This year, investors have clearly favored precious metals like gold to protect against the potential decline in paper money value, putting bitcoin aside .

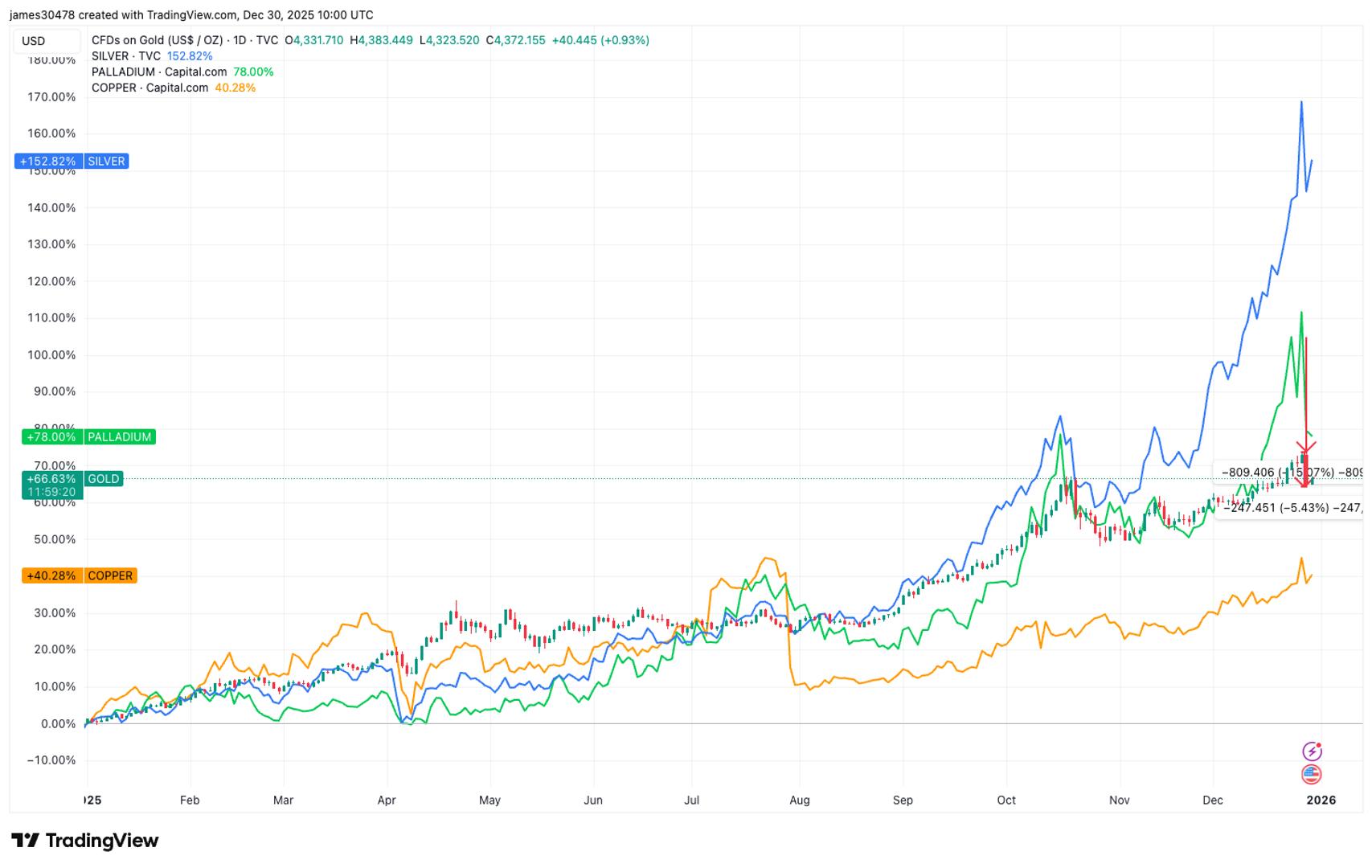

Since January 1, gold has increased by nearly 70%, while silver has surged approximately 150%, significantly outperforming the largest cryptocurrency, which has dipped about 6%.

Analysts attribute this uptick to the “debasement trade,” an investment strategy focused on acquiring assets viewed as stores of value while awaiting the devaluation of fiat currencies. Such depreciation results from ultra-loose monetary policies and fiscal deficits, leading to decreased purchasing power and an escalation in asset prices.

At the start of this year, bullish bitcoin advocates made optimistic projections, highlighting the debasement trade as a crucial influencer behind their end-of-year predictions. However, bitcoin’s surge unexpectedly stalled just above $126,000 in early October. Since that time, it has retreated below $90,000.

Gold’s Exceptional Rally

Gold’s ascent has been particularly remarkable from a technical analysis standpoint, as noted by The Kobeissi Letter.

The metal has consistently remained above its 200-day simple moving average—a widely recognized long-term trend indicator that smooths price fluctuations over approximately nine months—for roughly 550 consecutive trading days. This is the second-longest duration on record, only surpassed by the nearly 750-session period following the 2008 financial crisis.

Nevertheless, bitcoin proponents remain unfazed. Crypto analysts anticipate that the cryptocurrency will align with gold next year, continuing its historical pattern of lagging rallies.

“Gold has been ahead of BTC by about 26 weeks, and its consolidation last summer corresponds with Bitcoin’s current pause,” Lewis Harland, a portfolio manager at Re7 Capital, told CoinDesk. “The metal’s renewed strength indicates a market increasingly accommodating expectations of further currency debasement and fiscal challenges into 2026, an environment that has consistently boosted both assets, with Bitcoin often responding with greater intensity.”

The predictions market appears to support this perspective. Currently, traders on Polymarket have assigned a 40% likelihood of BTC being the top-performing asset next year, compared to 33% for gold and 25% for equities.