This week, a previously inactive Bitcoin stash was transferred to an exchange, reigniting concerns over the impact of old coins re-entering the market on prices.

Related Reading

The Origins of Mt. Gox and Their Remarkable Returns

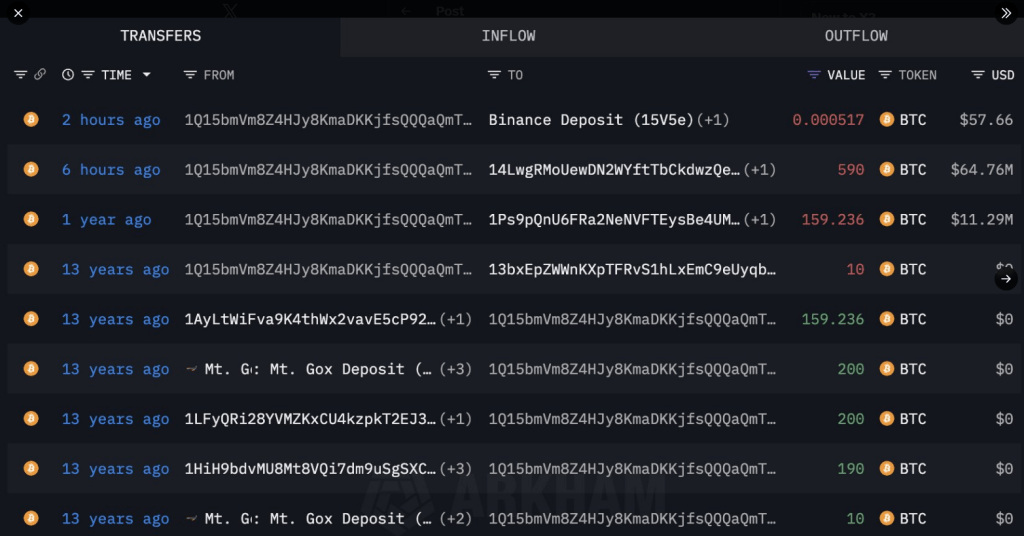

According to the blockchain analysis platform Lookonchain, a group of addresses associated with coins withdrawn from Mt. Gox over 13 years ago transferred 300 BTC to Binance in a single transaction.

These coins were initially acquired at around $11 each, making the original investment approximately $8,151. The current valuation stands at about $33.47 million, reflecting a stunning increase of roughly 410,624%. Reports indicate that around 590 BTC remains in the same cluster of addresses.

The market downturn just awakened a dormant Bitcoin OG, who deposited 300 #BTC($33.47M) into #Binance 2 hours ago.

Originally, he withdrew 749 $BTC($8,151 back then) from #MtGox 13 years ago, when $BTC was merely $11.

Last year, he transferred 159 $BTC to a new wallet but opted not to sell —… pic.twitter.com/tSxgO0Mw5E

— Lookonchain (@lookonchain) October 12, 2025

Wallet Activity and Recent Changes

Last year, the same owner moved 159 BTC into a new wallet and let it sit idle. The latest action is distinct, as the coins have been placed in an exchange hot wallet, allowing for quick sales.

Market participants observed the difference: one action maintained the coins on-chain, while the other moved them within the reach of an order book. It’s uncertain if the owner intends to sell some or all of the 300 BTC, but their presence on Binance facilitates rapid selling.

Market Shifts and Activity

Bitcoin’s price rebounded to approximately $115,000 on Monday, following a drop to $102,000 on Friday. This decline triggered billions in liquidations and left traders uneasy.

Statistics reveal that ETFs recorded $2.7 billion in inflows over the past week, and institutional demand remained strong despite the volatility. Nevertheless, the market’s stability is fragile; a substantial sell order from an old holder could swiftly alter short-term supply dynamics.

Analysts tracking on-chain activity flagged this move, which gained traction across social media. Inflows into exchanges from wallets associated with early miners or Mt. Gox addresses typically attract scrutiny, as they indicate the re-emergence of previously dormant supply. Here, the figures are substantial enough to capture traders’ interest.

Potential Outcomes and Risks

Should some of the 300 BTC be sold, it could exert upward pressure on prices, especially during periods of low trading volume. Alternatively, the transfer might represent estate consolidation or a strategic move to cold storage, in which case selling may not follow.

Related Reading

Market participants will closely monitor wallet behavior: quick withdrawals to multiple exchange addresses, for example, would likely signify a selling action.

Featured image from Gemini, chart from TradingView