Ethereum is experiencing one of its most significant resets in over a year, triggered by its price falling below $4,000. This retest has manifested prominently in futures open interest, as billions in positions have been eliminated across major exchanges. This swift unwinding is a corrective response to weeks of excessive leverage during upward trends that had driven derivatives activity to unsustainable levels.

Related Reading

Significant Open Interest Reduction Across Major Exchanges

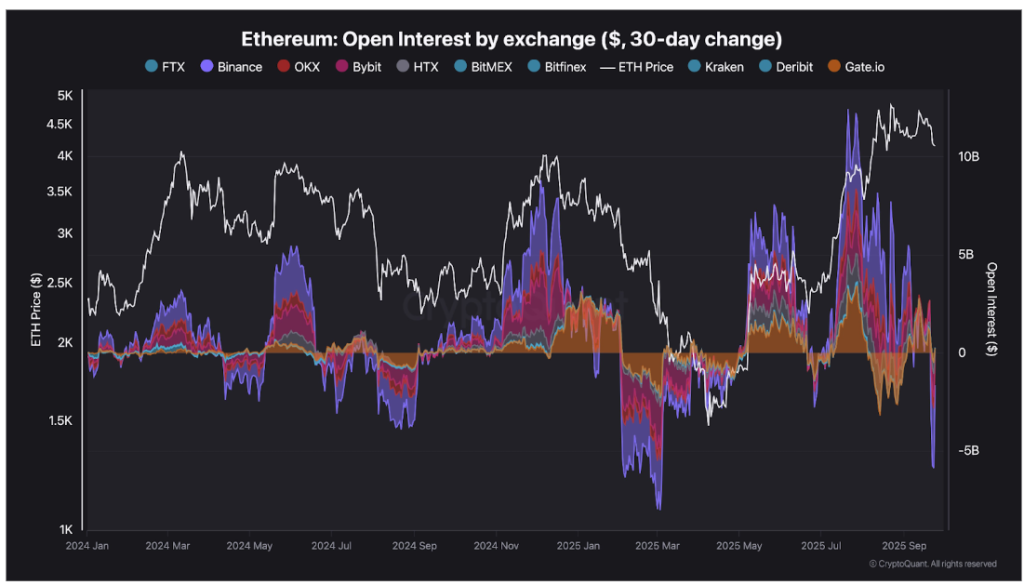

The latest correction in Ethereum’s price signifies a broader market reset rather than just a minor decline, with leveraged traders bearing the bulk of the losses. Data indicates that Ethereum’s open interest saw a steep drop over the past week across several crypto exchanges. As per data from the on-chain analytics platform CryptoQuant, billions worth of Ethereum positions were eliminated last week, with Binance observing the most significant monthly average decline.

Ethereum’s decline below the $4,000 threshold marked the breaking point for over-leveraged traders. This movement triggered a wave of liquidations across derivatives markets, intensifying selling pressure.

Data reveals that more than $3 billion was liquidated on September 23 alone through Binance, followed by over $1 billion the next day. Bybit also lost $1.2 billion in positions, while OKX recorded a $580 million drop. The sharp decline is reflected in the overall open interest, which has fallen to its lowest level since early 2024.

As illustrated in the chart data, futures leverage and open interest correlated closely with the price rally in July and August, and declined in tandem with the price drop.

Ethereum Open Interest by exchange

Spot Ethereum ETF Outflows Contribute to Market Pressure

Ethereum’s drop below $4,000 and the reduction in open interest align with a week of substantial outflows from spot Ethereum ETFs in the United States. According to data from Farside Investors, $795.56 million exited over five trading days last week, marking the largest weekly outflow since the products were launched.

The sell-off intensified towards the end of the week, with Thursday seeing $251.2 million in outflows, followed by another $248.4 million on Friday. Decreased institutional participation heavily contributed to the sell-side pressure, with investors exercising caution amidst uncertainty regarding regulatory approval for staking features within these ETFs. This simultaneous exit from both derivatives and institutional products has heightened volatility, fostering a confluence of pressure across Ethereum’s trading ecosystem.

Related Reading

After dropping as low as $3,845, ETH bears have managed to keep above $3,800. As of now, Ethereum is priced at $4,002. Despite this effort to stabilize, the leading altcoin remains down by approximately 10% on a weekly basis, given that it was trading around $4,490 the previous week. The bullish outlook now hinges on whether ETH can reclaim and maintain a position above $4,000.

Featured image from Unsplash, chart from TradingView