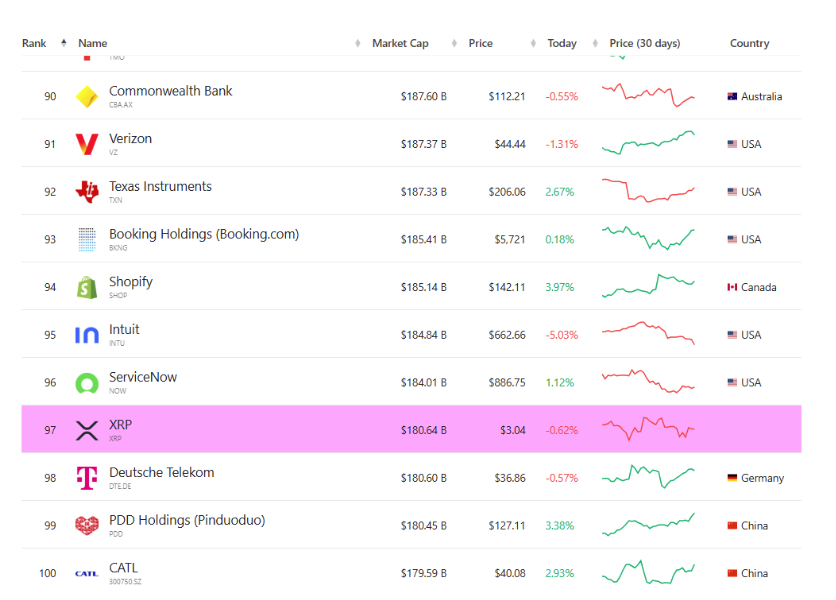

Ripple’s XRP has officially entered the top 100 global assets by market capitalization, a significant achievement that aligns it with some of the world’s most valuable companies like Shopify, Intuit, and Deutsche Telekom.

As per the latest data, XRP boasts a market cap of approximately $181.2 billion with a token price of $3.02, positioning it above 100th on the global list. Importantly, XRP has made it to this exclusive group without the support of a regulated spot ETF in the United States, unlike its crypto peers Bitcoin and Ethereum, which are also part of the largest global assets.

Related Reading

XRP Joins The Rank Of World’s Top Assets

Currently, XRP is the 97th largest asset in terms of market cap, ranking third among cryptocurrencies behind Bitcoin at 7th and Ethereum at 22nd. XRP’s rise to this point can be attributed to a surge of inflows that have significantly boosted the asset in recent months. This influx has propelled XRP’s market cap above BNB and stablecoin Tether USDT, solidifying its position as the third-largest cryptocurrency by market cap.

Both institutional and retail investors have flocked to XRP after the resolution of its legal conflicts with the US Securities and Exchange Commission. This newfound confidence, coupled with broader bullish trends in the crypto market, has allowed XRP’s price to establish a new support level at $3.

Achieving a spot within the top 100 global assets illustrates XRP’s performance in comparison to corporations beyond the cryptocurrency realm. At its current valuation, XRP closely trails renowned international companies such as Verizon, Texas Instruments, Shopify, and Intuit.

Top assets by market cap: CompaniesMarketCap

The Case For More Growth With A Spot XRP ETF

Bitcoin and Ethereum have experienced substantial institutional interest over the past 18 months due to the establishment of regulated spot ETFs in the United States. In contrast, XRP has achieved its current position without such an offering. As a result, XRP’s milestone may just signal the beginning of a significant upward trajectory.

The lack of ETF-related inflows indicates that XRP possesses considerable untapped potential waiting to be realized through financial institutions like BlackRock, Fidelity, and Grayscale once regulatory approval for a Spot XRP ETF is granted in the US. Such a trading vehicle could facilitate access for large-scale institutional investors who have thus far been limited in obtaining XRP exposure.

Related Reading

Should the inflow trends observed with Bitcoin and Ethereum ETFs repeat for XRP, its market capitalization may very well surpass its current competitors in the top 100 global asset rankings along with its price.

As of now, XRP is trading at $3.04. Projections associated with the anticipated approval of Spot XRP ETFs range from moderate estimates of $4 up to ambitious targets of as high as $1,000.

Featured image from Unsplash, chart from TradingView