Welcome to the Asia Pacific Morning Brief—your essential digest of overnight crypto developments that are influencing regional markets and global sentiment. Pour yourself a green tea and stay tuned.

BlackRock’s $366M crypto movement indicates potential selling pressure as Bitcoin briefly hit 112K before bouncing back. TORICO saw a boost due to its collaboration with Gentosha for Web3 expansion. Fed Chair Powell’s Jackson Hole speech tonight adds to market uncertainty.

BlackRock Crypto Transfer Indicates Possible Selloff

BlackRock transferred $366 million worth of Bitcoin and Ethereum to Coinbase Prime yesterday. This move included 1,885 BTC and 59,606 ETH, suggesting possible selling pressure. Such institutional transfers to exchanges usually signal preparations for potential market liquidation.

Bitcoin experienced a sharp drop, reaching levels around 112K before recovering above 113K. This selloff coincided with a general weakness in crypto markets during Asian trading hours.

Market participants are debating if this reflects portfolio rebalancing or a shift in institutional sentiment. The uncertainty surrounding Fed Chair Powell’s Jackson Hole speech later today adds to the mix, as traders anticipate hints regarding September rate cuts amid pressures for monetary easing from Trump.

TORICO Rises on Web3 Partnership

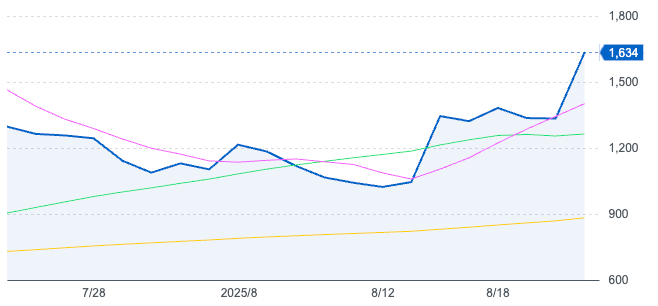

TORICO shares reached the daily limit yesterday following the company’s announcement of a partnership with major publisher Gentosha for Web3 expansion. Gentosha, known for its publication “New Economy,” a leading Japanese crypto media outlet, brings blockchain expertise to bolster TORICO’s initiatives. The partnership aims at creating new business opportunities in the cryptocurrency and blockchain space.

Starting in 2026, TORICO plans to invest 500 million yen in cryptocurrency, focusing on Bitcoin. Following the announcement, the manga retailer’s stock increased by 300 yen to 1,634 yen. Both publishing entities are targeting growth in emerging Web3 sectors.

BeInCrypto’s Asian Overview

Asian governments are currently debating strategies for national Bitcoin reserves, with Hong Kong leading in ETF and stablecoin licensing frameworks.

Wealthy Asian families are increasing their crypto allocations to 5% of their portfolios, driven by favorable regulations and strong returns.

A Chinese court sentenced a defendant to 3.5 years for knowingly facilitating USDT transactions related to stolen funds.

A Hong Kong construction company acquired 4,250 bitcoins valued at $483 million as part of its corporate treasury strategy.

A US policy group cautions that China worries USD stablecoins might undermine financial sovereignty and capital controls.

Japan’s FSA is set to establish a new bureau in 2026 to oversee cryptocurrency, digital finance, and asset management.

Additional Highlights

Crypto hackers have shifted their focus to RWA projects, resulting in $14.6 million in losses in the first half of 2025.

Ethereum is at risk of a downward trend below $4,000 after profit-taking erased gains from August’s peak of $4,793.

Optimism for a Fed rate cut in September continues to wane, as prediction markets show reduced hopes despite majority belief in it.

The OKB token burn strategy has spurred a 400% rally by decreasing the supply to 21 million tokens, aligning with Bitcoin’s cap.

Kanye West’s YZY meme coin raised insider trading suspicions after reaching a $3 billion valuation before crashing due to coordinated wallet activity.

The post BlackRock Potential Selloff, TORICO Web3 Partnership: APAC Brief appeared first on BeInCrypto.