As per Coinglass data, liquidations in the crypto market exceeded $1.6 billion in the last 24 hours, predominantly involving long positions. Increased inflows to exchanges pose a risk of Bitcoin (BTC) falling beneath the crucial support level of $112,000.

Bitcoin Declines: Is $112,000 at Risk?

Today, Bitcoin dropped from approximately $116,000 to a low of $111,800, coinciding with heightened volatility in the broader crypto market due to anxiety over a U.S. government shutdown. Current prediction markets on Kalshi indicate a 70% likelihood of a shutdown in 2025.

Related Reading

Regarding today’s BTC activity, CryptoQuant contributor PelinayPA noted that nearly 65,000 BTC were withdrawn from exchanges at the end of August and early September, which aligned with a price recovery for the digital asset.

The analyst presented a chart showing BTC withdrawals from exchanges. Large outflows typically suggest that investors are shifting their assets to personal wallets, reducing selling pressure and hinting at a bullish trend.

However, recent trends indicate that these outflows have diminished. Since September 20, exchange data reveals a tendency for more investors to retain their coins on exchanges.

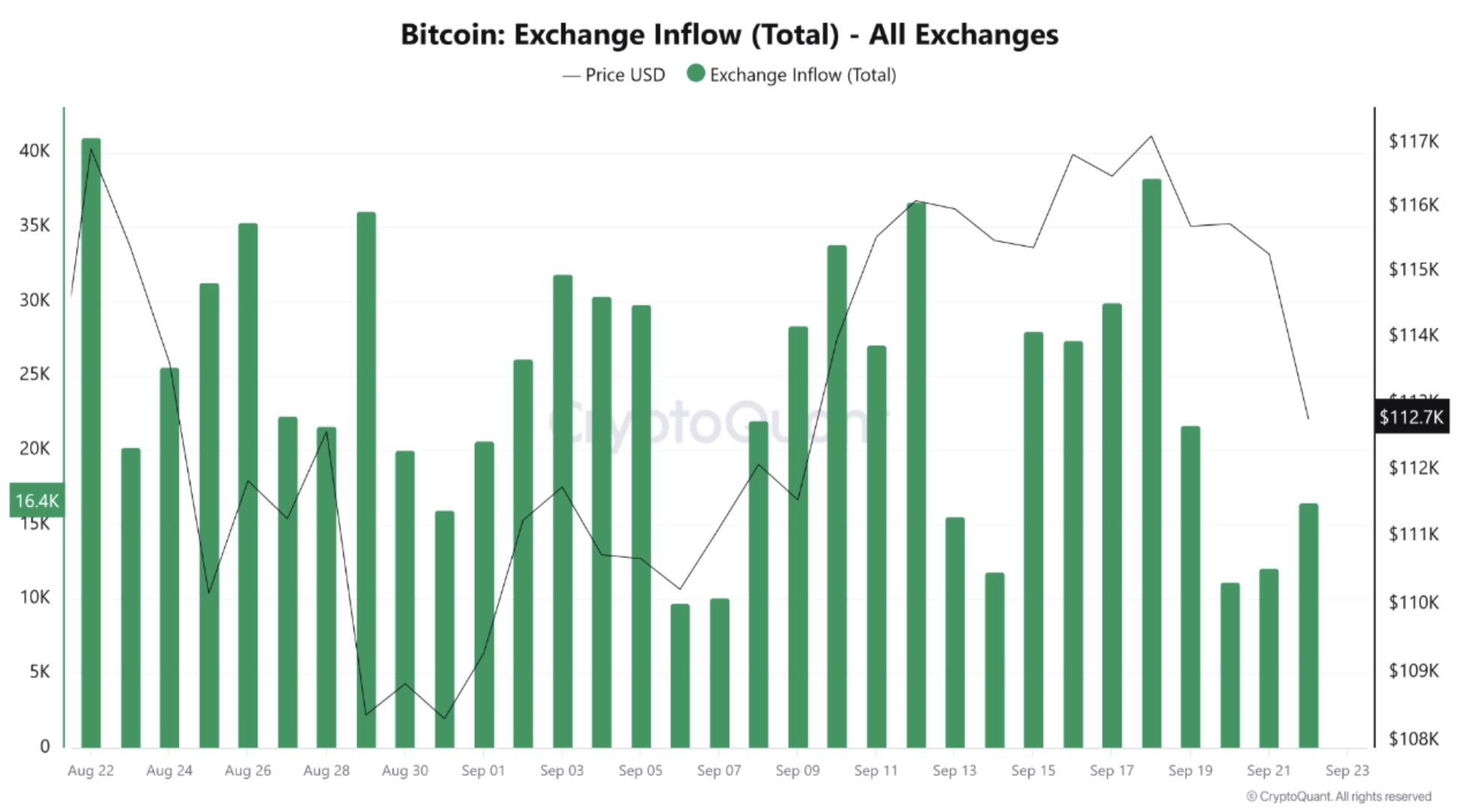

PelinayPA provided an additional chart depicting BTC deposits to exchanges. Significantly, between September 17 and 19, Bitcoin inflows soared to nearly 40,000, while the price fell to $117,000.

For those unfamiliar, significant BTC inflows to exchanges generally indicate that investors are transferring their assets from private wallets to platforms for selling, which signals increased selling pressure. This can lead to short-term bearish trends as supply on exchanges overtakes demand.

The CryptoQuant analyst noted that during the upswing from September 7 to 15, BTC outflows outpaced inflows, contributing to bullish momentum. However, the situation reversed after September 17, leading to significant selling pressure and a drop in BTC to $112,700. She concluded:

High inflows coupled with diminished outflows indicate short-term bearish pressure. A resurgence in outflows, suggesting accumulation, could result in a strong rebound for BTC from the $112K region. Otherwise, the potential for further declines continues.

Should BTC Holders Be Concerned?

Bitcoin’s decline to $112,000 isn’t entirely unexpected. Recent on-chain metrics already suggested that BTC might encounter challenges due to limited whale involvement during the latest rally.

Related Reading

Notably, BTC’s recent price drop occurred shortly after a 25 basis point interest rate cut by the US Federal Reserve (Fed). While Bitcoin experienced a decline, experts contend that it’s far from a true capitulation.

CryptoQuant CEO Ki Young Ju recently projected that BTC may reach as high as $208,000 in this market cycle. As of the latest update, BTC is valued at $113,175, reflecting a 2.1% decline over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com