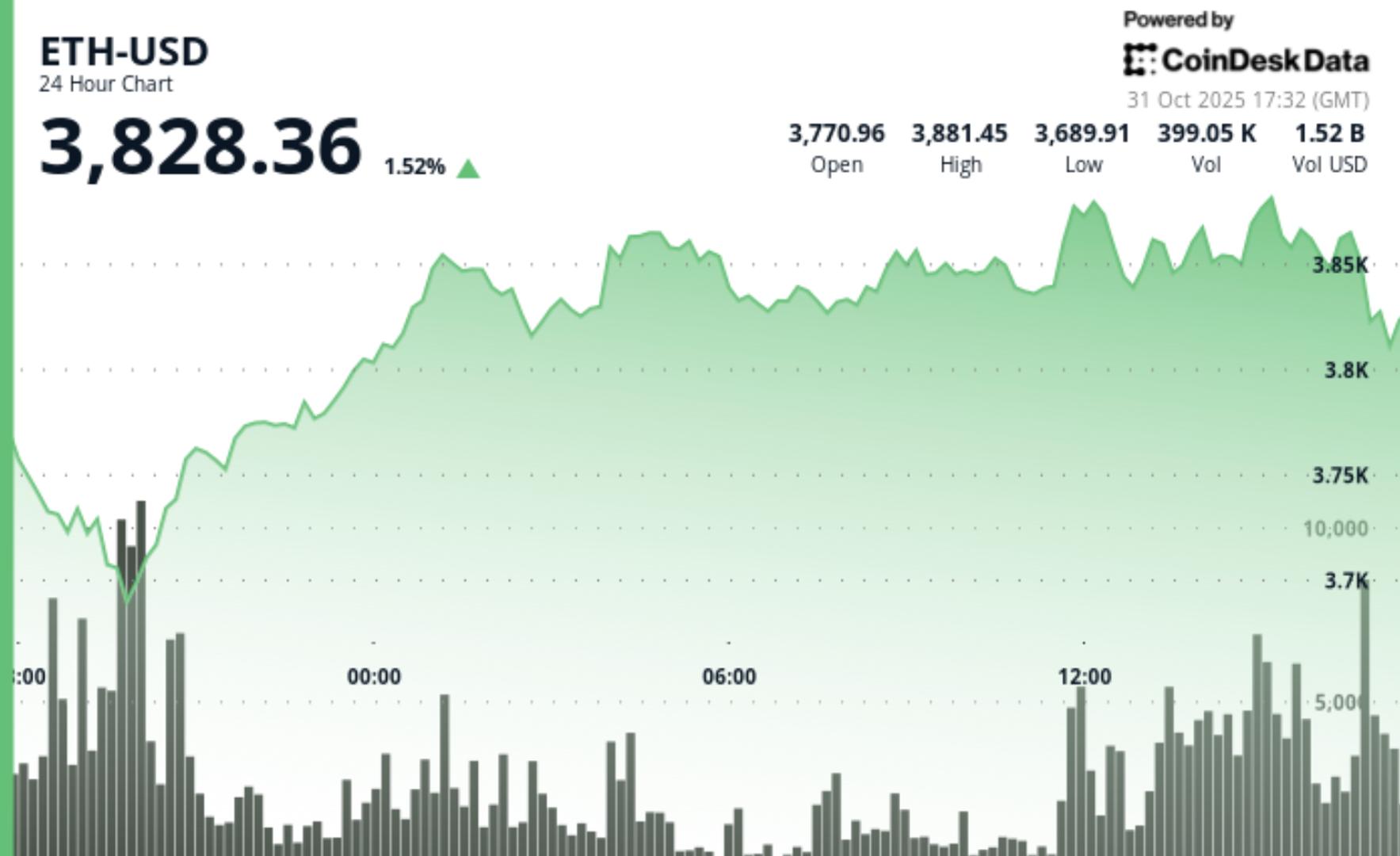

Based on CoinDesk Research’s technical analysis framework, ether rose amid higher-than-normal trading volume, then faced a late decline following an upper-band rejection, resulting in a tighter range and distinct checkpoints above and below.

Analyst Insights

- Crypto expert Michaël van de Poppe stated on X that Ethereum stands out as the prime ecosystem for investment, with ether approaching a potential all-time high exceeding $5,000.

- In simpler terms: his perspective highlights that developer engagement, innovative products, and network dynamics render the Ethereum ecosystem appealing, with price movements nearing the momentum observed prior to historical highs.

- Chart Context: the model indicates active buying trends, though sellers still dominate the $3,860–$3,880 range. A successful breach of $3,880, along with a close above the $3,887.35 session peak, would reflect a shift of power back to the buyers at the upper end of the range.

Technical Analysis Overview

- Performance and engagement: ETH +1.50% at $3,822.60, with a volume uptick of +19.01% compared to the seven-day mean; deviation from CD5 –0.06%.

- Intraday movement: From $3,771.27 to $3,822.78 within a $193.66 span, showcasing higher lows throughout.

- Momentum peak: At 2 p.m. UTC, 446.7K volume during the push past $3,860, reaching a high of $3,887.35.

- Late-stage rejection: In the final hour, a decline of –1.30% from $3,869 to $3,820 occurred on 21.8K volume (approximately 6× the average for that session), producing a lower high near $3,865.

Support and Resistance Framework

- Support: The $3,680–$3,720 zone provided support during initial session weaknesses.

- Resistance: The $3,860–$3,880 range, with $3,880 marking a psychological barrier.

- Short-term cluster: Trading focused around $3,730–$3,880 after testing the upper boundary.

- Session reference: Reclaiming $3,880 would reopen the path to the $3,887.35 high.

Volume Insights

- Overall: The +19.01% shift versus the seven-day average indicates significant market engagement.

- During the uptrend: 446.7K at 2 p.m. UTC represented the most robust bullish reading.

- Towards the close: 21.8K recorded during the dip from $3,869 to $3,820 indicated increased supply crowding late in the session.

Pattern Analysis

- Uptrend with caution: While higher lows supported an upward movement, the lower high observed at the close signals that sellers remain active near the range’s upper limit.

- Range dynamics: With demand present during dips and supply at $3,860–$3,880, the $3,730–$3,880 range frames the near-term outlook.

- Key proof point: Bulls seek a solid break and hold over $3,880; bears will aim for a drop below $3,720 to expose $3,680.

Target Settings and Risk Parameters

- If buyers push: A reclaim of $3,880 → target $3,887.35; sustained buying momentum keeps attention on the upper boundary.

- If sellers regain dominance: A drop below $3,720 → $3,680 becomes the subsequent demand zone.

- Tactical perspective: Given the elevated trading activity but respected resistance, many traders await a clear breakout from $3,730–$3,880 before making decisive moves.

Context of the CoinDesk 5 Index (CD5)

- Range and reversal: CD5 increased from $1,878.33 to $1,901.52, hitting $1,924.98 before retracting to $1,901.52, aligning with profit-taking at resistance across the major assets.

Disclaimer: Parts of this article utilized AI tools for generation and were reviewed by our editorial team to ensure accuracy and consistency with our standards. For further details, refer to CoinDesk’s complete AI Policy.