Reasons to trust

Rigorous editorial guidelines emphasizing precision, relevance, and neutrality

Developed by industry specialists and thoroughly vetted

Adhering to the highest standards in journalism and publishing

Rigorous editorial guidelines emphasizing precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

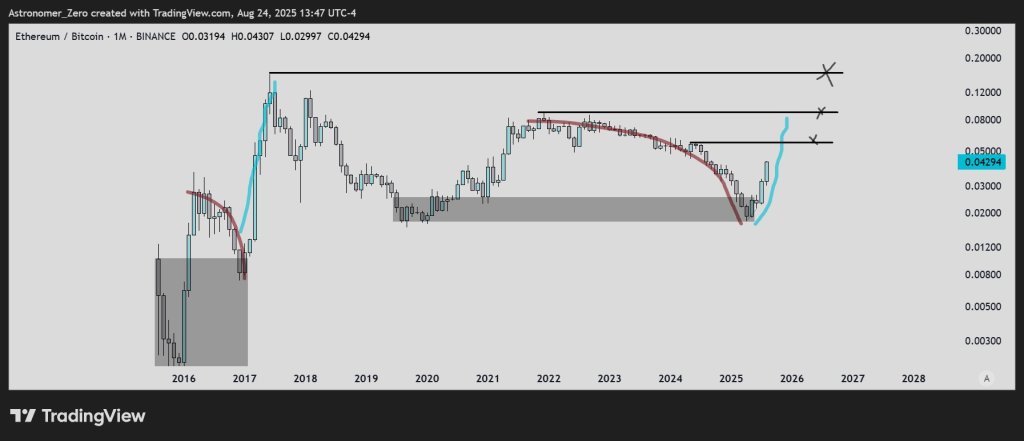

Crypto analyst Astronomer (@astronomer_zero) claims his long-held bottom thesis on the ETH/BTC pair has materialized, outlining explicit cycle targets tied to the cross. A chart shared on X confirms that the “ETH bottom call” is set, with a roadmap established predominantly around ETH/BTC levels, rather than ETH/USD, asserting that Ether’s superior performance generally trails Bitcoin’s momentum and that “all major liquidity originates from BTC.”

What Are Ethereum’s Prospects This Cycle?

Astronomer’s insights focus on a multi-month “zone” on ETH/BTC previously highlighted as a potential cyclical turning point. He notes that the initial prediction seemed “delusional” when first plotted—a “ridiculously long” line from what was deemed an “improbable ETHBTC bottom” at that moment—but states the turnaround aligns with his proprietary sentiment analysis.

“The sentiment surrounding ETH was historically poor,” with opinions varying from “ETH is a poor investment,” to “ETH foundation is liquidating,” to “SOL is the next ETH,” to “utility coins are obsolete.” He explains, “This kind of sentiment allowed us to solidify the bottom on ETHBTC in accordance with our long-established plan when it reached our zone.”

Related Insights

Against this backdrop, the chart and analysis outline three ETH/BTC targets for the remainder of the cycle. The first is 0.058 BTC for each ETH, which he points out was “still 35% higher” at the moment of posting and, using current Bitcoin values, “places ETH at roughly $6,500 if BTC maintains this level.”

The second is 0.091, “essentially a doubling from this point,” equating to “$ETH reaching $10,000+, in five figures,” a threshold where he mentions he “will have sold more than half of my spot holdings.”

The highest target is 0.16, “just below a 4x increase from here, suggesting ETH could reach $20,000 or more.” He clarifies that the 0.16 prediction is aspirational rather than a baseline expectation: “That is certainly my ultimate target, and while I don’t foresee it as a guarantee, I’m keeping it feasible in case it occurs.”

The technical rationale he outlines focuses on the pair. By tracing the cycle with ETH/BTC, he aims to capture relative strength over absolute price and avoid dependence on Bitcoin’s dollar value fluctuations. The implied ETH/USD figures are straightforward transformations of the ratio multiplied by BTC price; he adds that those dollar translations “will likely be conservative as I anticipate BTC rising further.” Essentially, the chart’s horizontal levels are ETH/BTC at 0.058, 0.091, and 0.16; the USD figures are relative and will adjust in tandem with Bitcoin.

Related Insights

The analyst explicitly dismisses calendar strategies. “The reason I avoid discussing seasonality or phrases like ‘red September’ or ‘sell in May, walk away’… is to prevent misleading you into investing your hard-earned money based on flimsy data… Seasonality holds no weight.” He adds, “Markets are governed by cycles, not seasons,” and concludes with a witticism regarding the meme: “For red September, please visit your local forest…”

Crucially, the trajectory he describes hinges on the same relative rotation mechanism that has influenced prior cycles: Bitcoin leads, Ether follows until liquidity shifts, then ETH/BTC progresses through established bands. Within this framework, the evaluation does not hinge on any single ETH/USD figure; it relies on ETH/BTC reclaiming and maintaining the specified zones.

Astronomer is transparent about market psychology as well. He contends that while “it appears many are publicly bullish on ETH now, holding significant positions,” order flow indicates “a majority of those individuals haven’t acquired from the lows, are effectively locked out, or are compelled to purchase at higher prices with increased leverage.” In his assessment, this setup still favors growth towards the outlined ETH/BTC targets: “As long as this remains true, I anticipate these targets will be achieved.”

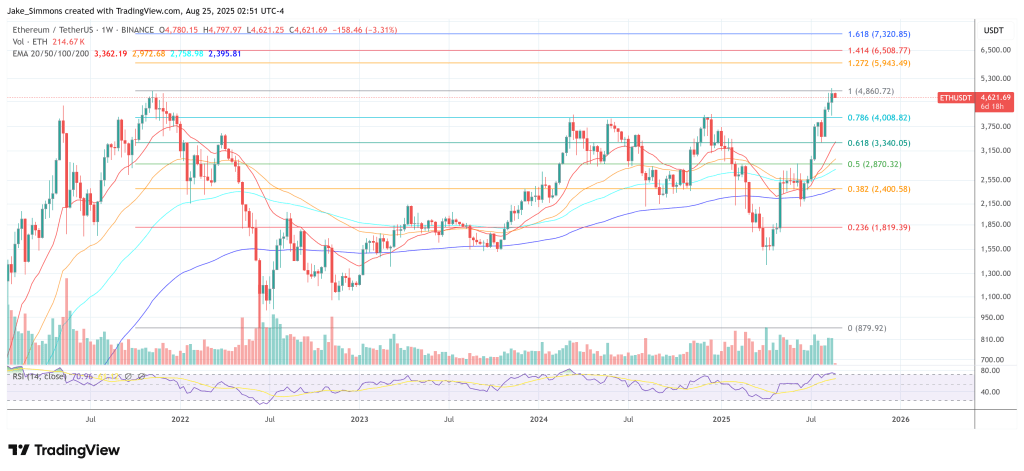

At press time, ETH was priced at $4,621.

Featured image created with DALL.E, chart from TradingView.com