Ethereum is currently facing a paradox. While ether reached all-time highs in late August, decentralized finance (DeFi) activity on Ethereum’s layer-1 (L1) remains subdued compared to its peak in late 2021. Fees collected on mainnet in August totaled just $44 million, representing a 44% decrease from the previous month.

On the other hand, layer-2 (L2) networks such as Arbitrum and Base are thriving, with $20 billion and $15 billion in total value locked (TVL) respectively.

This disparity raises an important question: are L2s undermining Ethereum’s DeFi activity, or is the ecosystem transitioning into a multi-layered financial structure?

AJ Warner, the chief strategy officer of Offchain Labs, the firm behind layer-2 Arbitrum, believes that the metrics present a more complex picture than merely layer-2 DeFi encroaching on layer 1.

In an interview with CoinDesk, Warner emphasized that concentrating solely on TVL overlooks the bigger picture. Ethereum is increasingly acting as crypto’s “global settlement layer,” serving as a foundation for high-value issuance and institutional involvement. Initiatives like Franklin Templeton’s tokenized funds or BlackRock’s BUIDL project launch directly on Ethereum L1 — engagements that aren’t fully reflected in DeFi metrics but highlight Ethereum’s foundational role in crypto finance.

As a layer-1 blockchain, Ethereum provides secure but relatively slow and costly base infrastructure. Layer-2s are scaling solutions built on it, created to process transactions more rapidly and at a fraction of the cost while ultimately settling back on Ethereum for security. This appealing aspect makes them attractive to traders and developers alike. Metrics such as TVL, which measures the amount of crypto invested in DeFi protocols, illustrate this shift, as activities move to L2s where lower fees and faster confirmations render everyday DeFi practices much more feasible.

Warner compares Ethereum’s role in the ecosystem to that of a wire transfer in traditional finance: trusted, secure, and suitable for large-scale settlements. Yet, everyday transactions are migrating to L2s — the Venmos and PayPals of the crypto world.

“Ethereum was never designed to be a singular blockchain with all activity concentrated on it,” Warner stated in his CoinDesk interview. Rather, it’s intended to maintain security while enabling rollups to execute applications that are faster, cheaper, and more diverse.

L2s have gained explosive growth over the last few years as they offer a more rapid and less expensive alternative to Ethereum, facilitating whole categories of DeFi that are less effective on mainnet. Fast trading strategies, such as arbitraging price disparities between exchanges or executing perpetual futures, are inefficient on Ethereum’s slower 12-second blocks. However, on Arbitrum, where transactions conclude in under a second, these strategies become viable, Warner noted. This trend is evident, as Ethereum has experienced fewer than 50 million transactions in the past month, whereas Base had 328 million transactions and Arbitrum had 77 million transactions, according to L2Beat.

Developers also see L2s as an optimal environment for testing. Alice Hou, a research analyst at Messari, highlighted innovations like Uniswap V4’s hooks, customizable features that can be tested far more cheaply on L2s before gaining mainstream adoption. For developers, faster confirmations and reduced costs are not merely conveniences; they broaden the realms of possibility.

“L2s create an ideal playground for testing these kinds of innovations, and once a hook achieves significant popularity, it could attract new user types engaging with DeFi in ways that were previously unfeasible on L1,” Hou remarked.

However, this transition isn’t solely technology-driven. Liquidity providers are reacting to incentives. Hou indicated that data reveals smaller liquidity providers are favoring L2s where yield incentives and reduced slippage enhance returns. Yet, larger liquidity providers continue to stay concentrated on Ethereum, focusing on security and liquidity depth over potentially greater yields.

