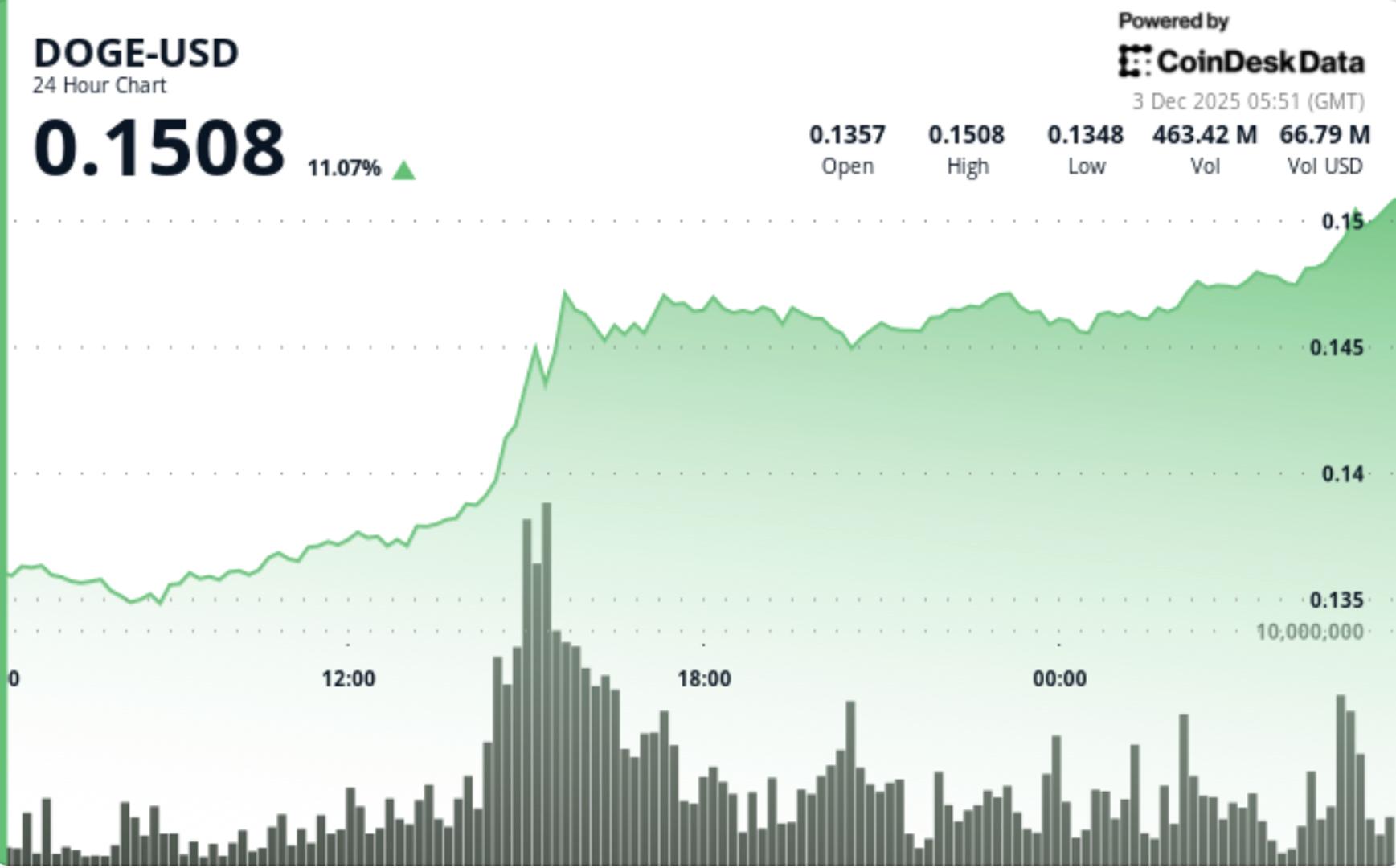

Dogecoin broke through its long-standing resistance with an impressive volume surge of 1.37B, representing its most robust breakout in weeks as substantial institutional flows returned to the memecoin market.

• DOGE increased by 8% from $0.1359 to $0.1467 in the past 24 hours

• Volume skyrocketed to 1.37B tokens — 242% above the typical 24-hour average

• The breakout coincided with a prominent strength in the meme coin sector following ETF news

• DOGE showcased a 9.3% trading range with multiple higher lows confirming accumulation

• Critical resistance at $0.1475–$0.1480 was tested as institutional activity dominated intraday volume

The technical structure turned decisively bullish as DOGE surpassed its multi-session ceiling while establishing consecutive higher lows from a $0.1347 base. The breakout candle at 15:00 marked the clearest volume confirmation of the month, with 1.37B tokens reflecting institutional accumulation over retail volatility.

The breakout level at $0.1475–$0.1480 aligns with the upper moment of DOGE’s short-term ascending channel, indicating that breaching this range opens the way toward the next high-liquidity zone at $0.1500–$0.1520. Multiple hourly candles closed cleanly above former resistance levels, bolstering the structural shift.

Momentum indicators suggest a continuation. Volume profile analysis identifies a solid node forming between $0.145–$0.147, signifying a strong foundation built by bulls. The swift rejection wick at $0.1477 implies absorption of supply rather than a reversal — a common precursor to a subsequent push. Heightened hourly volumes above 17.4M underline the maintained institutional presence needed for forward momentum.

DOGE opened near $0.1359 before steadily rising during midday consolidation. The explosive movement initiated at 15:00 during a 1.37B volume explosion, driving the price from $0.1419 to $0.1477 within minutes. The session peak at $0.1477 occurred just under the resistance zone, with late trading stabilizing around $0.1467.

A confirmed higher low at $0.1347 set a new structural support level. Following 60-minute data indicated ongoing buying, highlighted by a sharp 02:12 spike exceeding 17.4M that advanced DOGE through the $0.1475 range before temporarily consolidating. The token concluded near the $0.148 resistance area.

• Clearing $0.1475–$0.1480 remains the key indicator for momentum into $0.1500–$0.1520

• Sustained volume exceeding the 1B+ threshold is crucial to maintain breakout traction

• $0.1347 is now the essential downside invalidation level for short-term bullish scenarios

• Breakout structure supports a positive bias, though failure to clear $0.148 may lead to a corrective pullback to $0.142–$0.144

• Meme-sector dynamics and ETF speculation continue to serve as additional catalysts in DOGE’s volatility cycle