Bitcoin, Ethereum, and other cryptocurrencies have experienced a significant pullback over the past 24 hours, leading to a wave of liquidations on derivatives exchanges.

Crypto Long Liquidations Have Approached $600 Million In The Last Day

As per data from CoinGlass, the recent sharp movements in the cryptocurrency market have resulted in a considerable number of liquidations within the derivatives sector.

Related Reading

“Liquidation” refers to the forced closure of any open position once it incurs a certain level of losses. For long traders, this occurs when the asset’s value declines, while the opposite holds true for short traders during price increases.

The extent to which a cryptocurrency must move to liquidate a specific position depends on the percentage threshold set by the platform and the leverage the trader selects. Positions with higher leverage are typically the first to be liquidated during significant price fluctuations.

Bitcoin and other cryptocurrencies have showcased notable volatility in the past day, affecting traders in the derivatives market. As shown in the table below, over $650 million in liquidations have occurred in the last 24 hours.

Approximately $584 million of these liquidations were linked solely to long positions, representing nearly 90% of the total, highlighting the extent of the price volatility during this time frame.

Interestingly, the largest contributor to this liquidation event was Ethereum, rather than Bitcoin, which is often the case.

With over $235 million in contracts involved, Ethereum has significantly outpaced Bitcoin, which faced $186 million in liquidations. The increased liquidations in ETH likely stem from its more pronounced price decline over the last day.

Among altcoins, Solana leads with $37 million in liquidated positions, followed by XRP ($16 million) and Dogecoin ($12 million). Notably, SOL outperformed the others despite experiencing smaller losses.

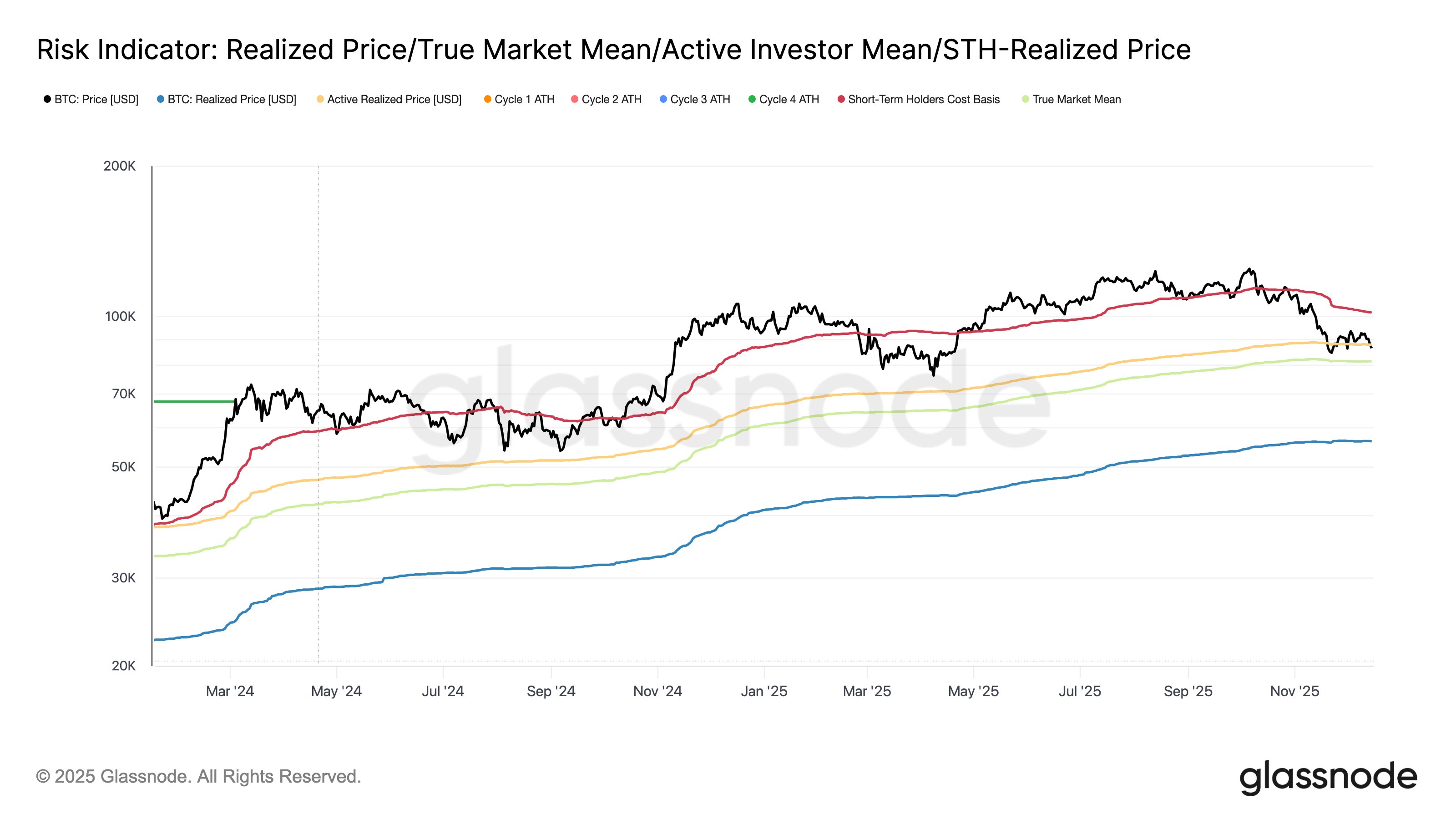

In other news, the recent drop in Bitcoin’s price has caused it to dip below a crucial on-chain price level, as indicated by a chart shared by analytics firm Glassnode.

The price level in question is the Active Realized Price, which indicates the cost basis of active participants on the Bitcoin network. Currently, it stands at $87,900, above the current spot price of the cryptocurrency.

Related Reading

This implies that the latest downturn has placed the overall active investors in a state of net unrealized loss.

Bitcoin Price

At present, Bitcoin is hovering around $87,200, reflecting a decline of over 3% in the past week.

Featured image from Dall-E, Glassnode.com, CoinGlass.com, chart from TradingView.com