Earlier this week, the US Federal Reserve (Fed) reduced interest rates by 25 basis points, offering crucial support to the economy following a period of rate hikes designed to curb inflation. This reduction is expected to favor risk-on assets like Bitcoin (BTC).

Fed Lowers Interest Rate, Bitcoin Supply Ratio Decreases

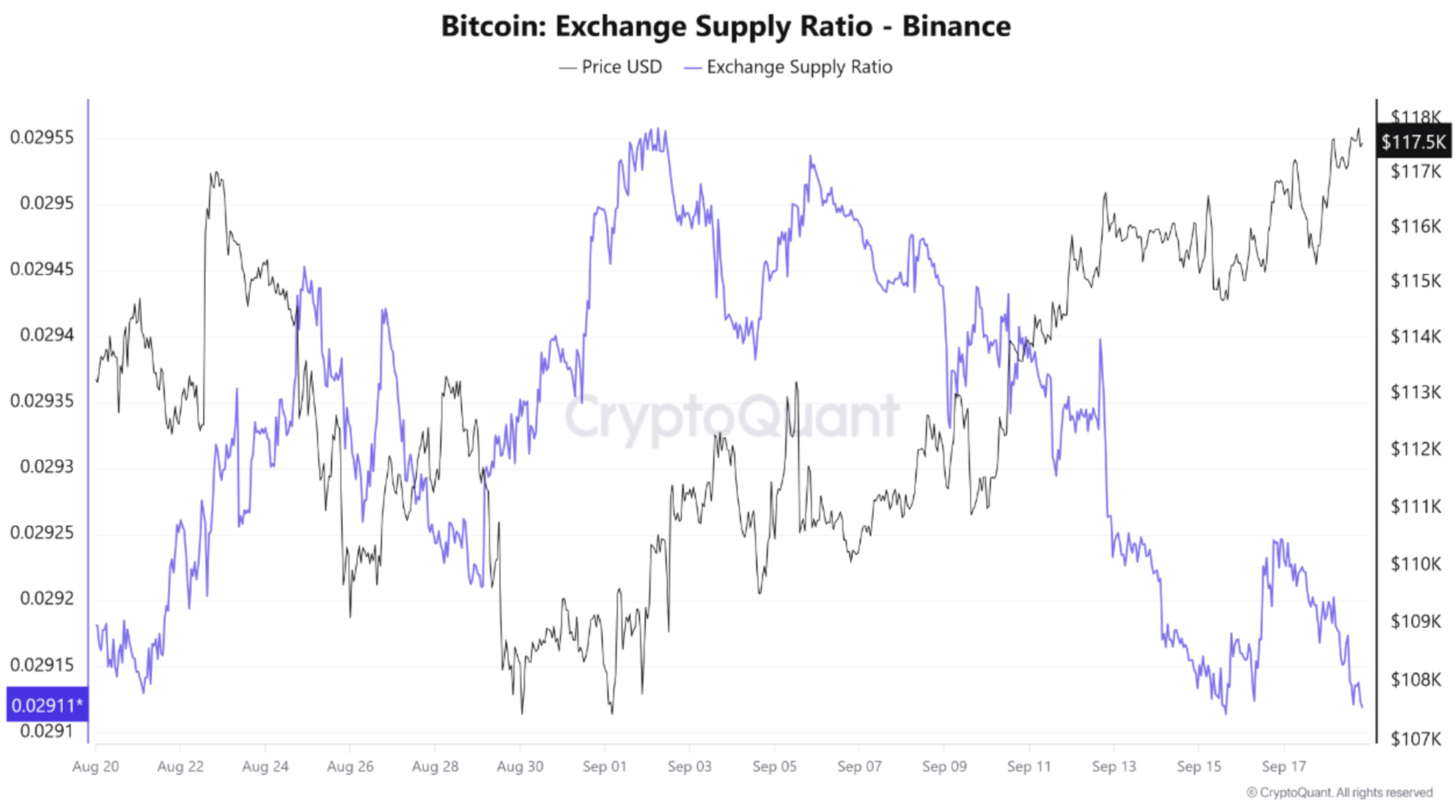

As highlighted in a CryptoQuant Quicktake post by contributor Arab Chain, recent data from Binance indicates that the interest rate cut has reignited investors’ enthusiasm for BTC. Notably, the exchange supply ratio has dropped to 0.0291, suggesting that investors are opting to withdraw their BTC from exchanges to hold it long-term rather than selling.

Related Reading

To substantiate their analysis, Arab Chain presented a chart illustrating a declining exchange supply ratio while BTC prices continue to rise. The analyst noted that the interest rate cut has enhanced risk appetite and liquidity within the market.

This trend indicates that the Fed’s monetary policy will likely remain accommodating in the near future, which may alleviate selling pressure on BTC temporarily. A low supply on exchanges is creating relative buying pressure, especially as Bitcoin maintains stability above $115,000.

The analyst noted that if BTC outflows from crypto exchanges continue at this rate, the digital asset may aim for the $120,000 resistance level. However, liquidity must keep flowing into digital assets as a result of the Fed’s decision. Arab Chain added:

The ongoing decline in the Bitcoin Exchange Supply Ratio, in conjunction with a rising price, supports a bullish outlook, particularly if traditional markets stabilize post-Fed’s decision. Conversely, if the Exchange Supply Ratio begins to rise again (indicating Bitcoin being returned to exchanges), it may suggest that investors are preparing to realize profits around the 118K–120K range.

Meanwhile, crypto analyst Titan of Crypto echoed similar sentiments. In a post on X, the analyst provided a chart, asserting that BTC is currently caught under the bearish fair value gap. A daily close above this gap – marked in red – could open the door for new highs for BTC.

Is BTC Facing a Supply Shortage?

The decreasing exchange supply ratio further implies that BTC might be nearing a bullish ‘supply crunch’ which could lead to notable price increases for the digital asset soon.

Related Reading

Recently, the Bitcoin Scarcity Index noted its first surge since June 2025, signaling possible upward price pressure on BTC. Additionally, BTC outflows from Binance are continuing quickly, further diminishing the digital asset’s active circulating supply.

Despite this, some concerns remain, particularly due to the recent lack of whale participation in BTC price movements. At publication, BTC is trading at $116,374, down 1.3% over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com