Bitcoin and cryptocurrencies are now closely associated with significant volatility. Investors have adapted, but the price movements last week were particularly notable due to the reemergence of the ‘Trump trade.’

Within just a few days, Bitcoin’s price fluctuated by over $20,000 between its highest and lowest points. Various macroeconomic factors fueled this tumultuous period, suggesting another wild week is imminent for Bitcoin.

Sponsored

From a New High to a Sudden Crash

The week for Bitcoin commenced positively, with its price soaring past $126,000 on Monday, hitting a new all-time high. Several factors contributed to this surge.

The value of US risk assets, which have recently displayed a strong correlation with Bitcoin, has been steadily rising. Additionally, the market responded favorably to Sanae Takaichi’s election as the new head of Japan’s ruling party on October 4.

Takaichi, considered the political successor to Shinzo Abe—architect of “Abenomics”—is expected to advocate for a monetary easing policy despite Japan’s significant inflation.

Following its peak, Bitcoin underwent a typical correction, stabilizing around the $122,000 mark for much of the week. However, trouble arose at around 4:00 PM UTC on Friday when President Donald Trump made a surprise social media post concerning China’s rare earth export restrictions, labeling it “a very hostile act.”

The Return of the ‘Trump Trade’

He expressed uncertainty about meeting President Xi Jinping during the upcoming APEC summit and threatened to impose substantial additional tariffs on China. This unexpected announcement shook the risk asset market, causing Bitcoin’s price to swiftly fall to $118,000, while US indices like the Nasdaq, S&P 500, and Dow Jones tumbled by approximately 2%.

Sponsored

However, the major shock came after the US stock market closed when Trump posted again on social media, introducing a new 100% tariff on all Chinese goods and warning of export controls on vital software starting November 1.

The crypto market, being the only active asset sphere at that moment, bore the brunt of this development. Bitcoin’s price briefly sank to the $102,000 level on some exchanges, while most altcoins dropped over 30%, and some experienced declines exceeding 50%.

Was the Crash Just a ‘Liquidation Cascade’?

The atmosphere in the crypto market was dampened following the sharp decline. Though a new 100% tariff on China is undeniably negative, was it sufficient to trigger a $20,000 drop in Bitcoin? Industry experts argue otherwise.

They believe the abrupt and significant decrease is attributed to a liquidation cascade of futures positions on perpetual decentralized exchanges (DEXs). A domino effect led to the eradication of a large number of leveraged long positions accumulated during the rally, resulting in a swift sell-off. User accounts indicate that stop-loss mechanisms failed on several exchanges.

Sponsored

Approximately $19.21 billion was liquidated within 24 hours, with the majority being long positions ($16.74 billion), alongside $2.47 billion in short positions also erased. This figure is 12 times the previous record of $1.6 billion set during the FTX crash for daily liquidations.

This liquidation wiped out a substantial quantity of investor capital. However, in the short term, there is a silver lining. The open interest in crypto derivatives has been reset, which was a considerable source of market pressure. If a new positive macro signal arises—like Trump retracting his 100% tariff threat—a price rebound could happen.

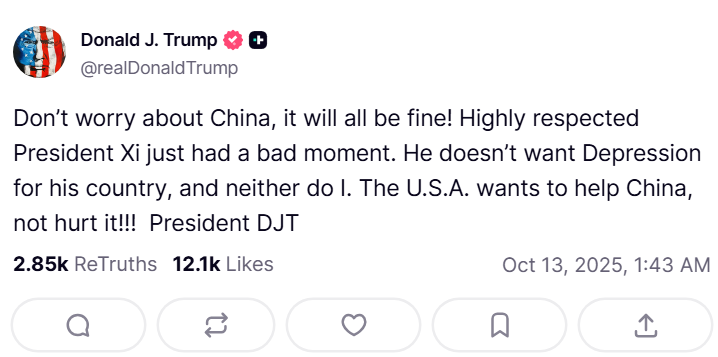

The good news arrived quickly over the weekend. China refrained from retaliating with its own tariffs. VP JD Vance mentioned the potential for dialogue with China during a media interview. On Sunday morning, Trump posted on social media, stating, “Don’t worry about China, it will all be fine!” Following this, Bitcoin’s price swiftly recovered to the $114,000 level.

With a single statement from Trump, asset prices can plummet, and with another, they can rebound. This moment evoked memories of the Trump trade we faced five months ago.

Sponsored

A Tense Week Ahead

Will the US-China tariff conflict return to its previous level, or was this merely the initial skirmish? The answer remains unclear. What is certain is that this situation will likely add more volatility to risk asset prices this week. The Trump trade is just starting.

This week, October 13 marks Columbus Day in the US. Although major stock markets like the NYSE and Nasdaq will function as usual, the bond market will be closed for the holiday.

No major data releases are on the calendar this week, but Fed Chair Jerome Powell is scheduled to deliver a public speech on Wednesday. In light of the government shutdown and renewed threats of a tariff war, many market participants anticipate a rate cut.

Any slight indication from Powell regarding future monetary policy could lead to considerable market volatility. Here’s hoping investors have a successful week.