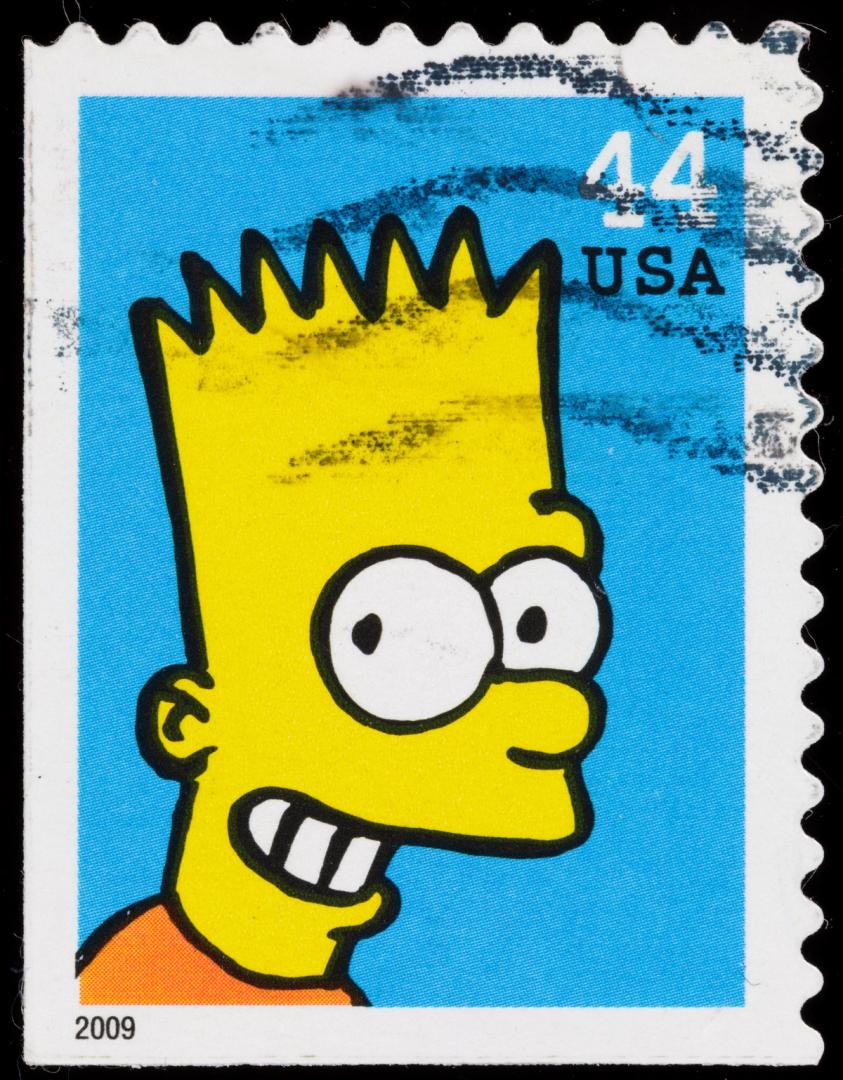

Bitcoin has dropped back to its weekly low of $85,500 after experiencing the infamous “Bart Simpson pattern” earlier on Wednesday, where the price spikes rapidly, levels off briefly, and then plummets back to its previous level. This movement creates a chart pattern resembling the head of the well-known cartoon character.

The cryptocurrency market seems to be caught in a troubling situation—showing no correlation with rising stocks, yet mirroring them closely when they decline.

This morning’s sharp rally collapsed alongside the Nasdaq, which began to decline as enthusiasm for artificial intelligence investments waned. About ninety minutes before the market closed, the tech-heavy index had fallen by 1.5%, with the chip sector taking the biggest hits.

Perhaps more disheartening for crypto enthusiasts is the noticeable surge in precious metals; silver has spiked an additional 5%, hitting a new record, while gold is up 1% and nearing its all-time high. Once, bitcoin was seen as the premier asset during Fed policy easing or as a safe haven during stock market turmoil, but now it’s gold, silver, and even copper that are attracting investments.

The scoreboard for the week in crypto is not encouraging: Bitcoin is down by 8%, ether by 15%, solana by 12%, and XRP by 12%.

Where’s the floor?

According to Jasper De Maere, a desk strategist at Wintermute, Bitcoin is expected to remain within a range of $86,000 to $92,000. He notes that the current consolidation period is marked by high volatility, making today’s abrupt price shifts not unusual as traders face liquidations.

De Maere advised against placing too much emphasis on technical indicators during this time and anticipates more profit-taking in the next two weeks due to year-end portfolio adjustments and tax implications. “Traders are reducing their positions to take a break … brief rallies are being sold off swiftly,” he stated.

He foresees Bitcoin’s sideways trading continuing until new catalysts emerge, potentially including significant options expirations in late December.

While he doesn’t assert that a bottom is imminent, De Maere observes that the market is starting to show early signs. “I feel like we’re at max pain,” he commented. “In the short term, it seems we are definitely oversold.”