Market Overview

XRP continued its upward trend on August 23 as institutional trading volumes surged past average levels, reinforcing positive sentiment following several weeks of stability. This surge aligned with dovish comments from Fed Chair Jerome Powell at Jackson Hole, boosting expectations for rate cuts in September and driving investment into risk assets, including cryptocurrencies.

Continuing regulatory clarity from Ripple’s court outcome further enhances institutional interest, with analysts suggesting ambitious targets of $5–$8 if XRP can decisively overcome near-term resistance.

Price Movement Overview

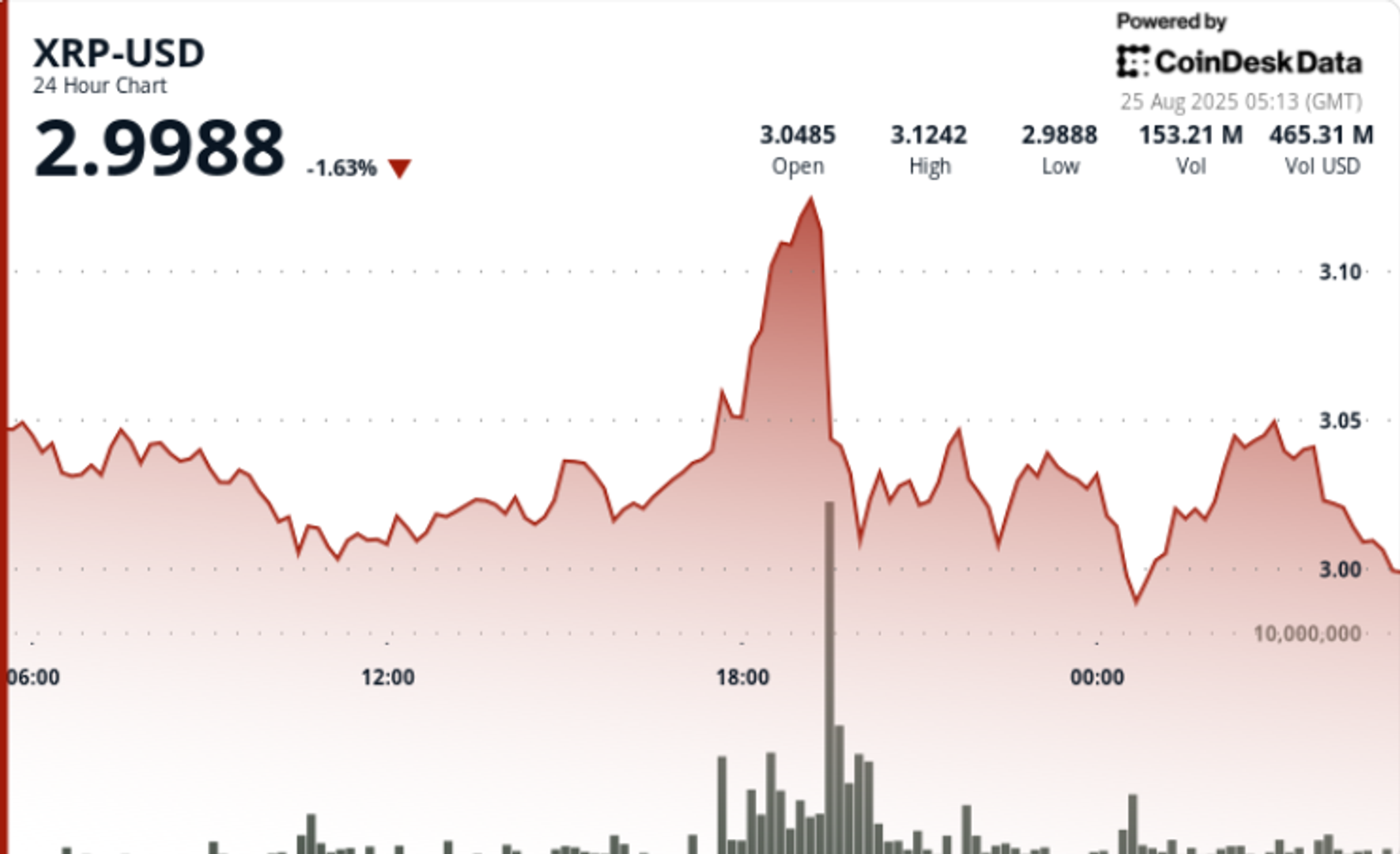

• XRP rose 3% during the 24-hour period from August 23 at 15:00 to August 24 at 14:00, increasing from $3.02 to $3.09 before settling back at $3.02.

• The token traded within a $0.09 range, reaching a high of $3.09 on a notable volume of 58.8 million—substantially above the 24-hour average of 33.2 million.

• Support established around $3.00 during the 11:00 candle with a turnover of 46.6 million, confirming demand at this critical level.

• XRP concluded the session near $3.02, indicating renewed momentum as it consolidates below resistance.

Technical Insights

• Resistance remains intact at $3.08–$3.09, marked by significant volume rejection during the midnight rise.

• Support has strengthened around $3.00 after several rebounds with higher-than-average participation.

• Volume surges indicate institutional interest, with fiatleak reporting $27 million worth of XRP transacted within a single minute.

• Chart formations exhibit double-bottom and symmetrical triangle patterns, which analysts believe could propel gains towards $3.30 and, if surpassed, pave the way to $5–$8.

Trader Focus Areas

• Monitoring whether $3.00 remains a strong foundation during profit-taking intervals.

• A significant breakout above $3.30 resistance could catalyze higher targets.

• Observing Fed policy developments leading up to September—confirmation of a rate cut would likely support inflows into risk investments.

• Tracking whale wallet accumulation and on-chain transaction volumes, which surged by 500% to 844 million earlier this week.

• Noting the broader relationship with equities, as lower yields continue to drive crossover investments into digital assets.