The Federal Reserve is set to announce its rate cut decision shortly, leading traders to speculate whether the adjustment will be 25 basis points, 50, or none at all. This uncertainty has sparked mixed feelings in the market, but three altcoins have emerged as key players ahead of the event.

Each of these assets is experiencing significant inflows from major holders while establishing bullish chart patterns that could signal the next upward movement.

Clearpool (CPOOL)

Clearpool, a lending project focusing on RWA, is currently priced at $0.155 — down 1.2% in the last week and 12% over the month, but still showing a 40% increase over three months. Accumulation is notably strong beneath this surface activity.

Sponsored

Sponsored

In the past week, the top 100 wallets, including both large holders and whales, have amassed 25.21 million CPOOL, worth around $3.91 million at current market values. This increase in holdings by large players has contributed to a decline of 10.8 million CPOOL in exchange balances.

Given that exchange balances dropped by only 10.8 million against the 25.21 million purchased by significant holders, it indicates that retail investors and smart money may be offloading their assets, even as whales are accumulating.

On a technical note, CPOOL is exhibiting an inverse head-and-shoulders pattern. The neckline resistance stands at $0.181, with the subsequent challenge at $0.193. A breakout above these thresholds could project potential gains towards $0.240, based on the head-to-neckline analysis.

Interested in more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Momentum indicators also support this perspective. The Relative Strength Index (RSI), which gauges the speed and direction of prices, shows hidden bullish divergence: prices have achieved higher lows, while the RSI has recorded lower lows. This divergence often indicates trend continuation (the ongoing 3-month bullish trend), enhancing the likelihood that CPOOL’s breakout could occur and sustain.

Sponsored

Sponsored

The bullish pattern weakens if it falls below $0.149, while a drop beneath $0.141 — the “head” of the formation — would completely invalidate the setup.

Overall, the combination of on-chain accumulation, decreasing exchange balances, and supportive momentum metrics positions CPOOL as a notable altcoin to monitor ahead of the Fed’s announcement.

Hyperliquid (HYPE)

Hyperliquid (HYPE) has attracted attention following Circle’s announcement regarding the expansion of USDC into its validators, providing the project with a strong narrative boost. However, price movements have been stagnant in the short term. HYPE is trading near $54, remaining stable over the past week, but up 25% over the past month.

Retail traders may be feeling the pressure from this range-bound behavior. On-chain analysis reveals that retail wallets have been consistently selling, with net outflows from the spot market last week at $101.21 million. This figure has since dropped to $19.04 million — an 81% decline — indicating rising selling pressure. While retail has exited during this volatile phase, they may overlook opportunities that larger players are positioning for.

Despite the retail selling, prices have not corrected in the past week, and the overall market pressure continues to favor buyers. Whales may be behind this phenomenon.

