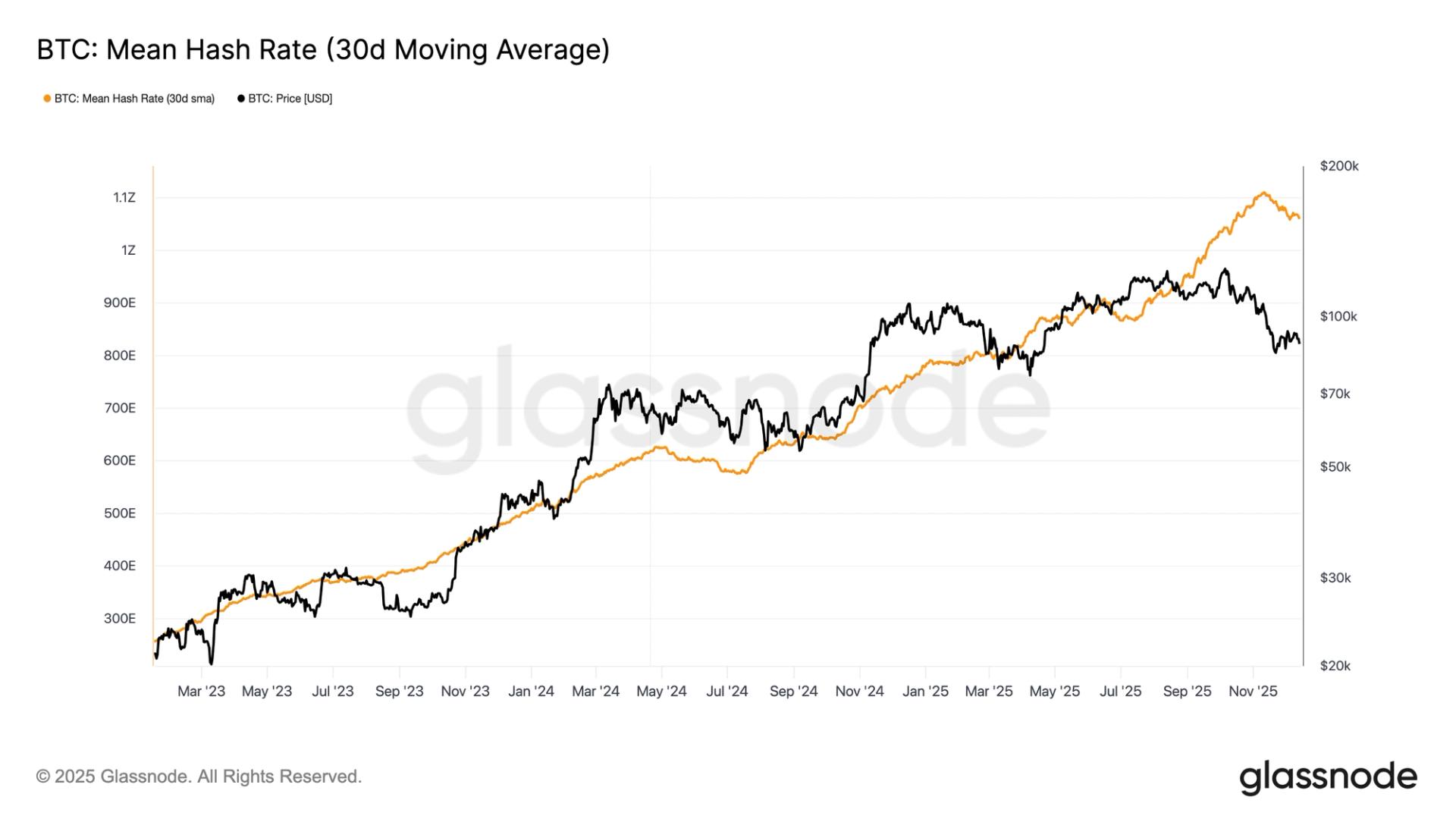

Bitcoin’s 30-day simple moving average (SMA) hashrate has seen a significant decline since the April 2024 halving, as noted by Matthew Sigel, head of digital assets research at VanEck.

The bitcoin hashrate evaluates the total computational strength securing the network.

Former Canaan chairman Jack Kong remarked on a post on X that approximately 400,000 mining machines have recently been deactivated in China. Kong stated that the computing power decreased by roughly 100 exahashes per second (EH/s) compared to the previous day, indicating an 8% drop. This reduction corresponds to more than 400,000 mining machines being turned off based on an average of 250 terahash per second.

Kong further indicated that mining farms in Xinjiang are shutting down consecutively, implying the U.S. benefited without direct action.

This information emerges just a month after China re-emerged as the world’s third-largest bitcoin mining center, accounting for about 14% of the global hashrate.

Data from Glassnode reveals that the overall hashrate has decreased from approximately 1.1 zettahash per second to just above 1 (ZH/s). This decrease aligns with ongoing pressure on miner revenues, with hash prices lingering near $37 per petahash per second, marking about a five-year low.

Currently, bitcoin mining difficulty is expected to decrease by about 3%, providing temporary relief to miner revenues. The metric currently stands at 148.2 trillion (T), just shy of its all-time peak.