Certainly! Here’s a rewritten version of the content while keeping the HTML tags intact:

Summary

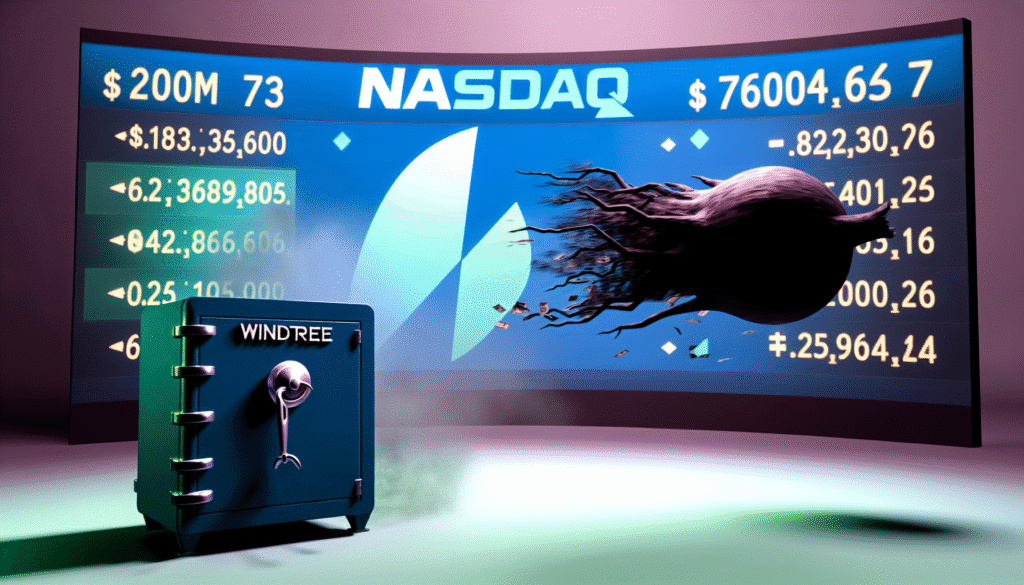

- Windtree has announced that its shares will be halted from trading on Nasdaq this Thursday due to not meeting the $1 minimum bid requirement.

- Last month, the company indicated its intention to invest up to $700 million in Binance’s BNB token.

- Decrypt was informed that struggling companies transitioning into crypto treasuries may lack substantial backing beyond the narrative.

Windtree Therapeutics, a drug development firm based in Pennsylvania, is set to be delisted from Nasdaq, just over a month after its failed $700 million shift into a digital treasury model focused on Binance’s BNB token that couldn’t elevate its stock price above the exchange’s threshold.

In a filing with the SEC on Tuesday, Windtree confirmed that its stock trading on Nasdaq will be halted when the market opens on Thursday, August 21, due to its inability to maintain the minimum bid price of $1 per share, with its stock plummeting 77% in value to just $0.11.

Windtree initially listed on Nasdaq in May 2020, but has consistently faced challenges in meeting the listing requirements.

The exchange decided to suspend Windtree’s shares after multiple bid-price infractions since at least June 2022, as outlined in a 2023 SEC filing. The latest warning regarding deficiencies was issued in December of the previous year.

Windtree and Nasdaq have not responded to Decrypt’s request for a statement.

Earlier last month, Windtree declared its commitment to purchase up to $700 million in Binance’s BNB token, coinciding with a reach of a new all-time high in that cryptocurrency.

Although Windtree briefly regained compliance in March of this year, it subsequently faced challenges as a tumultuous pullback in the crypto market began to unfold over the past week.

Numerous publicly-traded treasury firms have seen their stocks declining or stagnating in tandem, including those from KindlyMD, SharpLink, Coinbase, and Strategy, which reached a 4-month low on Wednesday amid a wider crypto stock downturn.

Due to the suspension, the company will transition to the over-the-counter market under the same ticker, WINT. Unlike Nasdaq, which enforces stringent listing criteria such as minimum bid prices and equity benchmarks, OTC venues are characterized by looser regulations and generally offer reduced liquidity and transparency.

“Distressed companies encounter a fundamental mismatch with DAT models,” stated Ryan Yoon, a senior analyst at Tiger Research, in an interview with Decrypt. “While they may secure initial funding lacking credibility, future capital raises become increasingly problematic as market doubt intensifies.”

Digital asset treasuries depend on “premium-based funding, but struggling companies can’t maintain NAV premiums over the long haul,” Yoon remarked.

Net asset value (NAV) represents the total worth of a company’s assets minus its liabilities, calculated on a per-share basis. It indicates whether the company’s stock price surpasses or falls short of the total value of its assets, including non-digital assets.

“This sets off a reverse flywheel during market downturns: asset decline → forced liquidation → further decline,” Yoon explained.

For instance, Yoon cites Michael Saylor’s Strategy as establishing a “compelling narrative in crypto markets” that has created a model that struggling public companies aspire to imitate.

However, “unlike established DAT firms with proven operational structures,” financially troubled companies abruptly shifting to become digital asset treasury firms “often lack meaningful substance beyond the narrative itself,” Yoon concluded.

Daily Debrief Newsletter

Receive top news stories every day, along with original features, podcasts, videos, and more.