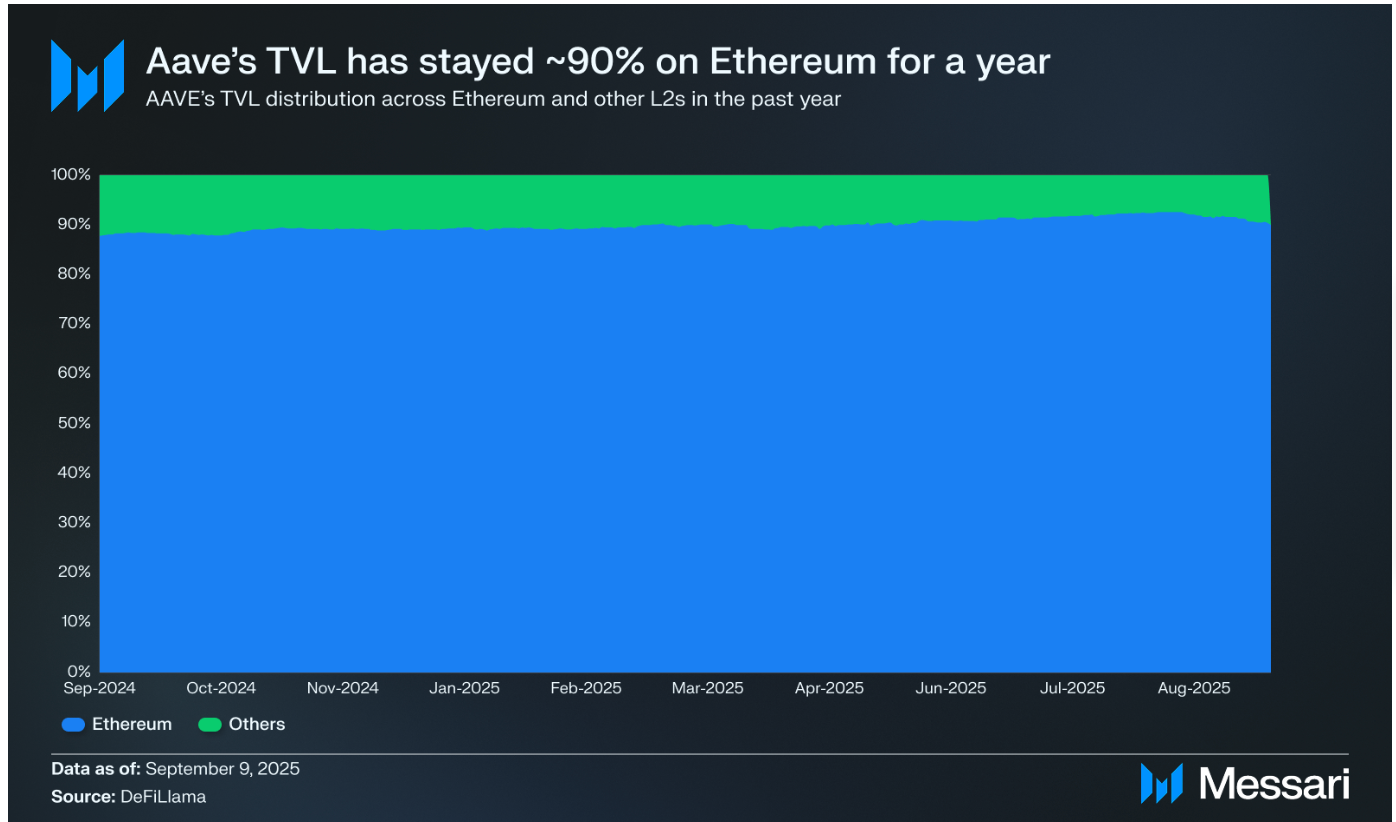

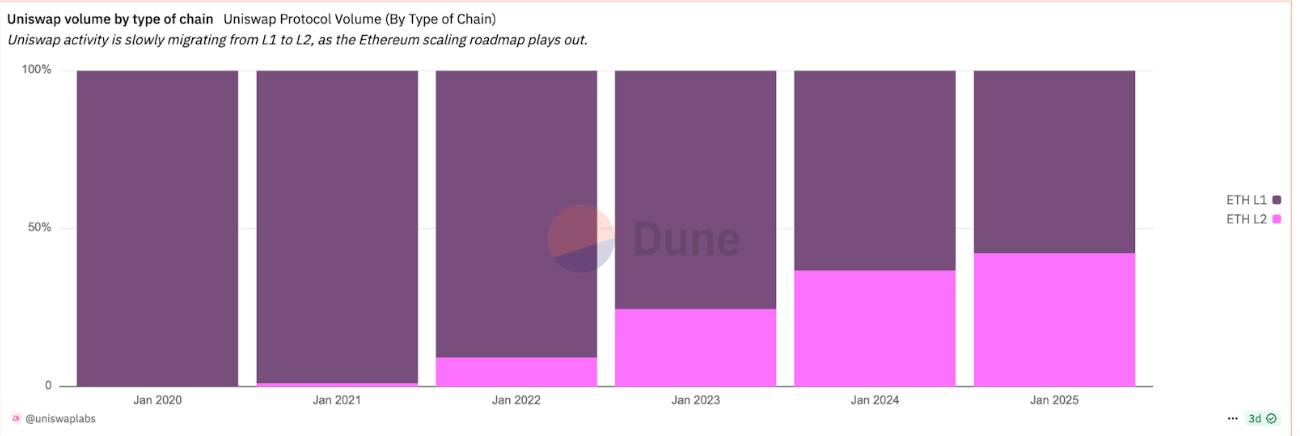

Interestingly, while L2s are increasingly taking on more activity, flagship DeFi protocols like Aave and Uniswap remain heavily linked to mainnet. Aave has consistently maintained around 90% of its TVL on Ethereum. Conversely, Uniswap has seen an incremental shift towards L2 engagement.

Another element driving L2 adoption is user experience. Wallets, bridges, and fiat on-ramps are increasingly directing newcomers to L2s, according to Hou. Ultimately, the data suggests that the L1 vs. L2 discussion isn’t zero-sum.

As of September 2025, approximately a third of L2 TVL still originates from Ethereum, another third is natively generated, while the rest comes from external bridges.

“This distribution indicates that while Ethereum continues to be a primary source of liquidity, L2s are also fostering their own native ecosystems and drawing in cross-chain assets,” Hou mentioned.

Thus, Ethereum appears to be solidifying its position as the secure settlement facilitator for global finance, while rollups like Arbitrum and Base emerge as execution layers suited for fast, inexpensive, and innovative DeFi applications.

“Most transactions I conduct use services like Zelle or PayPal… yet when I purchased my home, I utilized a wire. This scenario is somewhat analogous to the relationship between Ethereum layer one and layer twos,” Warner from Offchain Labs stated.

Read more: Ethereum DeFi Lags Behind, Even as Ether Price Crossed Record Highs