Bitcoin may be preparing for another decline as on-chain data indicates ongoing selling pressure. A recent report from CryptoQuant highlights an increase in selloffs among spot and futures traders.

If this trend continues, BTC might fall below the crucial $110,000 threshold.

Bitcoin Sell Pressure Intensifies

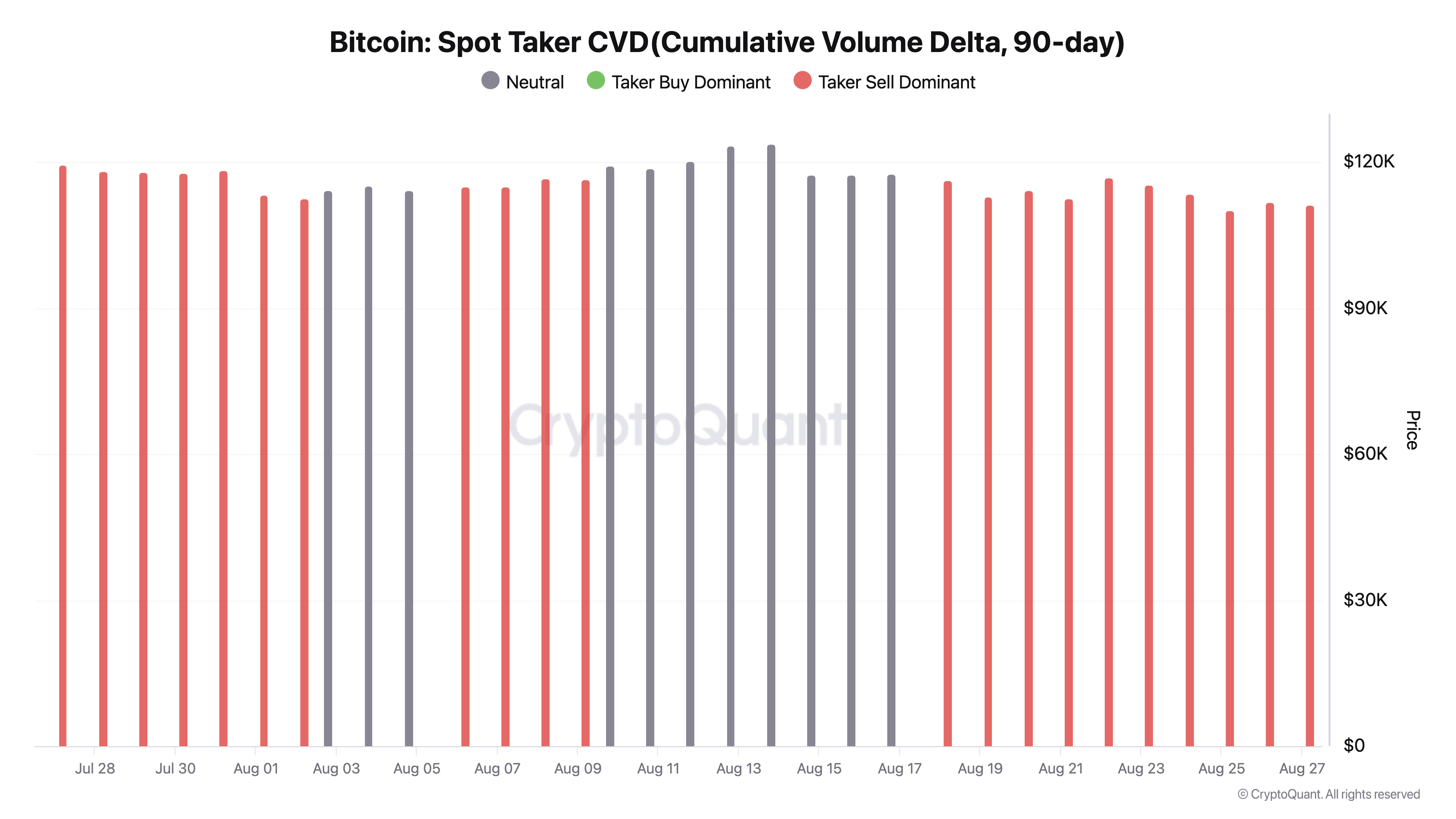

As per a freshly released report on CryptoQuant, Bitcoin has experienced a rise in selloffs from both spot and futures traders, indicated by two significant metrics—the Spot Taker Cumulative Volume Delta (CVD, 90-day) and the Taker Buy/Sell Ratio.

