Sure! Here’s the rewritten content while keeping the HTML tags intact:

Tom Lee, Chairman of BitMine, anticipates that Bitcoin and Ethereum could emerge as significant trades over the next three months, contingent on the Federal Reserve’s decision to cut interest rates. What might the upcoming rally entail?

Summary

- According to BitMine Chair Tom Lee, he expects “monstrous movements” for Bitcoin and Ethereum in the next three months if the Fed opts for interest rate cuts.

- The broader cryptocurrency market appears to be preparing for the Federal Reserve’s rate decision, with surveys reflecting high optimism regarding a potential interest rate cut.

In a CNBC interview, Tom Lee, Chairman of BitMine, mentioned that digital assets are one of the sectors likely to receive a substantial boost in the coming three months. Should the Federal Reserve proceed with interest rate reductions, the market could experience significant shifts in the weeks ahead.

He pointed out that Bitcoin (BTC) and Ethereum (ETH) historically exhibit “seasonal strength,” making them suitable candidates for larger surges following a Fed interest rate adjustment.

“I believe they could see a monster move in the next three months, something enormous,” Tom Lee stated during his interview.

As reported by CBS, the Fed’s next rate announcement is scheduled for 2 PM EST on September 17. The CME FedWatch indicates a 96% probability of a 0.25% cut, based on 30-day Fed Funds futures prices. Crypto traders are preparing for the Fed’s decision by allocating more capital into stablecoins for on-chain deployment.

Moreover, key beneficiaries are expected to include Nasdaq 100, particularly MAG7 and AI stocks, which will benefit from the interest rate reductions. Tom Lee refers to events in September last year and in September 1998 as reference points for his predictions.

Both years featured the Fed delaying significant actions before announcing mid-month interest rate cuts. Besides tech and crypto, Lee noted that small-cap and financial stocks might also gain from the rate reductions.

Is the crypto market poised for Tom Lee’s anticipated Fed rally?

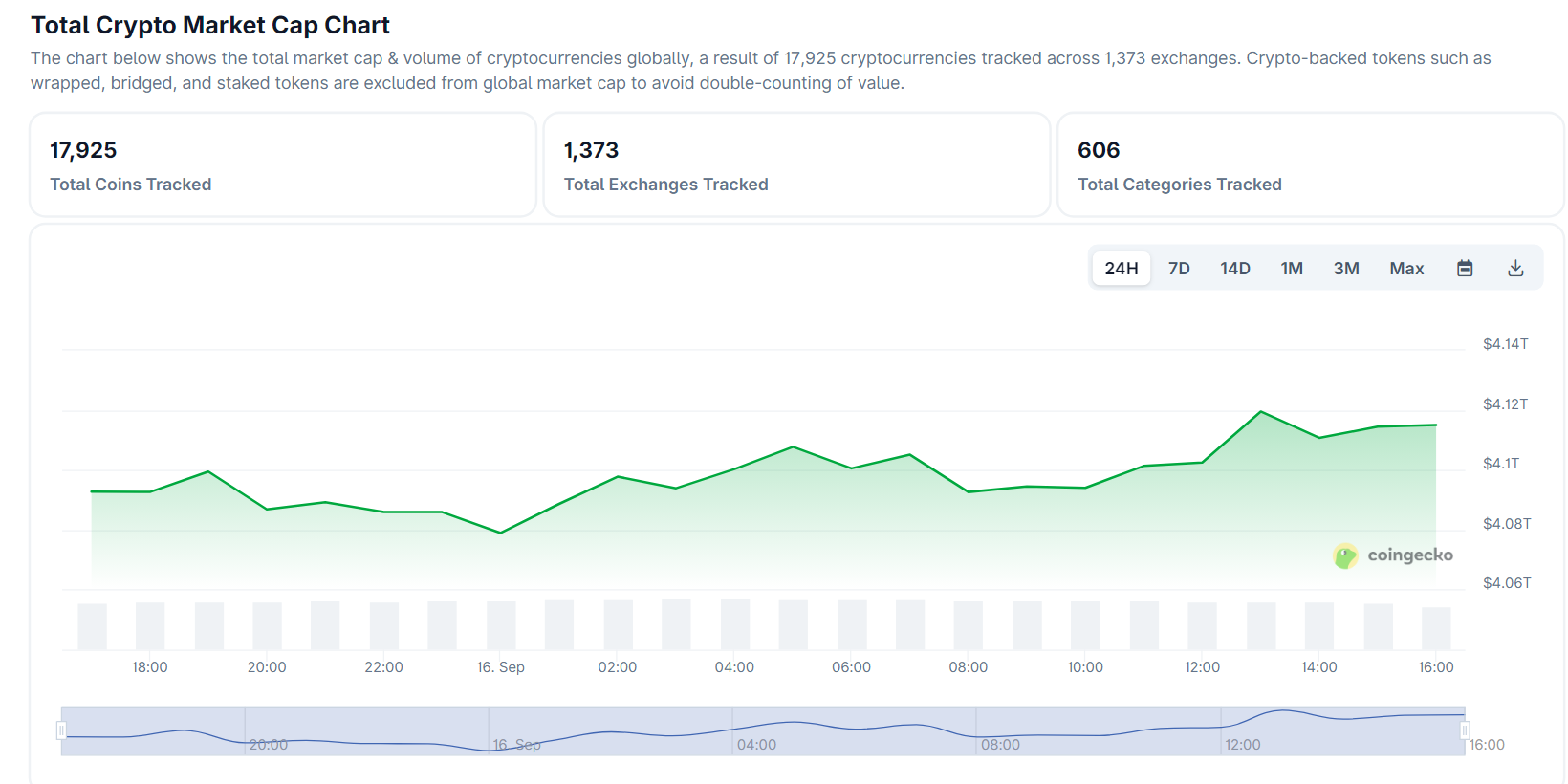

As of September 16, a day before the Fed’s interest rate decision, the total crypto market cap has surpassed the psychological $4 trillion threshold. Currently, the overall market cap stands at $4.11 trillion, indicating a healthy influx of liquidity into the market.

Bitcoin continues to lead the market with a dominance of 55.43%, while Ethereum maintains a 13.05% share.

According to data from TradingView, Bitcoin is currently trading around $115,498, fluctuating just below the $116,000 resistance level after demonstrating consistent upward momentum earlier this month. The price chart reflects a phase of volatile trading with multiple attempts at retouching the $116,000 resistance and solid support forming near $114,000.

Meanwhile, the Relative Strength Index (RSI) is near 51, indicating a neutral position, not overly bought or sold. This suggests that the market is preparing itself for the Federal Reserve’s decision on interest rates.

If the Fed goes ahead with a rate cut, Bitcoin could benefit from increased liquidity and a weakened dollar, which may encourage a breakout above the $116,000 resistance level. Such a scenario could pave the way for BTC to reach the $118,000 to $120,000 range.

Conversely, Ethereum is trading at roughly $4,508, having pulled back from highs above $4,700 earlier this month. The chart indicates a recent drop with weakening momentum, as shown by an RSI of 40 that points to bearish sentiment and suggests ETH is nearing oversold levels.

Critical support is around $4,400, with resistance moving back to approximately $4,650. Price action illustrates caution among traders as they await the Fed’s rate decision. A substantial rate cut could drive liquidity into risk assets, possibly igniting a rebound and helping ETH reclaim the $4,600 to $4,700 range.

Let me know if you need any further modifications!