Reasons to Trust

A rigorous editorial policy emphasizing accuracy, relevance, and neutrality

Developed by industry specialists and thoroughly vetted

Adhering to the highest standards in reporting and publication

A rigorous editorial policy emphasizing accuracy, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Eric Trump presented a straightforward, bullish argument regarding the potential for Bitcoin to reach $1 million. He pointed out that increasing institutional access coincides with Bitcoin’s capped supply of 21 million coins during a session titled “Bitcoin Takes Over the World” at the Bitcoin Asia conference in Hong Kong on August 29.

Bitcoin’s Journey to $1 Million Is ‘Certain’

“Everyone wants Bitcoin. Everyone is acquiring Bitcoin. And that’s an extraordinary situation. That’s why I’ve consistently maintained that I truly believe Bitcoin will hit a million dollars in the coming years. Without a doubt, Bitcoin will reach a million dollars,” Trump conveyed to the audience, adding, “When you have a limited supply of an asset class that everyone wants… it’s not hard to see where that leads.” He recommended long-term holding over precise timing: “Purchase now. Close your eyes. Hold it for the next five years, and you will see great returns.”

Trump shared insights from his private conversations with prominent investors prior to the conference: “In conversations with influential figures in the region and in the hospitality sector, when you’re explaining digital currency, it underscores how early we are in this evolution… I constantly hear inquiries about entering cryptocurrency, whether they’ve missed the boat. I just laugh. We haven’t even begun to grasp what Bitcoin will become.”

Related Reading

Trump’s fundamental argument centered on two key ideas: limited issuance and expanding distribution networks. He continuously highlighted Bitcoin’s demonstrable scarcity—“Only 21 million coins exist… It’s finite. That’s its incredible power”—while stating that pathways for ownership have broadened significantly. “In the U.S., people are investing in it as part of their retirement plans for the first time… you have trillions of dollars of liquidity being unlocked,” he stated, pointing to custody options at “major financial institutions” and interest from “top banks,” “prominent families,” “Fortune 500 companies,” and “sovereign wealth funds.” According to Trump, these groups are in it for the long haul: “Those retirement funds aren’t parting with their Bitcoin. Those companies won’t let go of it. Those sovereign wealth funds are keeping it.”

When asked about his insights from high-level discussions worldwide, Trump relayed an anecdote—without naming the country—about a leader who “literally [takes] the entire energy supply of a major city during winter to mine Bitcoin, reflecting their belief in the asset.” He noted, “We are just at the beginning… more individuals are discovering their entry points,” highlighting improvements in exchange usability and new consumer on-ramps. “We’re working to make cryptocurrency accessible to everyone,” he mentioned regarding World Liberty Financial.

Related Reading

Trump also mentioned his commercial ties to the industry. He characterized American Bitcoin as “one of the largest Bitcoin mining enterprises globally,” claiming it produces “approximately 3% of the world’s Bitcoin daily,” operates from “some of the most affordable energy sources in the U.S.… in Texas,” and targets a “mining cost of about $37,000,” with plans to list on Nasdaq “very soon.” In addition to mining, he praised his association with MetaPlanet alongside Simon Gerovich—whom he referred to as “the Michael Saylor of Asia”—indicating the company has “significantly altered the perspective of Japan and much of Asia” regarding Bitcoin.

The discussion returned frequently to Bitcoin’s evolving narrative of utility. Describing Bitcoin as “digital gold” and “the most significant store of value ever created,” Trump contended that its use cases are expanding: “Every day, new methods are being discovered to stake it, generate yield, and use it for daily transactions… you’re taking this digital gold and enhancing its utility.” He framed volatility as beneficial for long-term investors—“Volatility is our ally”—and, making a nod to Michael Saylor’s well-known extremism, added, “I know he jokes about it, but he has a point. Buy it, hold it, and I believe you’ll see exceptional gains.”

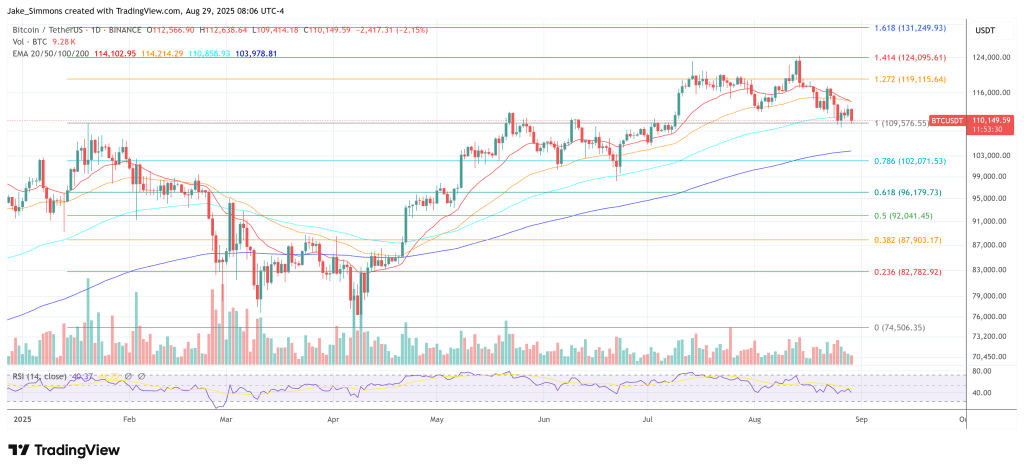

As of the latest update, BTC was trading at $110,149.

Featured image created with DALL.E, chart from TradingView.com