Reasons to Believe

A rigorous editorial policy that prioritizes accuracy, relevance, and neutrality

Developed by seasoned professionals and thoroughly vetted

Adhering to the highest standards of journalism and publishing

A rigorous editorial policy that prioritizes accuracy, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Arthur Hayes provides a straightforward perspective on the ongoing debate. In an August 21 conversation with Ran Neuner, the BitMEX co-founder asserted that both Ethereum and Solana are set to surge, but he specifically favors ETH as the cycle progresses. “Is Solana going to rise? Absolutely. Will it surpass ETH’s growth? I’m not sure. Probably not,” Hayes commented. Regarding portfolio strategy, he was clear: “For a position… you’d lean more towards ETH? Correct. Yes.”

Ethereum vs. Solana: Who Prevails This Cycle?

Neuner highlighted that the dynamics have shifted from a “Solana-only” focus to an Ethereum-centric trade, prompted by various catalysts—from stablecoins to influential supporters—that have turned ETH into “the asset of choice on Wall Street.” Hayes concurred, framing the rivalry between the two chains as a “race” increasingly characterized by the influx of capital targeting Ethereum: “ETH is a larger asset to influence, but there’s considerable money pursuing it. So, it’s shaping up to be an intriguing competition.” Put simply, size isn’t a drawback when the liquidity is sufficiently abundant; it’s an asset that attracts the strongest bids.

Related Reading

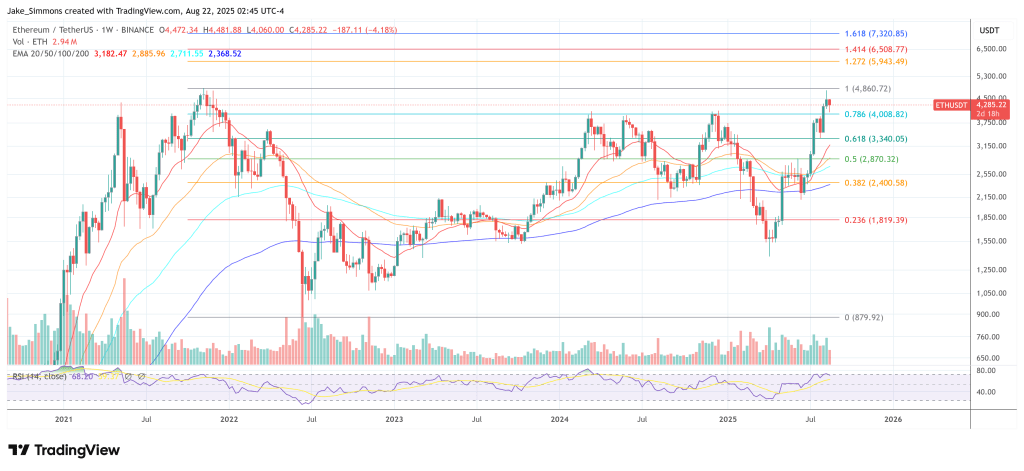

This focus on liquidity also accounts for Hayes’ belief in ETH’s potential for upward acceleration once resistance is convincingly surpassed. In response to Neuner’s note that Bitcoin has already surpassed its previous all-time high while ETH has been “struggling to break,” Hayes looked beyond mere recovery to unlimited upward momentum: “I see ETH reaching $10,000 [or] 20,000 by the cycle’s end… once it has cleared the gap, there’s open space to escalate.” He emphasized that on shorter time frames, “the chart indicates upward movement,” noting he’s “reacquired some ETH” he had previously sold.

Despite this, Hayes isn’t bearish on Solana. He revealed his advisory role with Upexi, a Nasdaq-listed firm with a Solana-centric treasury, and reiterated that SOL will also benefit from the same risk-on trends: “Both will rise. The question is, which one rises more?” Yet, despite his proximity to Solana, he circled back to the comparative perspective: “Do I think [Solana] will outpace ETH?… Probably not.”

Related Reading

Neuner bluntly summarized the narrative shift: ETH “acquired this significant Wall Street narrative,” with stablecoins, tokenized assets, and prominent figures like Joseph Lubin and Tom Lee amplifying Ethereum’s profile, after a period dominated by discussions of a “SOL cycle.”

Hayes’ response wasn’t to rehash the technical comparisons—Neuner even humorously referred to Solana as the “fast monolithic chain”—but rather to root his ETH preference in the capital formation dynamics and growing passive demand shaping Ethereum’s market environment. He suggested that as institutional investments and public ETH treasury companies attract new inflows, the “larger asset to influence” becomes the ideal destination for the strongest liquidity.

Thus, Hayes’ comparative stance relies on three key recorded insights. First, positioning: he is more heavily invested in ETH compared to SOL. Second, liquidity: he anticipates increased investment in ETH during this cycle phase, owing to its larger scale. Third, direction: upon ETH achieving a sustained breakout, he perceives “the sky’s the limit” scenario emerging, with a cycle price target of $10,000–$20,000 for ETH. Although he acknowledges Solana’s potential, the victor—based on Hayes’ analysis and portfolio—is clearly Ethereum.

As of the latest update, ETH was priced at $4,285.

Featured image generated with DALL.E, chart sourced from TradingView.com