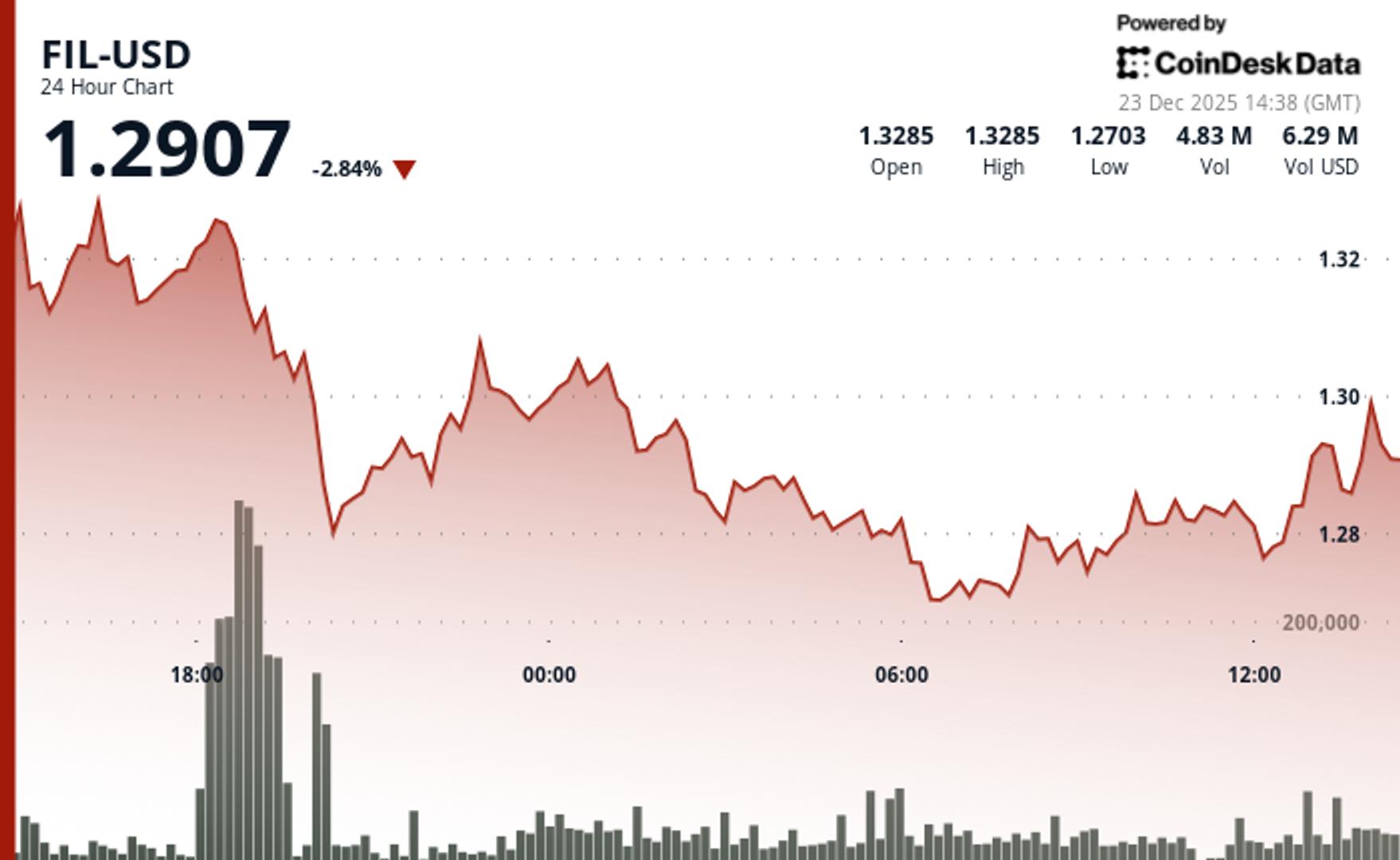

Filecoin decreased by 2.2% over the last 24 hours, falling from $1.32 to $1.29 as technical sellers took control of price movements.

The decentralized storage token formed a distinct bearish channel pattern, with repeated lower highs indicating continued downward momentum within the 5 cent trading range, as noted by CoinDesk Research’s technical analysis model.

The model indicated that trading volume was telling the real story. Trading surged to 7.59 million tokens yesterday evening, an increase of 180% above the 24-hour average.

This spike correlated with selling around the $1.33 resistance level, signifying clear institutional distribution, according to the model.

With no fundamental drivers influencing price movements, technical levels became the primary focus. The rapid recovery from the $1.28 support level shows that institutional buyers remain active despite the prevailing bearish channel structure, the model stated.

The decline in FIL occurred alongside a downturn in broader cryptocurrency markets. The CoinDesk 20 index dropped by 3.1% at the time of publication.

Technical Analysis:

- Key support remains at $1.28 following an intraday liquidation event

- Major resistance point at $1.33 where institutional selling was noted

- Volume spike to 7.59 million tokens confirms significant distribution activity

- Descending channel pattern reflects successive lower highs affirming bear trend

- V-shaped recovery from $1.28 indicates institutional accumulation interest

- Immediate target for upside at $1.31-$1.32 presents a 3.5% profit potential

- Drop below $1.28 key support could lead to a $1.26 extension

- Current risk/reward ratio favors long positions with stops below $1.2800

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For additional details, please refer to CoinDesk’s complete AI Policy.