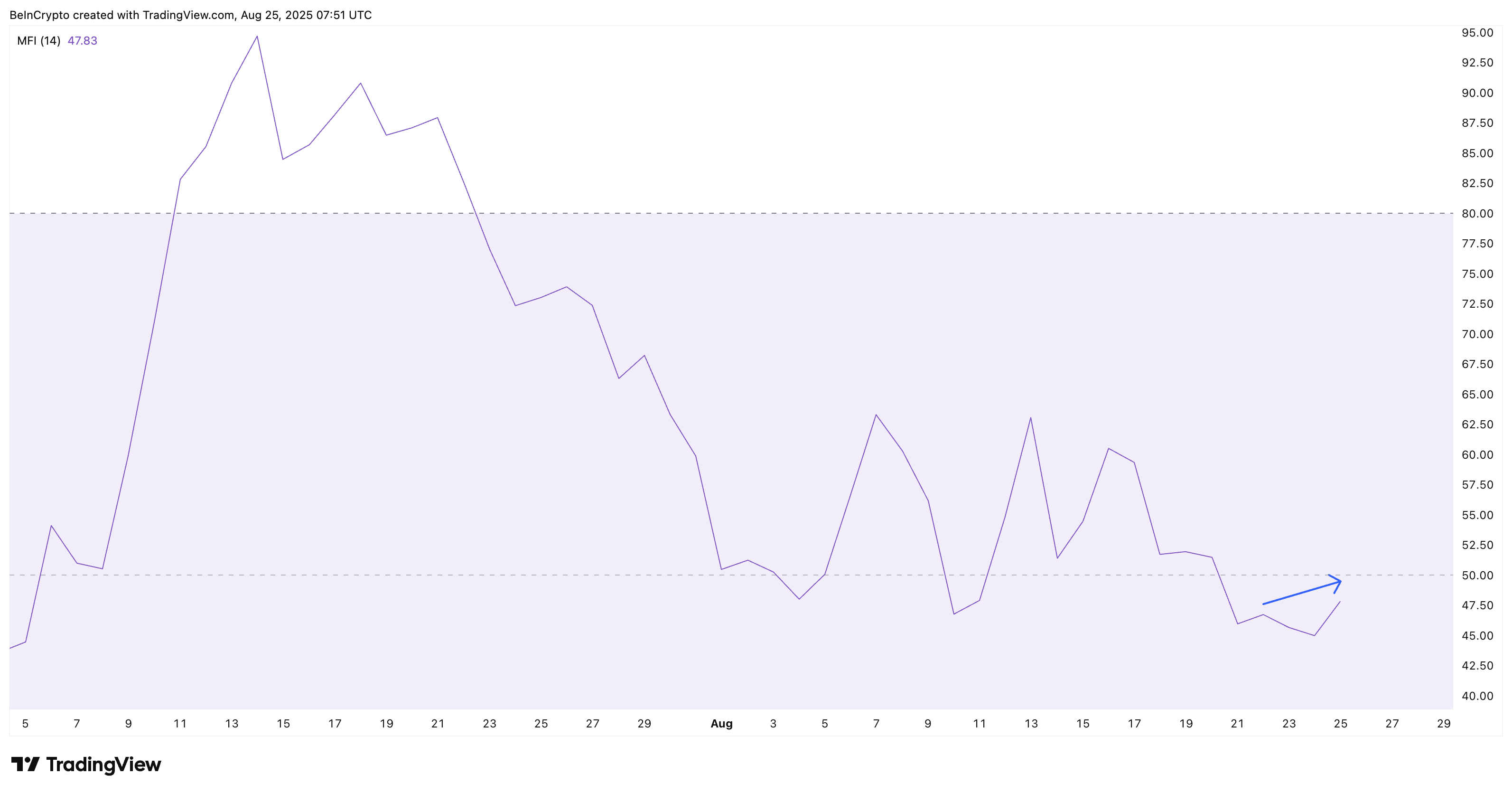

For now, buyers remain active. The Money Flow Index (MFI), indicating capital inflow or outflow, has risen from 45 to 47.8 while the price has dipped.

In simple terms, more capital has entered even as HBAR’s price declined — a sign that dip buyers are stepping in. This reinforces the structure as still bullish in the short term, but only just.

If prices reclaim $0.250 and break above $0.257, it could pave the way to $0.276 for HBAR. This level signifies the next major resistance. If bulls can surpass it, higher highs might return, dispelling bearish sentiments.

The post HBAR Price Leans Bullish Despite 3% Dip, Yet A Key Level Could Flip the Trend appeared first on BeInCrypto.