Bitcoin ETFs experienced net outflows of $83.27 million on December 26, continuing a multi-day trend of redemptions as BTC struggled to reach $88,000.

Summary

- Bitcoin ETFs saw $83.27M in outflows on Dec. 26, extending a five-day selloff.

- Fidelity’s FBTC led redemptions, with $74.38M, while most ETFs reported no flows.

- ETF outflows now surpass $750M as Bitcoin remains under the $90K mark.

Fidelity’s FBTC topped withdrawals with $74.38 million in outflows, while Grayscale’s GBTC recorded $8.89 million in redemptions.

The other Bitcoin (BTC) ETFs displayed no flow activity as of December 26. BlackRock’s IBIT data was yet to be updated by press time.

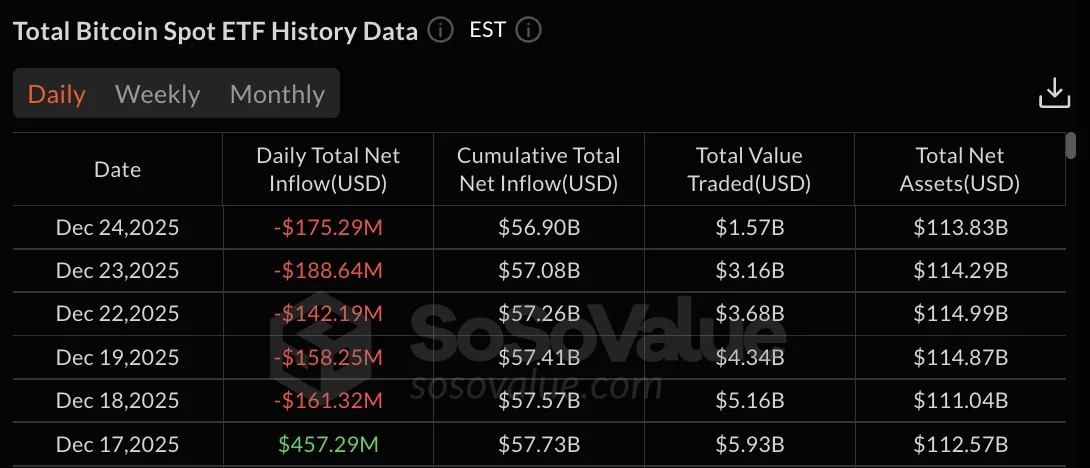

Total net assets under management decreased to $113.83 billion, whereas cumulative total net inflow held steady at $56.82 billion. BTC fell over 1% in the last 24 hours, trading below $88,000.

Five consecutive days of Bitcoin ETF redemptions

The outflow streak for Bitcoin ETFs began on December 18 with $161.32 million in withdrawals, spurred by a brief rally on December 17 that attracted $457.29 million. On December 19, outflows reached $158.25 million before a weekend pause.

Trading resumed on December 22 with $142.19 million in redemptions. On December 23, outflows accelerated to $188.64 million, followed by $175.29 million on December 24.

The outflows of $83.27 million on December 26 brought the total for the five-day period to over $750 million in net redemptions.

The total value traded dropped to $1.57 billion on December 24 from $5.93 billion on December 17. This prolonged outflow phase has depleted assets as Bitcoin’s price struggled to stay above $90,000.

Fidelity’s FBTC accounted for the majority of the outflows on December 26 at $74.38 million, making up 89% of total redemptions. Grayscale’s GBTC fund had $8.89 million in withdrawals.

Grayscale’s mini BTC trust, along with Bitwise, Ark & 21Shares, VanEck, Invesco, Franklin, Valkyrie, WisdomTree, and Hashdex all recorded no flows.

Ethereum ETFs reflect Bitcoin’s weakness

Ethereum (ETH) spot ETFs also encountered selling pressure, with $52.70 million in outflows on December 24, following $95.53 million in redemptions the day before.

December 22 offered a brief respite with $84.59 million in Ethereum ETF inflows, but outflows resumed shortly after. The total net assets for Ethereum products stood at $17.86 billion on December 24, down from $20.31 billion on December 11.

The cumulative total net inflow across Ethereum ETFs remained at $12.38 billion. Bitcoin’s inability to consistently break above $90,000 has triggered profit-taking and liquidation of positions.