Sponsored

Sponsored

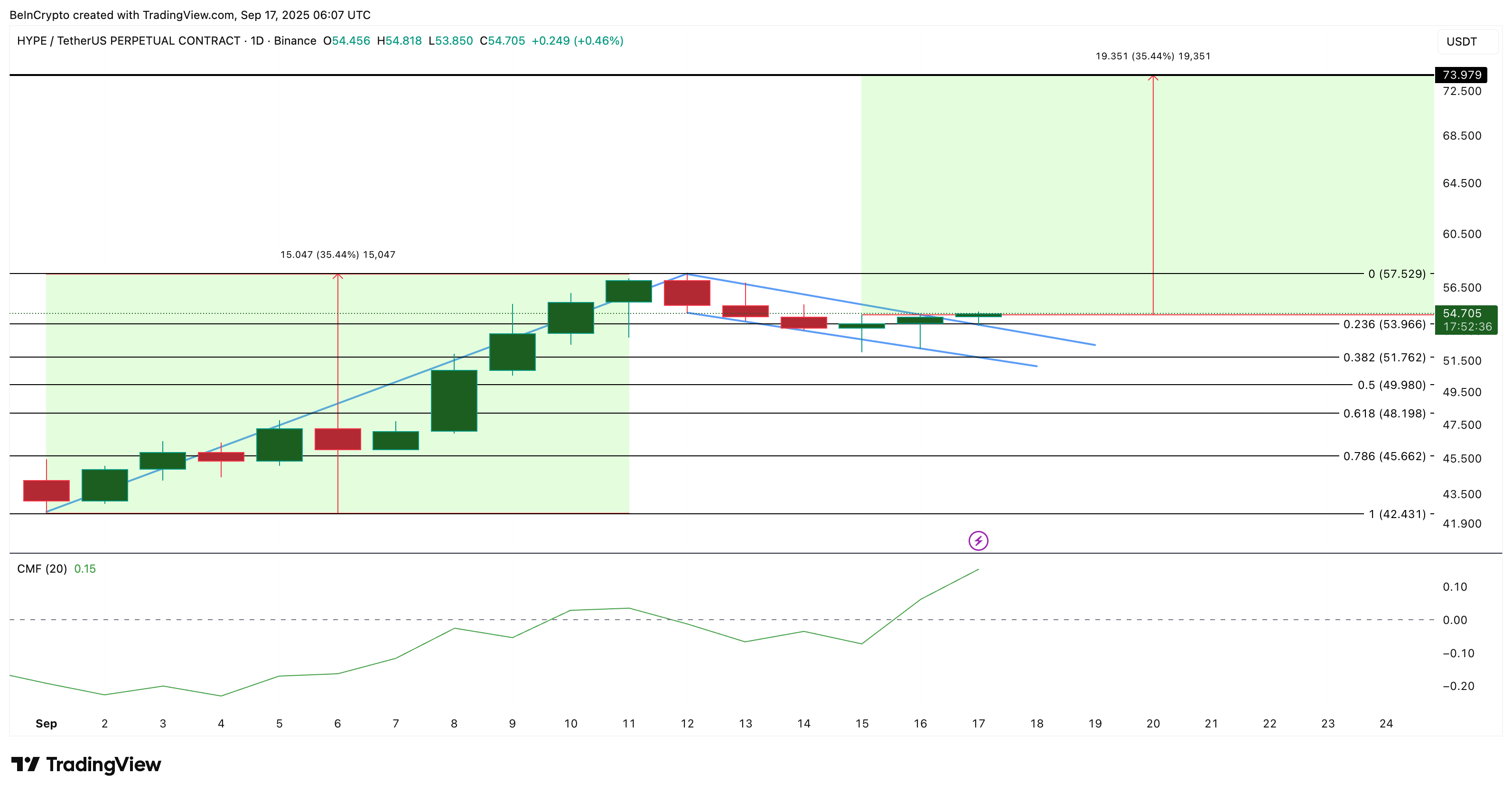

The Chaikin Money Flow (CMF), which measures the flow of money in and out of a token, underscores this dynamic. As HYPE consolidated within a bull flag pattern, CMF surged from -0.07 to +0.15 in just two days. This notable shift suggests larger wallets are buying and pushing liquidity higher, even as retail investors reduce their exposure.

The price chart further reinforces this shift, as HYPE has just emerged from a bull flag on the daily chart.

The pole of this pattern suggests an upside target around $73, approximately 35% higher than current levels. To maintain momentum, HYPE price must remain above $57, while the bullish setup gets invalidated below $48.

Cardano (ADA)

Cardano, a prominent Layer-1 platform, is currently trading at $0.87, having moved sideways over the past week and down 3.6% in the last month. However, in the last three months, ADA has appreciated by 47%. This subdued short-term movement coincides with the upcoming Fed rate cut decision, with whale wallets quietly preparing for a potential breakout.

Sponsored

Sponsored

On-chain observations indicate that the largest cohort — holding more than 1 billion ADA — has added 60 million coins since September 9, raising their total to 1.94 billion. Another significant group holding 10 million–100 million coins has added 40 million ADA within the last 24 hours, increasing their total to 13.05 billion. Collectively, that’s 100 million new ADA accumulated in less than a week — valued at approximately $87 million at present prices.

This combination of consistent long-term accumulation and abrupt short-term buying suggests that whales may have identified a critical technical signal.

This signal involves the completion of ADA’s cup-and-handle formation. The token has surged above the handle’s upper trendline, indicating that the period of consolidation may be coming to an end.

The next significant levels to watch are $0.91 and $0.95. A clear move above $0.95 would validate the breakout and position ADA for a target of $1.17, which is the projected endpoint of the cup.

The invalidation point lies at $0.78, the lowest point of the cup. Additionally, RSI divergence bolsters the setup: from August 21 to September 15, ADA made higher lows while RSI created lower lows, indicating a hidden bullish signal. With whale activity escalating and Fed rate cuts potentially providing additional momentum, ADA’s pattern positions it as one of the top altcoins to monitor before the Fed’s rate cut announcement.