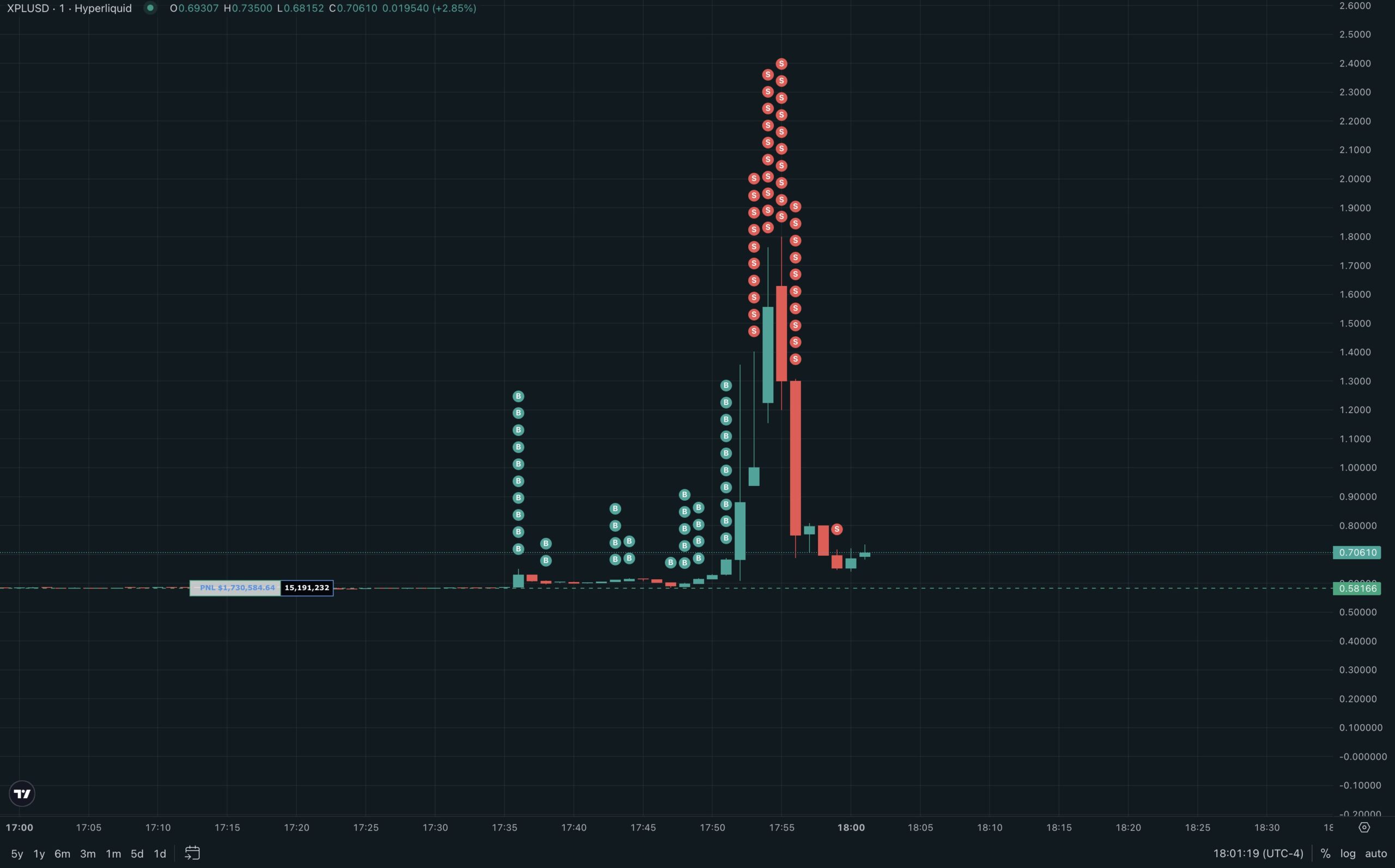

A significant wallet shook the Hyperliquid market by depositing 16 million USDC and launching millions of XPL long positions within minutes.

This action immediately “cleaned out” the order book, liquidating all short positions and causing XPL’s price to surge over 200% from the $0.58 range to a peak of $1.80.

Liquidity Shock

Based on data from Lookonchain, this wallet partially exited its position in under a minute, netting a $16 million profit. Some traders believe this wallet is linked to Justin Sun, the creator of the Tron (TRX) network.

“Justin Sun just secured a $16M profit in under 60 seconds. He longed millions of $XPL, clearing the entire order book and instantly wiping out other traders. This sent $XPL soaring to $1.80 (+200% in 2 minutes). He still holds 15.2M $XPL ($10.2M) long. It’s one of the wildest liquidation cascades ever seen on Hyperliquid,” commented an X user .

