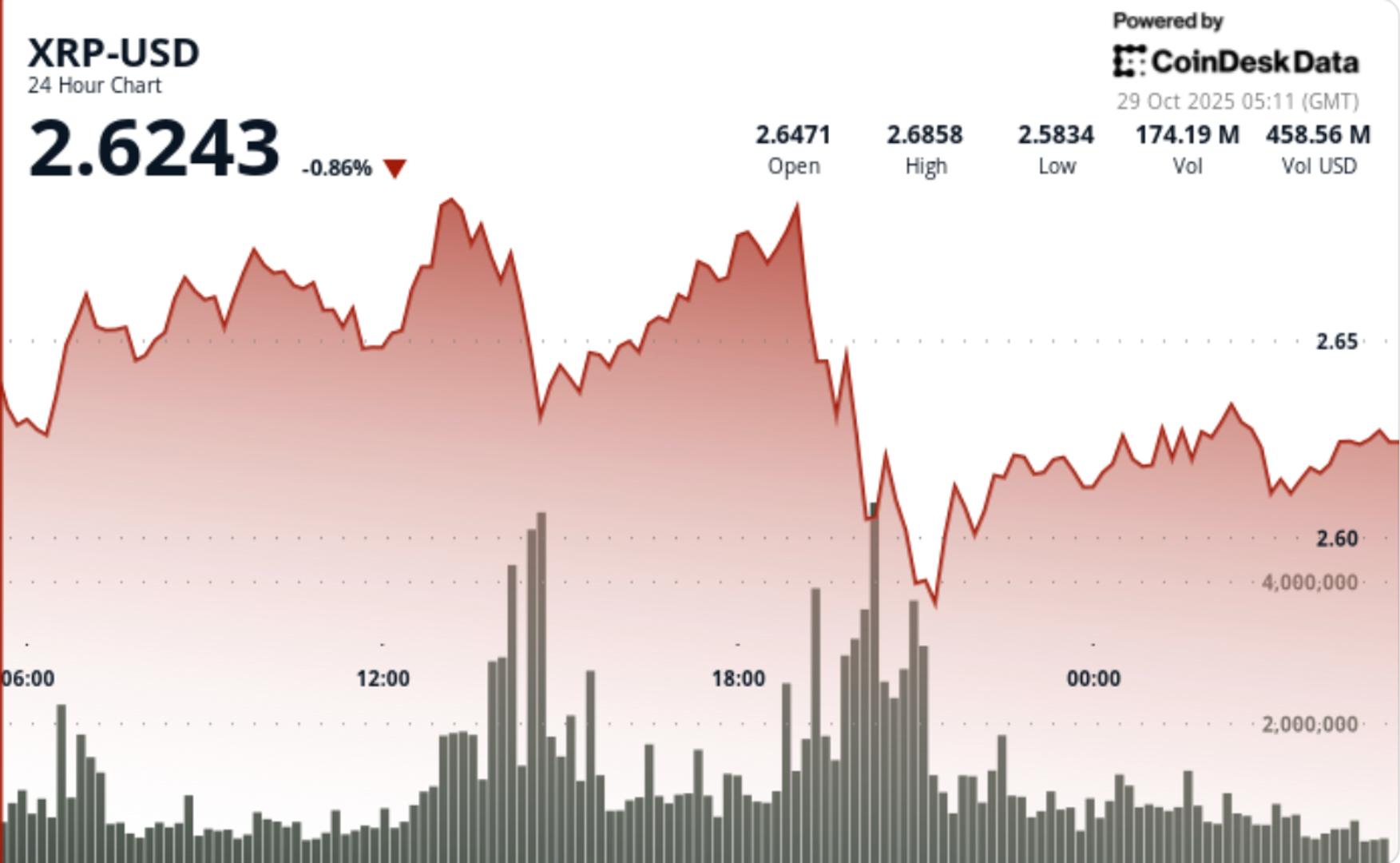

XRP showed a slight increase as trading activity rose, yet momentum indicators point to a potential for short-term consolidation.

News Background

- XRP rose 0.60% to $2.623, with trading volume increasing by about 47% over its seven-day average, reflecting heightened institutional interest despite the absence of strong breakout drivers.

- The token is still encountering resistance following a rejection around $2.68, with multiple analysts warning that, although bullish chart patterns are visible, the recent momentum may be limited.

Price Action Summary

- Throughout the session, XRP traded within a $0.11 range, fluctuating between approximately $2.64 and $2.62.

- A peak volume of around 167.3 million tokens (approximately 140% above the 24-hour average) was noted during the unsuccessful breakout near the $2.68 resistance.

- The $2.60 psychological support level remained intact after several tests, indicating controlled accumulation rather than an outright breakout.

Technical Analysis

- The attempt to break above $2.68 was rejected, confirming that resistance remains strong.

- The support zone around $2.60 has proven to be resilient, although momentum indicators—like the TD Sequential—have issued caution signals.

- The chart indicates consolidation between $2.60 and $2.67, which could establish the groundwork for a future movement but also indicates a potential short-term pause.

- An increase in volume supports continuing interest, but the absence of a clear breakout suggests the current movement is still in a preparatory phase.

What Traders Should Know

- Traders should keep an eye on whether XRP can maintain the support area around $2.60-$2.63.

- A sustained close above $2.65 combined with increased volume would shift the sentiment to bullish, opening targets near $2.70-$2.90.

- On the contrary, a drop below approximately $2.60 would lead to a retest of around $2.55 or lower.

- The impending ETF decision timeline and institutional inflows are vital catalysts to monitor.