Today, the price of bitcoin remained beneath $90,000, sitting around $80,000, as traders made yet another late effort to recover year-end losses during the thin holiday trading period. However, the market still lacked the necessary conviction for a sustained breakout.

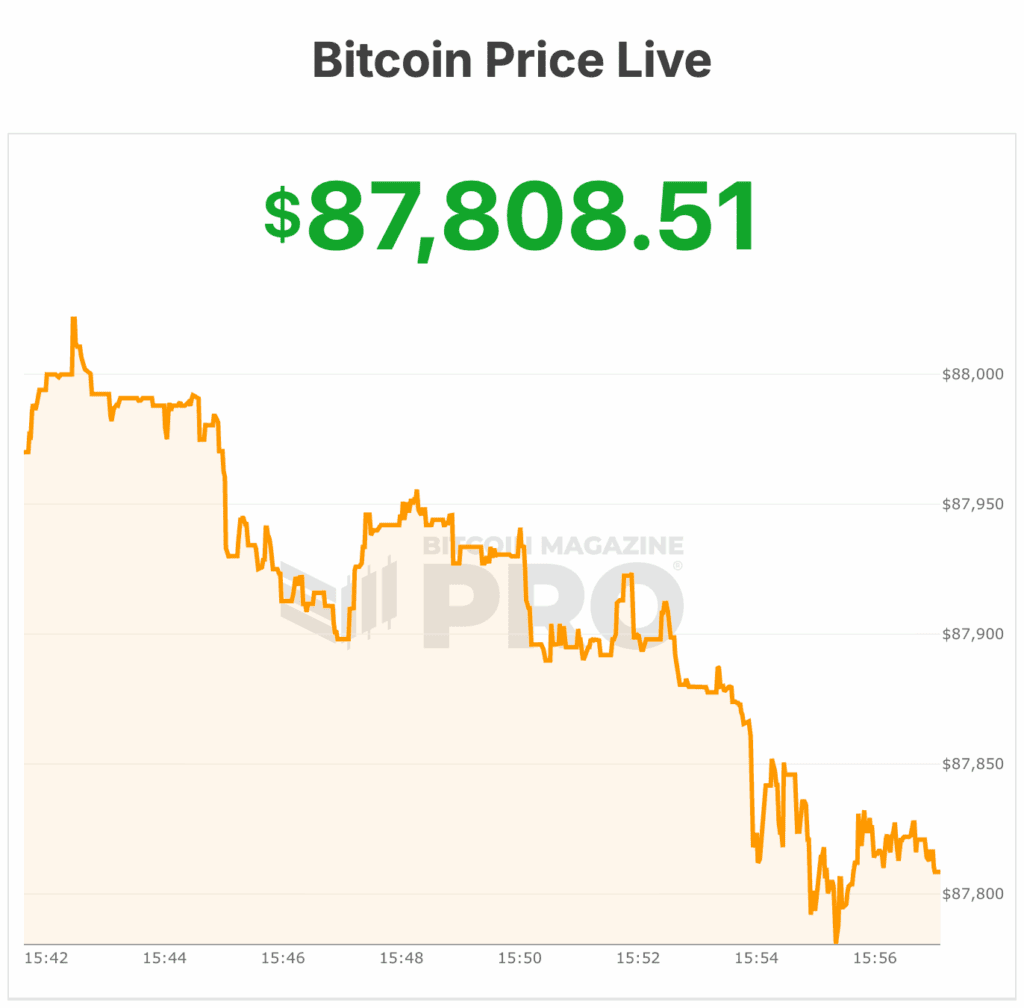

As of this writing, the bitcoin price was recorded at $88,063, reflecting a rise of about 1% over the past 24 hours, based on market data. The total trading volume reached approximately $40 billion, indicating subdued activity as December comes to an end.

Bitcoin is currently approximately 1% below its seven-day peak of $89,201 and roughly 1% above its seven-day trough of $86,855.

The leading cryptocurrency has a circulating supply of 19,969,296 BTC, with a maximum cap of 21 million coins. Bitcoin’s overall market capitalization is around $1.76 trillion, also showing a 1% increase from the previous day.

Yesterday, bitcoin attempted to push past the $90,000 mark for the second consecutive session, but the rally once again fizzled out. Price movements are still restricted to a broad range between roughly $85,000 and $95,000, a structure that has characterized the market since the sharp sell-off in October.

This downturn followed bitcoin’s all-time high reached in early October, when prices surged nearly 30% for the year.

Since then, market sentiment has shifted. Currently, the bitcoin price is about 5% lower than last December, which puts it on course for its first annual loss in three years.

“I expect exaggerated moves on light flow into the New Year,” stated Jasper De Maere, desk strategist at Wintermute, in a note to Bloomberg. He warned traders against heavily depending on short-term signals until liquidity stabilizes.

The recent price stagnation stands in contrast to the wider recovery in traditional risk assets. Bitcoin began the year with a robust rally fueled by optimism regarding crypto-friendly policies under the second Trump administration.

However, that enthusiasm diminished as uncertainty around President Donald Trump’s tariff agenda unsettled global markets.

Bitcoin price dealing with leveraged traders

While U.S. equities have largely bounced back from those instabilities, bitcoin has had difficulties regaining traction. The downturn in October was exacerbated by a wave of liquidations as leveraged positions hit record levels. On October 10, a sudden sell-off liquidated long exposures and reset market positioning.

Interest in spot Bitcoin exchange-traded funds has also diminished. Data from Bloomberg indicates that ETF outflows have approached around $6 billion in the fourth quarter, adding consistent pressure as bitcoin struggled to regain the $90,000 threshold.

Holiday trading conditions have distorted price movements further. Earlier this week, the bitcoin price fluctuated sharply around $90,000 during low-liquidity sessions, exhibiting rapid gains and losses without follow-through.

Prices saw a brief increase of approximately 2.6% during thin trading and remained above $86,000 for the week; however, they again could not maintain levels above $90,000 during the Asian trading hours.

QCP Capital noted that recent movements reflect a market low on participation. In a note, the firm highlighted a considerable drop in derivatives activity following last Friday’s record options expiry. Open interest decreased by nearly 50%, signaling that many traders stepped back.

This options expiry also changed short-term market dynamics. According to QCP, dealers who were long gamma before the event have since turned short gamma on the upside. In such environments, rising prices may incite hedging activity that accentuates short-term movements, especially with thin liquidity.

A similar situation arose earlier this month when the bitcoin price briefly neared $90,000. Funding rates surged rapidly as traders flocked to bullish positions, causing temporary upward pressure.

Deribit’s perpetual funding rate soared above 30% after the latest expiry, up from near-flat conditions previously. High funding rates often signify overheated positioning and increase the cost of maintaining long exposure.

From a technical standpoint, analysts at Bitcoin Magazine indicated that the market continues to reject lower levels within a broadening wedge pattern, implying a weakening of downside momentum. Significant resistance lies at $91,400 and $94,000. A weekly close above $94,000 could pave the way toward $101,000 and $108,000, although resistance is still substantial.

On the downside, $84,000 serves as critical support. A breach below this level could drive the bitcoin price towards the $72,000 to $68,000 range.