Billions in Bitcoin and Ethereum options are set to expire on December 20, with max pain clusters and a BTC put skew creating an environment ripe for short-term volatility.

Overview

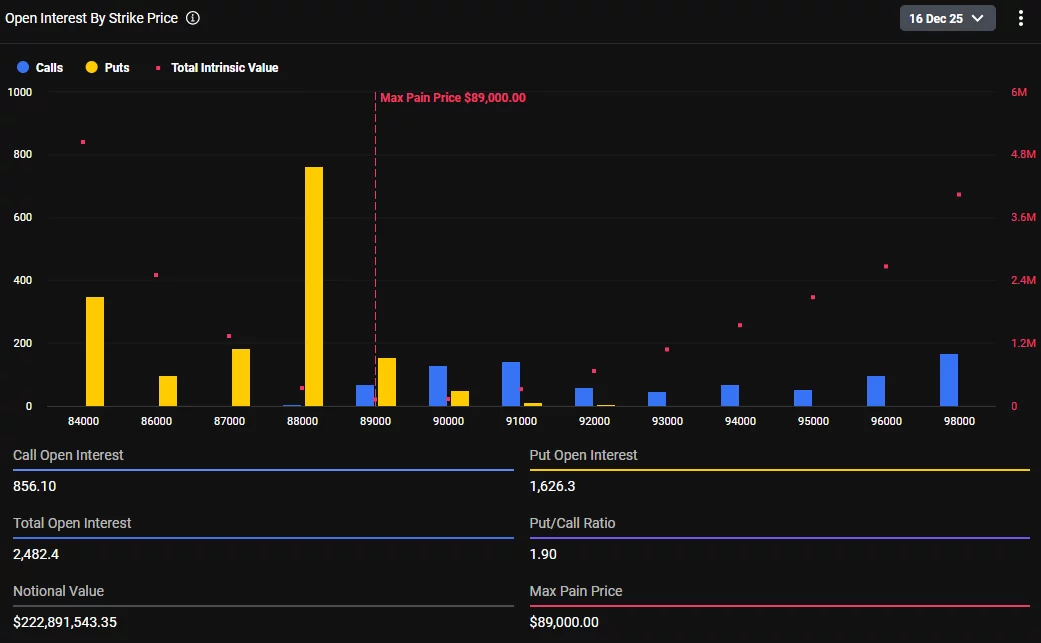

- Data from the options market indicates that the upcoming expiry on Friday will center BTC and ETH open interest around distinct max pain levels, which typically serve as near-term attractors.

- Bitcoin’s structure shows a greater inclination toward puts, indicating a heightened demand for downside protection compared to calls as the settlement date approaches.

- The put/call ratio for Ethereum appears more balanced, suggesting less insistence on hedging and a lighter downside bias relative to Bitcoin.

A substantial amount of Bitcoin (BTC) and Ethereum (ETH) options contracts is set to expire on Friday, with significant notional values involved, according to market data.

Impending Expiry of Bitcoin and Ethereum Options

According to the data, Bitcoin options constitute the bulk of contracts due for settlement, with market analysis pinpointing a max pain price level—defined as the price at which the highest number of options would expire worthless.

The current options data shows a stronger presence of put open interest and a put/call ratio that indicates a preference for put contracts in Bitcoin as expiration approaches, based on market insights.

In contrast, Ethereum options make up a smaller fraction of the overall expiry volume, with fewer contracts approaching maturity. The data also identifies a max pain price for Ethereum.

Ethereum’s options positioning reveals put open interest and a put/call ratio that is more balanced when compared to Bitcoin, suggesting a lesser focus on downside protection for Ethereum relative to Bitcoin, according to the data.

Market analysis identifies key price levels for both Bitcoin and Ethereum as critical zones related to Friday’s options expiry. These levels are where options positioning is most heavily aggregated as settlement approaches, as per the analysis.

The expirations of options can significantly affect short-term price movements as market participants realign their positions ahead of contract settlements.