Sure! Here’s a rewritten version of your content with the HTML tags preserved:

The price of Bitcoin is nearing new all-time highs, bolstered by an increase in open interest. With price movements maintaining above crucial levels, the market structure remains strongly bullish.

Summary

- Bitcoin is approaching the $123,348 resistance, the final significant hurdle before reaching new all-time highs.

- The channel structure continues to show bullish momentum, with a series of higher highs and higher lows.

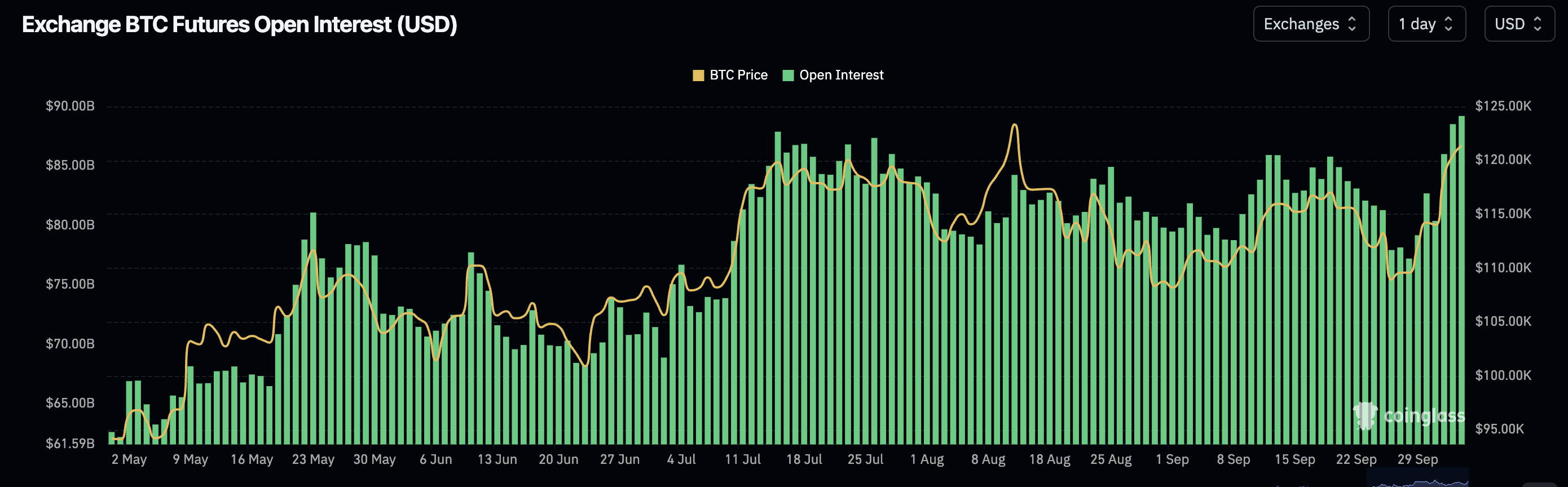

- With rising open interest, demand is confirmed, further supporting bullish momentum toward $131,000.

Bitcoin’s (BTC) momentum is gaining traction as it reaches the upper limits of its long-term trading channel. Following a defense of the channel low coinciding with the point of control, BTC has rallied into the $123,348 high-timeframe resistance area. This zone now acts as the last barrier before potential new all-time highs are achieved.

As open interest increases alongside the price, the move is underpinned by robust demand and greater market engagement. Additionally, Strategy’s Bitcoin holdings have surged to $77.4 billion as BTC recaptured the $120,000 mark, indicating confidence from major institutional investors.

Key Technical Points for Bitcoin Price

- Bitcoin is testing the $123,348 high-timeframe resistance, the final significant obstacle before new all-time highs.

- The channel structure remains in place with a consistent pattern of higher highs and higher lows.

- Increased open interest reflects strong demand, supporting the ongoing bullish movement.

The price dynamics of Bitcoin continue to respect its predefined trading channel. Each pivot, marked by crucial dollar thresholds on the chart, has upheld the bullish framework. The latest instance of this respect occurred at the channel low, aligning perfectly with the point of control, serving as an ideal launchpad for a bullish uptick. This response propelled Bitcoin towards the $123,348 resistance, now a critical level to monitor as the market anticipates a possible breakout.

If this resistance is confidently reclaimed, it could pave the way for a “blue sky breakout,” leading Bitcoin into unexplored price territory. Historically, such scenarios generate increased volatility as liquidity diminishes above all-time highs. The next logical aim within the channel is the $131,000 area, corresponding with the upper channel resistance.

Market structure still supports this optimistic scenario. The sequence of higher highs and higher lows remains intact, reinforcing the strength of the upward trend. Each expansion has been succeeded by a healthy correction, ensuring the trend remains sustainable. This controlled progression lends credibility to the notion that Bitcoin is not just rallying, but is also establishing a stable foundation for further advances.

The rise in open interest further corroborates this optimistic outlook. As the price ascends, the volume of active market positions also increases. This correlation between price growth and open interest escalation suggests that the movement is driven by real demand, not just speculative trading.

In previous cycles, a surge in open interest accompanied by a bullish framework has often heralded substantial continuation rallies. Reflecting this soaring optimism, a major Wall Street institution has even forecasted that Bitcoin might soar as high as $231K, showcasing the magnitude of bullish sentiment building in the market.

Anticipations for Upcoming Price Movements

Bitcoin maintains its bullish stance across various technical dimensions: price structure, market dynamics, and open interest. A breakout above $123,348 is likely to accelerate momentum towards $131,000, where channel resistance is situated. With open interest on the rise, the setup favors upward continuation, although traders should prepare for heightened volatility in this blue sky territory.