Eric Jackson, CEO of EMJ Capital, has put forth one of the most ambitious long-term bitcoin forecasts, claiming in an interview with Phil Rosen that the cryptocurrency could soar to $50 million per coin by 2041. This projection is based on his belief that bitcoin will transition from being merely “digital gold” to becoming the essential collateral layer of the global financial system.

Jackson’s perspective stems from the same “hundred bagger” approach he applied when investing in distressed stocks like Carvana. He recounted how he entered the Carvana market when its stock plummeted from approximately $400 to around $3.50 in 2022, during a time of overwhelmingly negative sentiment. “You would hear comments like, that’s run by a bunch of criminals. This is what a bunch of idiots. Like you’d have to be an idiot to let your company fall from $400 this year to $450 or $350 rather,” he told Rosen.

Related Reading

For Jackson, that phase exemplified market behavior at its extremes. “It’s almost human nature that in moments of maximum pain or pessimism, you can only focus on what’s immediately in front of you,” he stated. Nevertheless, the underlying product remained robust: “It wasn’t a broken platform. It wasn’t a broken service […] customers would say they loved it. It was so easy. It provided the best customer experience they had.” From that point, he could “envision how they were going to be a much more profitable business” once the company prioritized profitability and managed its debt.

Jackson’s Long-Term Thesis For Bitcoin

He applies the same forward-looking perspective to bitcoin, suggesting that daily price fluctuations and divisive narratives obscure its fundamental potential. “We become so attached to turning on the TV and just checking, what’s the price of Bitcoin today […] Some are pessimistic, calling it a Ponzi scheme, while others are overly optimistic, throwing out unrealistic targets that don’t really connect to reality,” Jackson explained. “It’s challenging to grasp the true value of this asset.”

Jackson starts with the conventional framing of bitcoin as “digital gold.” He questions the size of the gold market, the number of central banks and sovereign nations that possess it, and the reasons behind this. “Could Bitcoin eventually match gold’s size? That seems like a reasonable assumption,” he asserted, noting that its “digital” and “programmable” nature might make it more appealing as a store of value for younger generations. However, he emphasizes that this is just one facet of the narrative, as bitcoin has yet to establish itself as a medium for everyday transactions “since the person who bought pizza with Bitcoin back in 2011.”

The “penny dropped,” he remarked, when he began to consider what he terms the “global collateral layer” that supports borrowing by sovereign nations and central banks. Traditionally, this foundational element shifted from gold to the Eurodollar system starting in the 1960s, and is now closely linked with sovereign debt. “Countries around the globe issue debt and then typically borrow against it to conduct their daily government transactions,” he noted, but “there are challenges with that.”

Related Reading

In Jackson’s “Vision 2041,” he envisions bitcoin supplanting the Eurodollar, effectively becoming the neutral asset upon which other balance sheets are constructed. He argues that bitcoin serves as “far superior” collateral due to its digital and “apolitical” characteristics, existing outside the purview of central banks and the influence of any current treasury secretary in the U.S.

Much like with the Eurodollar, he views this not as a direct challenge to the dollar or Treasuries, but rather as a new foundational layer: “There’s an underlying element that many countries and financial systems borrow against to carry out their operations.”

Eric Jackson (@ericjackson) predicts bitcoin will reach $50 million by 2041.

He compares his theory to how he identified Carvana, $CVNA, as a 100-bagger stock pick. pic.twitter.com/CA9BWoR4zF

— Phil Rosen (@philrosenn) December 7, 2025

Looking ahead 15 years, Jackson foresees sovereign entities currently issuing and rolling over debt instead “relying on Bitcoin,” as “over time, that makes far more sense.” Given the “enormous” scale of the sovereign debt market, he asserts that if bitcoin establishes itself as the predominant collateral base, its price per coin would need to escalate to levels far exceeding current valuations—hence his $50 million target for 2041.

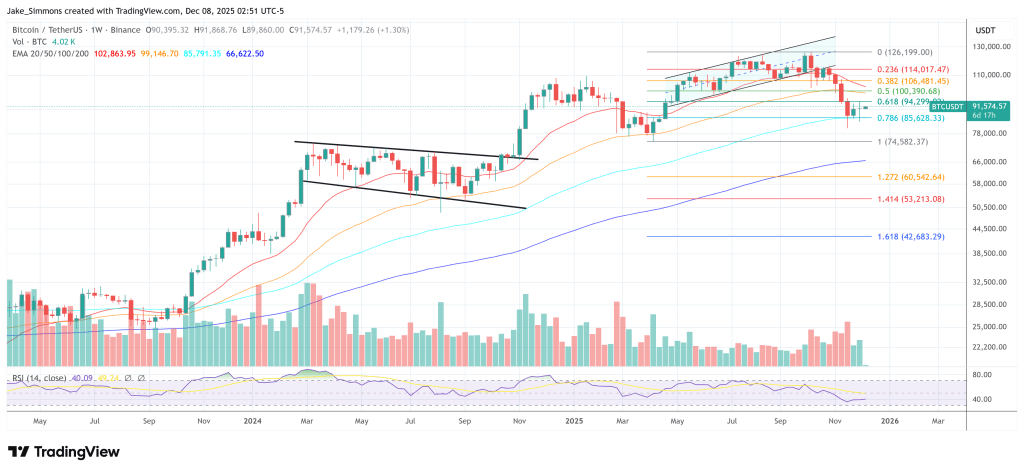

As of the latest update, Bitcoin was trading at $91,574.

Featured image created with DALL.E, chart from TradingView.com