While the overall market appears to be losing momentum, the BNB price train continues to roll. In the last 24 hours, Binance Coin has dipped by 1.5%, now trading at $877. Given its strong track record, this retreat seems more like a planned rest than a setback.

In the past month, BNB has risen by 15%, with three-month returns at 30%, and an impressive annual growth of 51%. Just 2% below its all-time high of $899, the token is still well-positioned for a breakthrough that could land it in the four-digit range for the first time.

Spot Demand Builds Through HODL Waves

This consistent rise is bolstered by a growing presence across various HODL wave cohorts: a metric tracking the percentage of circulating supply held over different time frames.

Between July 24 and August 23, three major cohorts increased their holdings: one-year to two-year wallets climbed from 6.55% to 7.52%, three-month to six-month holdings saw a surge from 1.62% to 7.30%, and one-month to three-month wallets ticked slightly upward from 2.29% to 2.306%.

These increases indicate that both long-term and mid-term investors are buying into strength rather than waiting for price dips, providing additional momentum to the BNB price train.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Futures Open Interest Keeps Momentum Alive

It’s not just spot markets contributing to the rally. BNB futures open interest has been steadily rising along with prices, recently peaking at $1.27 billion on August 22 for the first time in three months. Current levels remain close to this peak.

Increasing open interest suggests that leveraged traders are entering the market, heightening the possibility of both upward moves and sudden liquidations. If momentum stays with the bulls, short coverings could propel prices past $899, leading to higher discovery levels.

Conversely, a rapid long squeeze could introduce volatility and pullback, though the existing trends in spot and derivatives indicate a prevailing upward bias.

Futures open interest reflects the total number of unresolved futures contracts, illustrating the amount of capital locked in derivatives.

BNB Price Action: $898 Is the Gateway to Four Digits

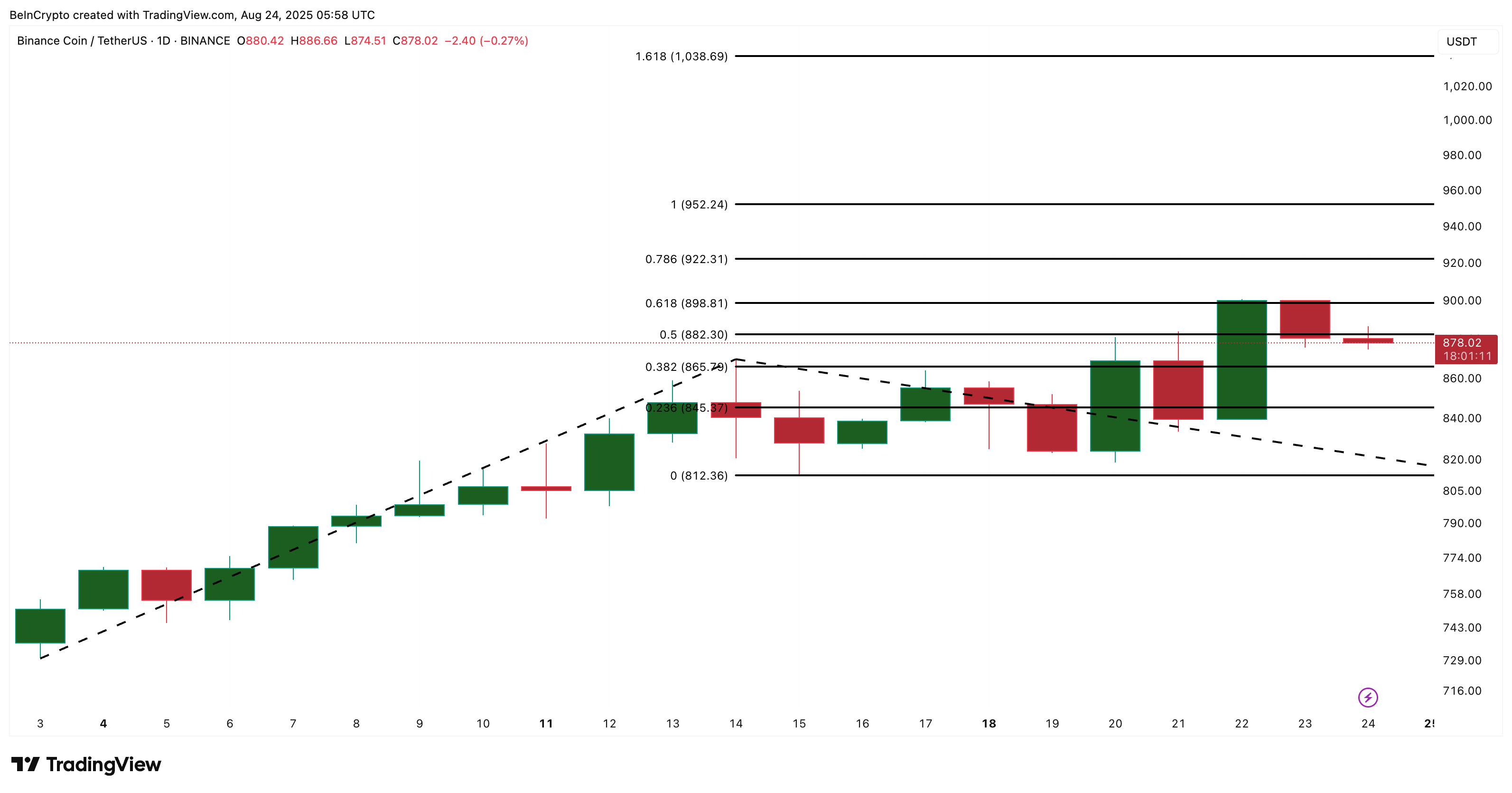

BNB is currently testing pivotal resistance levels that may dictate its next move. The token recently retracted from $898, which corresponds with the 0.618 Fibonacci extension, often regarded as a significant barrier during uptrends. BNB is trading just below another critical resistance level of $882.

With $898–$899 marking its historical high and representing one of the most formidable resistance levels, a decisive close above this could pave the way to $922 and $952.

Once BNB moves strongly beyond $898 and enters a phase of price discovery, the first four-digit target is set at $1,038. Should spot and derivative momentum persist, this could be just the start of a more extended rally, with $1,000 serving as a milestone rather than a final destination.

However, if BNB falls below $812, a critical retracement zone, it would undermine the bullish outlook in the short term. This would temporarily halt the BNB price train.

The post BNB Price Train Steams Toward $1,000 as Buyers Fuel the Rally appeared first on BeInCrypto.