The Spot Taker CVD, which monitors whether market takers are mostly buyers or sellers, has turned red after months of buyer strength. This transition suggests renewed selling pressure, a trend that has typically foreshadowed market corrections.

For token TA and market updates: Interested in receiving more insights like this? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

This reflects a decline in aggressive buying interest and an increasing readiness among BTC spot traders to sell off positions, indicating market fatigue.

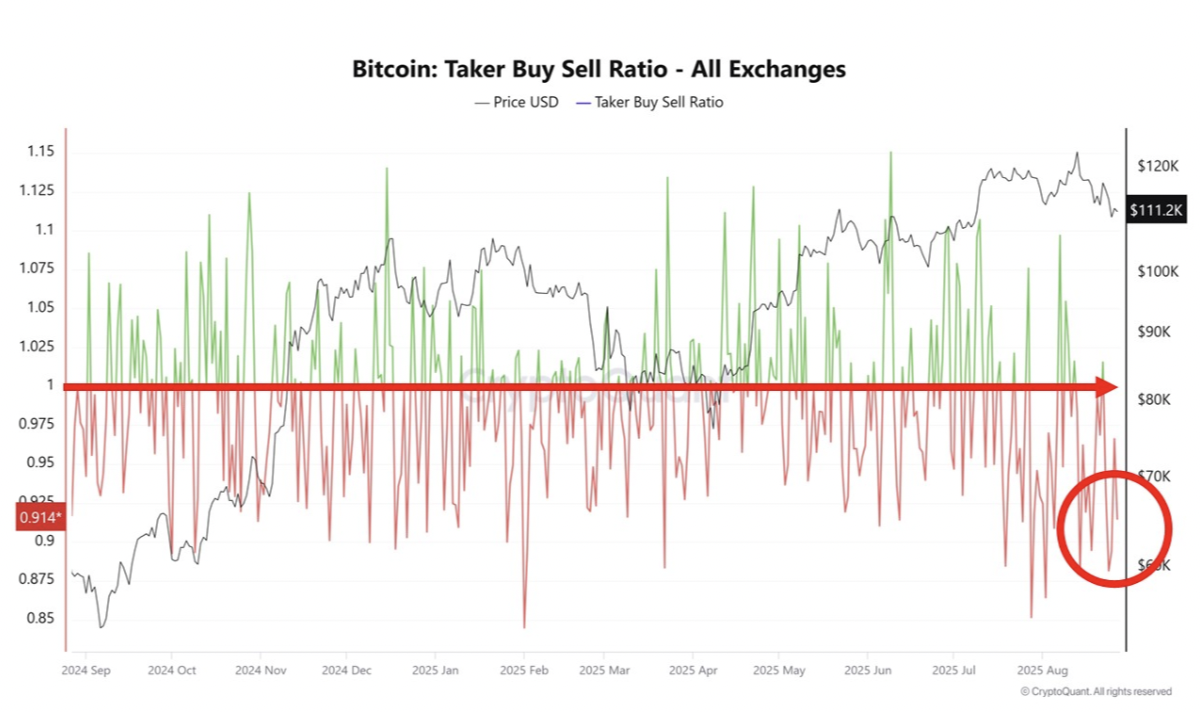

Moreover, the report reveals that BTC’s Taker Buy/Sell Ratio has dropped to 0.91, falling beneath its long-term average of 1.0. This trend shows that sell orders are now consistently outpacing buy orders in the coin’s futures market.

An asset’s taker buy-sell ratio gauges the relationship between buy and sell volumes in its futures market. Values above one indicate a surplus of buy volume, while those below one suggest that more futures traders are liquidating their holdings.

This confirms the increasing sell-side pressure and declining sentiment, which could exacerbate BTC price drops if the trend persists.

Can the $112,000 Support Fuel a Fresh Rally?

At the time of writing, BTC trades at $112,906, resting above the support level at $111,920. If demand rises and this price floor solidifies, it could lift BTC’s price towards $115,764. A successful breach of this point might pave the way for a surge to $118,922.

On the other hand, if the selling pressure intensifies, BTC risks dropping below $111,920 and heading towards $109,267.

The post Bitcoin Braces for Another Dip as On-Chain Data Warns of Spot and Futures Selloffs appeared first on BeInCrypto.