Dogecoin has lost a significant technical support level in light of the Federal Reserve’s recent decision on interest rates, with substantial trading volume indicating a short-term shift towards bearish control.

News context

On Tuesday, Dogecoin fell by 5% as cryptocurrency markets adjusted to the Federal Reserve’s 25-basis-point rate reduction and cautious outlook. Although the target interest rates were lowered to between 3.5% and 3.75%, policymakers expressed internal disagreements regarding the pace of future easing, which decreased risk appetite across digital assets.

Meme coins lagged in performance amid the general market downturn, with DOGE facing heightened pressure as traders reduced their positions after recent consolidations near resistance levels. This movement seemed more influenced by positioning and macroeconomic sentiment than by any fundamentals specific to the token.

Technical insights

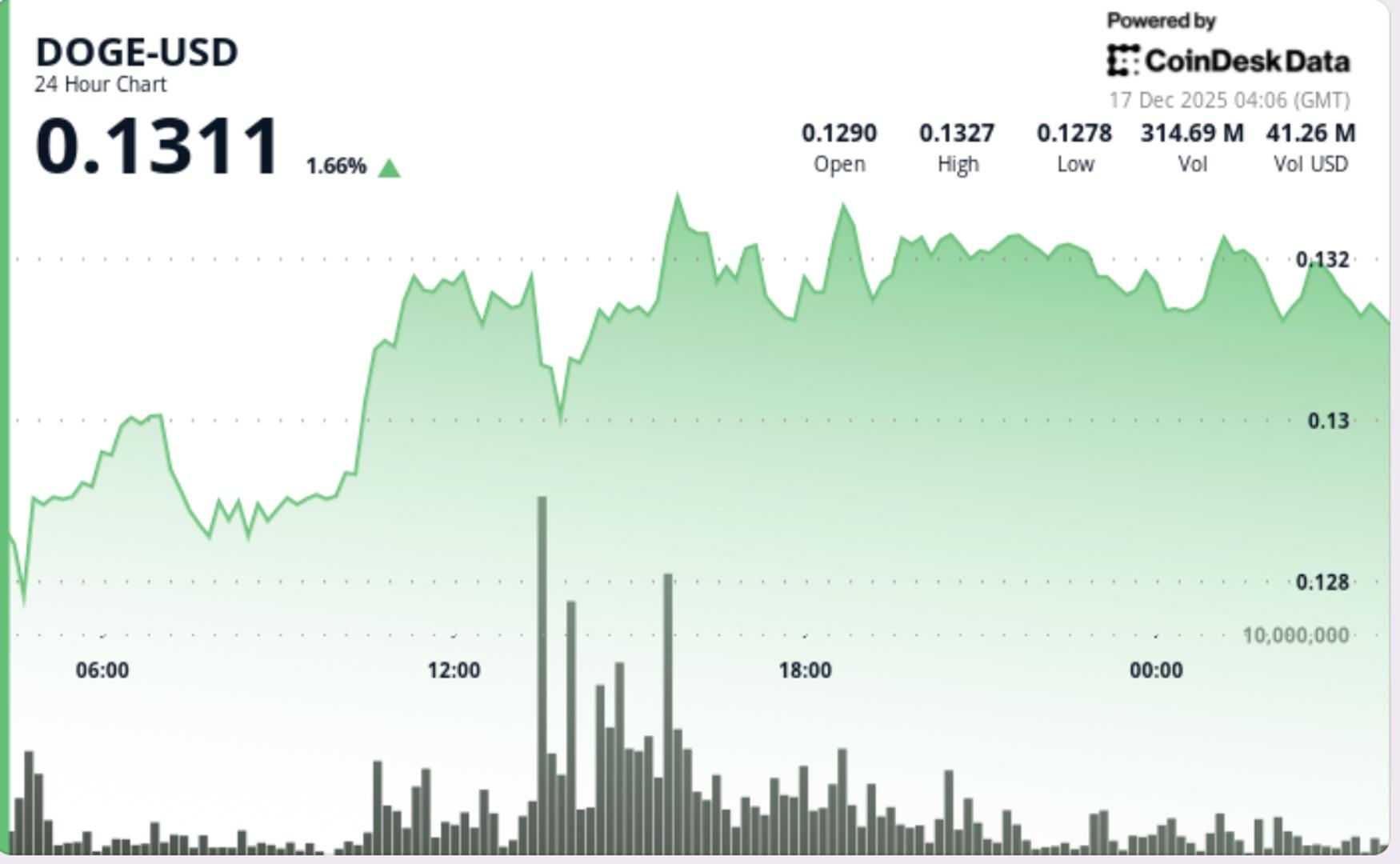

DOGE decisively fell below the $0.1310 consolidation zone, which previously served as short-term support during the recent range-bound trading. The failure of this level triggered rapid selling, signifying a breakdown rather than just a brief liquidity sweep.

Trading volume spiked to 769.4 million tokens during the downturn, significantly above recent averages, confirming the action as active distribution rather than a low-liquidity drift. The price formed a lower high around $0.1324 before reversing, reinforcing a bearish structure on the intraday chart.

From a structural perspective, the breach of $0.1310 places DOGE back into a corrective phase, with any rallies likely facing selling pressure unless this level is convincingly reclaimed.

Price action overview

DOGE traded from $0.1315 down to a session low of approximately $0.1266 before finding some stability. Buyers emerged at lower price levels, yielding a modest rebound back towards $0.1291 by the day’s end.

However, this recovery took place on diminishing volume and left the price below important moving averages. Overnight trading indicated continued pressure, with DOGE slipping from $0.1320 to $0.1314 on steady but controlled trading, implying that sellers remain active during rallies.

Advice for traders

The $0.1310–$0.1315 zone now represents immediate resistance. As long as DOGE stays below this range, upward movements are seen as corrective instead of trend-confirming.

On the downside, $0.1290 is the initial level to monitor. A consistent break below this threshold would likely reopen the support area around $0.1266. Conversely, maintaining levels above $0.1290 could permit DOGE to consolidate before the next directional shift.

Volume trends are crucial. Persistent high volume during downside moves would confirm continued distribution, while decreasing volume near support might indicate that selling pressure is starting to wane.