Sure! Here’s a rewritten version of the content while keeping the HTML tags intact:

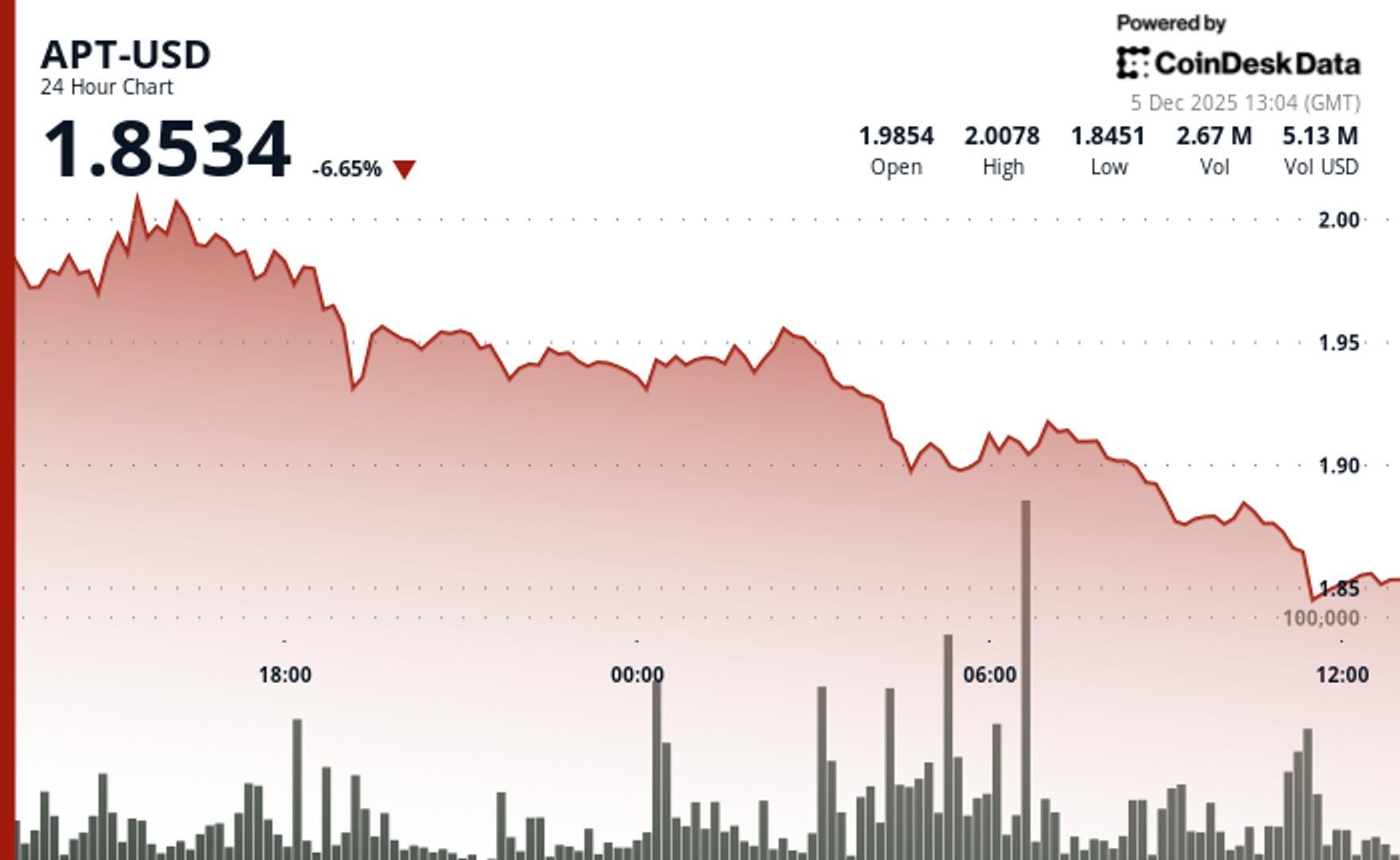

experienced a sharp decline during Friday’s trading session, plunging 6% to $1.85 as technical selling dominated over buyer activity.

The token underperformed against the wider crypto market, with the CoinDesk 20 index dropping 2.5% at the time of publication.

Trading activity has been low, at merely 10.8% of the 30-day average, indicating APT’s descent does not have significant backing, as per CoinDesk Research’s technical analysis model.

This model illustrated that Aptos established a trading range of $0.17, reflecting 8.5% volatility as recurrent selling waves formed new session lows.

Recent market movements hint at a phase of stabilization.

The token exhibited a potential double-bottom pattern around $1.842, implying that institutional buyers may be stepping in at these lower price levels, according to the model.

This positive shift represents the first technical sign of strength following several days of ongoing weakness, the model noted.

Technical Analysis:

- Double-bottom support remains solid at $1.842, with psychological resistance at $1.90 and a breakdown level at $1.87 now presenting as overhead supply.

- Significant selling volume of 3.54 million validates the breakdown’s authenticity, while subsequent lighter volume indicates reduced selling pressure.

- A descending trendline break completes the $0.17 range decline, with the double-bottom formation suggesting a possible floor.

- Immediate resistance targets $1.87, which was former support, with potential downside to $1.80 if the double-bottom fails to hold.

Disclaimer: Parts of this article were generated with AI assistance and reviewed by our editorial team to ensure accuracy and compliance with our standards. For further details, please see CoinDesk’s full AI Policy.