Sure! Here’s the rewritten content while keeping the HTML tags intact:

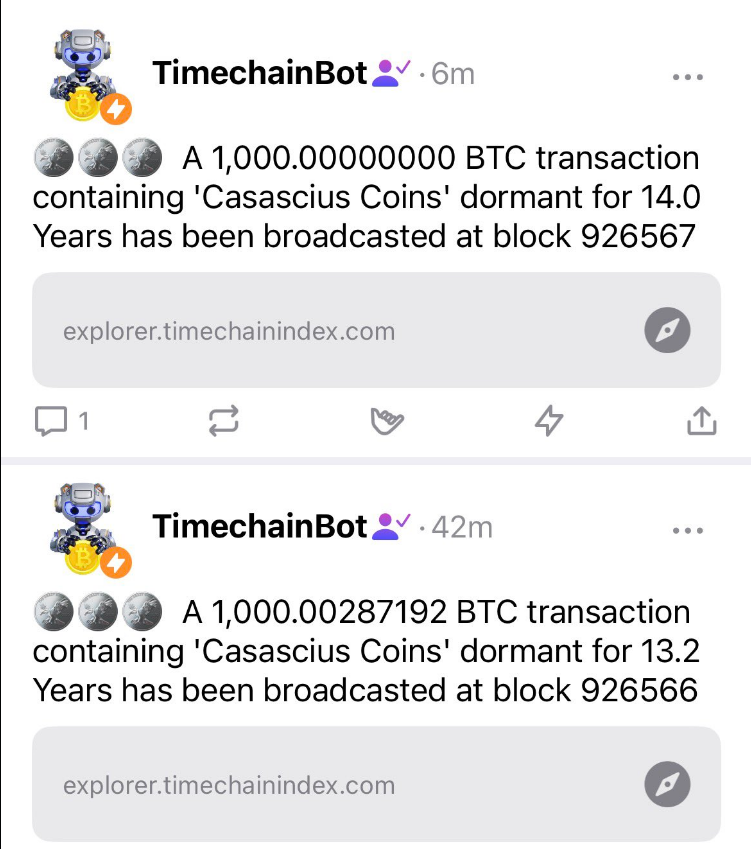

On Friday, two long-idle Casascius coins, each containing 1,000 Bitcoin, were activated, releasing over $179 million that had remained dormant for more than 13 years.

According to onchain data, one coin was minted in October 2012, when Bitcoin was valued at $11.69. The other originates from December 2011, when BTC was priced at $3.88, resulting in an impressive theoretical gain of nearly 2.3 million% since its minting.

Historic Physical Coins Released

Reports indicate that Casascius coins (metal coins) were created by Utah entrepreneur Mike Caldwell between 2011 and 2013 as tangible representations of Bitcoin. Each coin or bar concealed a paper with a private key, protected by a tamper-evident hologram.

Two Casascius coins, each with 1,000 BTC, have just been activated after over 13 years of dormancy. pic.twitter.com/nlFUy39MkD

— Sani | TimechainIndex.com (@SaniExp) December 5, 2025

Records indicate that only 16 of the 1,000 BTC bars and 6 of the 1,000 BTC coins were ever produced, making these items remarkably rare and of significant historical importance.

Caldwell ceased operations after receiving a notice from FinCEN that questioned whether his venture qualified as an unlicensed money transmission business.

Understanding The Coins

The system was straightforward to use but had strict implications: whoever removed the hologram to disclose the private key could claim the Bitcoin value stored underneath.

Once the sticker was removed and the private key was used, the coin lost all Bitcoin value. Reports indicate that collectors view this moment as irreversible. Some owners opted to transfer funds off the physical coins without liquidating them.

Rarity And Returns

Data illustrates why collectors and investors closely monitor these developments. Two coins, each worth 1,000 BTC, represent a significant reserve when prices are high. Not accounting for minting costs, the December 2011 coin’s increase from $3.88 to its current valuation showcases an eye-catching multiple.

However, experts caution that converting the private key into usable Bitcoin is merely the first step; subsequent actions depend on the holder’s decisions. Some may retain their holdings, while others might transfer funds to cold storage. Selling is not always assured.

Derivatives Market Shock

In the meantime, both spot and derivatives markets are witnessing considerable volatility. According to CoinGlass data, today’s derivatives activity reflected an 11,588% liquidation imbalance that primarily affected long positions.

As of this writing, Bitcoin was trading below $90,000, with over $20 million in BTC long liquidations occurring within minutes, while short positions remained relatively stable. This kind of imbalance occurs when many traders are aligned in the same direction and market conditions shift rapidly.

Featured image from Unsplash, chart from TradingView