Dogecoin experiences a slight decline following Monday’s rally, yet a notable increase in turnover—up nearly 30% from weekly averages—indicates steady accumulation by larger players anticipating a breakout above key resistance levels.

News Overview

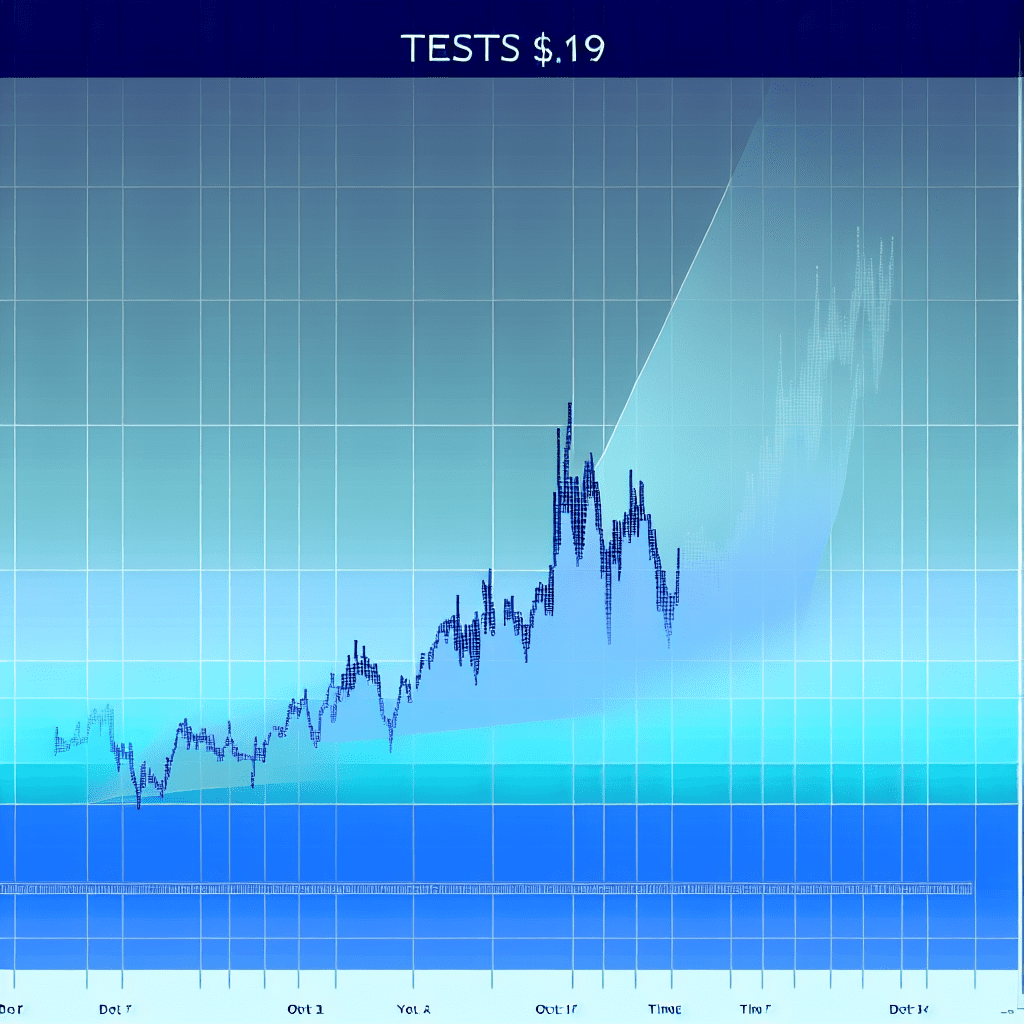

Over the past 24 hours, Dogecoin has decreased by 2% to $0.1910, falling from intraday highs of $0.1953 as selling pressure limited momentum across the broader market. Trading activity surged 29% over the seven-day average, reflecting proactive positioning by institutional traders as opposed to retail exits.

This pullback came after a 6.8% increase on Monday to $0.2061, likely prompting structured profit-taking near the upper range. The mix of high turnover coupled with a modest price decline suggests rotation instead of complete liquidation—a typical setup for re-entry positions if market sentiment stabilizes.

Price Movement Summary

Throughout the session, DOGE navigated a tight yet volatile range, spanning $0.0138 between its highs and lows—approximately 6.7% of its total value. Trading volume peaked at 768 million tokens near the $0.1950 resistance, affirming rejection at that level before drifting toward the $0.1880 support area.

Despite a downward trend, buyers defended bids below $0.1900, resulting in a late-session recovery that stabilized the token around $0.1915. The 60-minute tape indicated a formation of higher lows off $0.1888, revealing a constructive short-term pattern that suggests underlying accumulation despite apparent weakness.

Technical Insights

The current structure of DOGE illustrates a narrowing consolidation between the $0.1880 support and $0.1950 resistance. The descending trend of recent highs indicates short-term fatigue; however, the volume behavior remains bullish—showing spikes during pullbacks and declines during rallies—a classic indication of smart-money absorption.

Momentum indicators remain neutral to positive as volatility compresses, creating potential for a breakout within the next 24–48 hours. A closing price above $0.1950 would invalidate the near-term downtrend, targeting the $0.1980–$0.2000 range. Conversely, losing the $0.1880 support may lead to a drop toward $0.1840.

Observations from Traders

Traders are monitoring DOGE’s ability to maintain the $0.19 base amid ongoing institutional flows. A decisive breakthrough above $0.1950 would confirm breakout intentions, while renewed weakness below $0.1880 would indicate that distribution might surpass accumulation.

With volume remaining robust—29% above weekly averages—the next directional movement could be rapid. Market participants are positioning themselves accordingly.