Dogecoin experienced a significant selloff, breaching a crucial technical level, indicating a shift in short-term market dynamics and prompting traders to reevaluate immediate risks.

News background

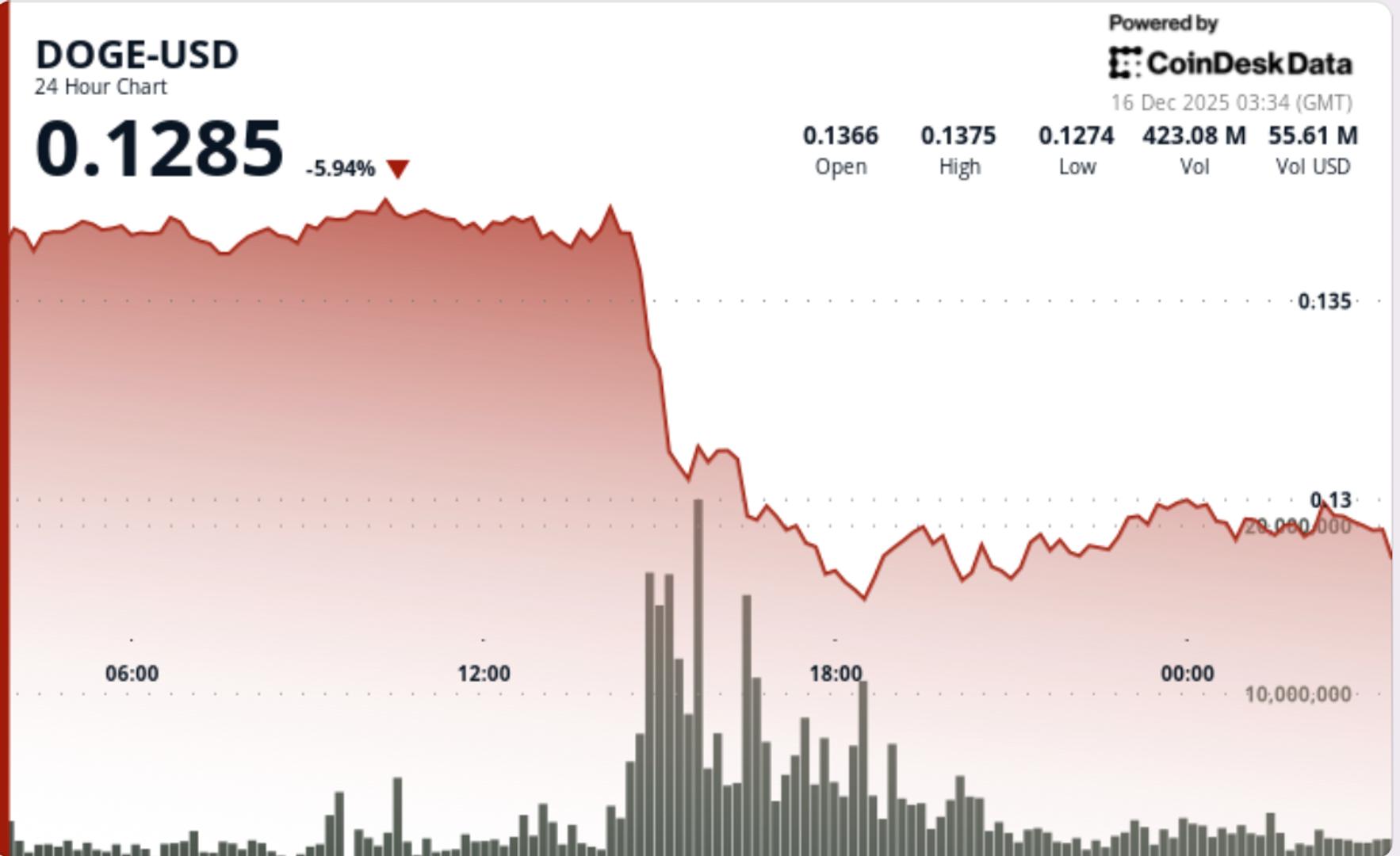

- Over the last 24 hours, Dogecoin dropped 5.5%, sliding from $0.1367 to $0.1291 amidst rising selling pressure across the crypto landscape.

- This decline occurred alongside weaker risk appetite and a decrease in engagement with high-volatility assets, with meme coins facing relatively larger downturns compared to major cryptocurrencies.

- No specific catalyst was identified for the selloff, though it aligned with ongoing shifts away from speculative assets and less liquid market conditions.

- While DOGE is trapped in a range on a broader timeframe, the latest decline signifies a clear inability to maintain previously held support levels.

Technical analysis

- The fall below $0.1370 represented a significant breach of short-term trend support. Volume surged to 1.63 billion tokens during the decline, approximately 267% above typical levels, confirming that the movement was influenced by large trades rather than a gradual drift.

- The price passed through key support levels without substantial interruption, reflecting weak buyer interest once $0.1320 was breached. The failure to recover $0.1300 on the initial rebound keeps the near-term outlook negative, despite some stabilization in momentum indicators.

- From a structural perspective, DOGE’s status has transitioned from range compression to downside expansion. Until the price rebounds to reclaim prior support levels, any rallies are likely to be corrective rather than indicative of a trend reversal.

Price action summary

- After hitting session lows around $0.1290, DOGE started to stabilize as selling pressures eased. Subsequent candlesticks displayed lower volume and reduced downside movements, hinting that liquidation pressures may be subsiding.

- Intraday price movements have begun forming higher lows off the $0.1290 low, but upward momentum remains constrained. Sellers frequently emerge near $0.1300, capping prices and affirming this level as immediate resistance.

What traders should know

- The short-term direction of DOGE now depends on its ability to hold above the $0.1290–$0.1280 support zone.

- Remaining below this region could reveal additional support near $0.1250, while a successful recovery of $0.1300 would signal a potential easing of downward momentum.

- Volume patterns are crucial. Ongoing normalization could facilitate a consolidation phase, whereas renewed spikes in selling would indicate further distribution pressure. Currently, DOGE exists in a delicate stabilization phase, where patience and confirmation are prioritized over speculation.