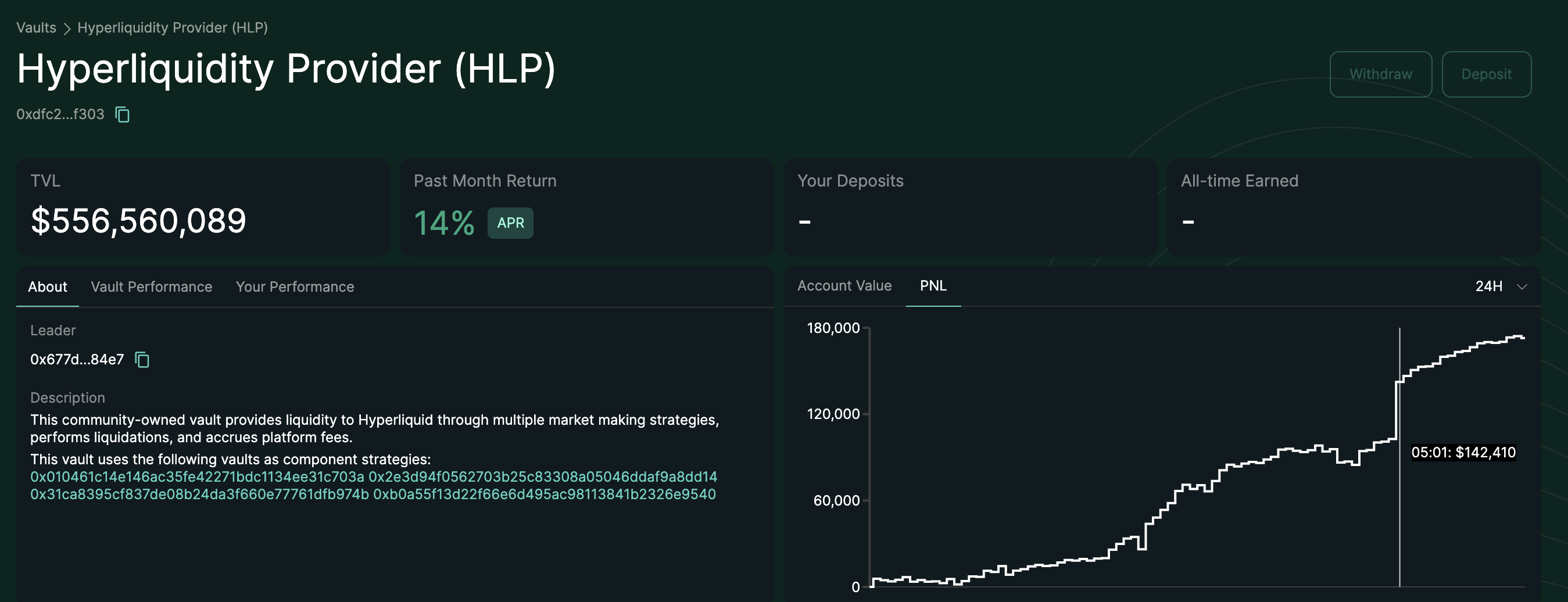

While whales profited, Hyperliquid’s HLP vault also accrued about $47,000 from this volatility. Nevertheless, the vault had previously faced a nearly $12 million loss in a similar situation. This underscores the dual-risk nature for liquidity providers: they can earn fees while concurrently facing substantial losses amidst volatility.

Prior to XPL, Hyperliquid experienced a similar incident with the JELLY token. During that episode, unusual price fluctuations led the HLP vault to incur losses of nearly $12 million, exacerbated by its role in liquidity provision during an order book “wipeout.”

HyperLiquid addressed the JELLY squeeze by refunding affected traders and implementing stricter security protocols to avert future occurrences. Both incidents stemmed from significant whale movements in a thinly liquidated market, prompting extensive short squeezes.

Risks for Retail Traders

The XPL price surge illustrates the “order book sweep” phenomenon in decentralized derivatives exchanges. When liquidity is somewhat limited, a sufficiently large order can penetrate multiple price levels, triggering a cascade of liquidations. This creates extreme volatility in an instant. In this instance, Hyperliquid’s order book was nearly fully “devoured,” leaving retail traders unable to respond and facing mass liquidations.

This pattern highlights the hazards of trading in markets with restricted liquidity. Whales can influence short-term trends, transforming profits into vast losses for other investors.

For individual investors, the XPL event on Hyperliquid emphasizes three key lessons. First, investors should avoid high leverage when market liquidity is scarce, as a “squeeze” can obliterate accounts within seconds.

Second, it’s critical to monitor order book depth and on-chain cash flows prior to entering a position in order to evade zones manipulated by whales.

Lastly, for those engaging in liquidity vaults like HLP, understanding that short-term profits can be paired with significant risk of loss during unexpected volatility is essential.

The post Was It Justin? XPL Soars 200% on Hyperliquid as Whale Wipes Out Order Book appeared first on BeInCrypto.