In spite of increased scrutiny from South Korea’s financial regulators, leverage-based “crypto lending” services are resurfacing on local exchanges.

Exchanges like Upbit, Bithumb, and Coinone are either reintroducing or modifying these controversial products under newly established government regulations, indicating a cautious yet significant return.

Sponsored

Sponsored

Coinone Introduces “Coin Borrowing”

On Monday, Coinone, South Korea’s third-largest crypto exchange, launched its new cryptocurrency trading feature, “coin lending.” This announcement follows similar services rolled out by competitors Upbit and Bithumb just two months prior in July.

The offering allows users to borrow cryptocurrency by using Korean won as collateral, enabling leverage-based trading strategies. This includes short-selling—borrowing crypto, selling it at market rates, and repurchasing later at a lower price if values decline.

Coinone assured that the service complies with the government’s Financial Services Commission (FSC) lending regulations. The rules stipulate that individual borrowing limits align with equity short-selling frameworks, ranging from $22,000 (KRW 30 million) to $51,000 (KRW 70 million), based on the user.

Users can start with a minimum pledge of $37 and borrow up to 82% of their collateral, capped at the $22,000 limit. Currently, only Bitcoin can be borrowed.

Upbit and Bithumb Modify Their Offerings

Industry leader Upbit reinstated its lending features last week, adjusting its terms to satisfy the FSC’s guidelines. Their maximum collateral limit dropped by 25%, from $37,000 to $28,000.

Sponsored

Sponsored

Bithumb, the second-largest exchange in the nation, continues under its previous structure but has indicated that revisions are ongoing.

“We fully understand the objectives of the FSC and the DAXA guidelines,” stated a Bithumb representative. “We are evaluating borrowing limits, ratios, and liquidation conditions to ensure investor safety and market stability. Our goal is to transition the service smoothly while minimizing user disruption.”

Regulators Implement Stricter Safeguards

Earlier this month, the FSC released its guidelines to address concerns about investor risks and excessive leverage. Regulators clarified that lending services should not function as unchecked, high-risk offerings.

Exchanges are now required to provide loans solely from their reserves and restrict borrowing to major cryptocurrencies. Borrowing limits are imposed for each individual, and users must complete online education courses and pass suitability tests prior to accessing the service. To safeguard retail traders, authorities have also established a maximum annual interest rate of 20 percent and bolstered disclosure requirements.

Officials stated that the framework aims to balance fostering innovation in virtual asset markets while ensuring consumer protection and reducing reckless speculation.

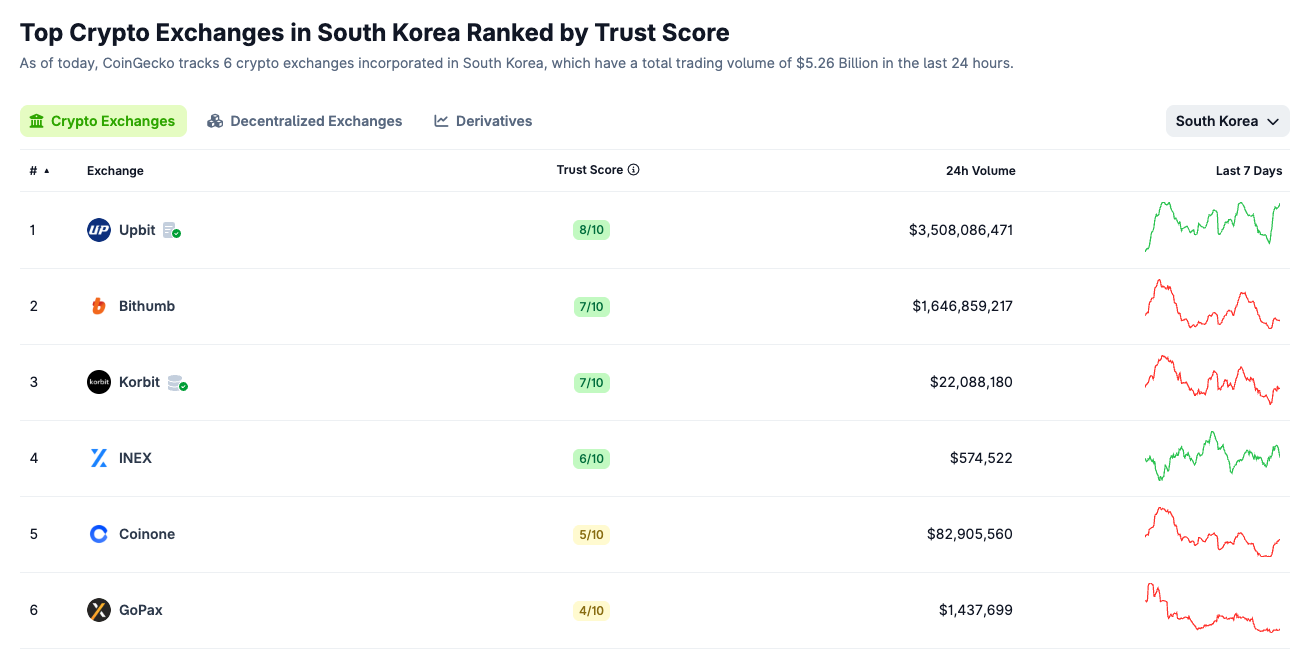

As per CoinGecko, six exchanges based in South Korea—including Upbit, Bithumb, and Coinone—collectively handle $5.26 billion in daily trading volume.