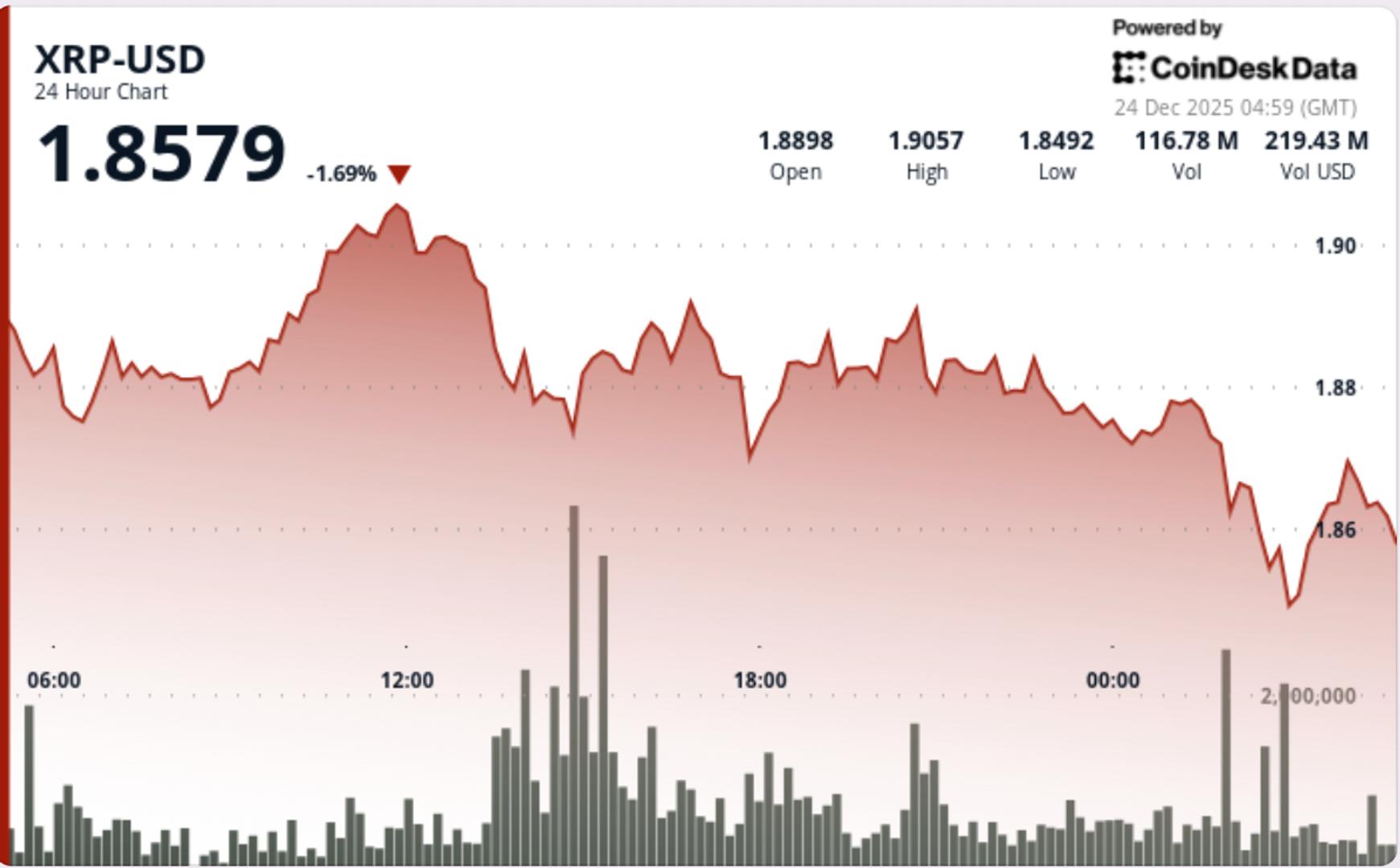

XRP slipped below short-term support on Wednesday as sellers reappeared around $1.90, keeping the token confined in a narrowing range with focus shifting towards the $1.85 level.

Market Overview

This decline occurs as the crypto markets experience volatility heading into year-end, a period characterized by low liquidity and positioning that often influences price movements. Traders have adopted a more cautious approach, prioritizing short-term risk management over directional bets, especially following recent erratic movements among major assets.

XRP’s performance has also been shaped by mixed signals from analysts. Some technical analysts have identified a rising wedge pattern that could exert downward pressure if support continues to fade, while others highlight RSI divergence patterns typically seen near points of local exhaustion. This divergence has resulted in diminished conviction among traders, amplifying the market’s inclination to retreat from rallies at clear resistance levels.

Technical Breakdown

Throughout the session, XRP utilized the $1.8615–$1.8700 range as a support zone, but late selling pressure forced the price beneath this threshold into a lower distribution area.

A significant factor was the volume concentration at resistance. Trading volume surged to approximately 75.3 million tokens during the rejection at $1.9061, nearly double the average for the previous 24 hours, indicating that larger market participants were more inclined to sell into strength rather than accumulate.

From an intraday perspective, the drop from roughly $1.878 to the mid-$1.86s occurred alongside repeated spikes in volume, including a 2.7 million token surge during the decline from $1.867 to $1.865, underscoring that the breakdown was driven by heavy trading activity, not merely a gradual decline.

Price Action Recap

- XRP decreased from $1.8942 to $1.8635 within 24 hours

- Resistance remained firm near $1.9061 with the highest session volume

- The $1.8615–$1.8700 support zone broke late, resulting in a shift to a lower price range

- Overall trading remained subdued, with a range of $0.0395 (approximately 2.1%)

Key Considerations for Traders

The $1.87 level has transitioned from being a support level to a critical near-term decision point. If XRP can reclaim and maintain this level, it could signal a reset within the range that might lead to a resurgence toward $1.90–$1.91. Conversely, a failure to hold could redirect attention toward $1.860–$1.855, where buyers are anticipated to step in to prevent a more significant downturn.

Currently, the prevailing strategy remains to “sell rallies near $1.90, buy dips around $1.86,” with the next decisive move likely hinging on whether trading volume increases during a breakout, rather than another low-liquidity test within the current range.