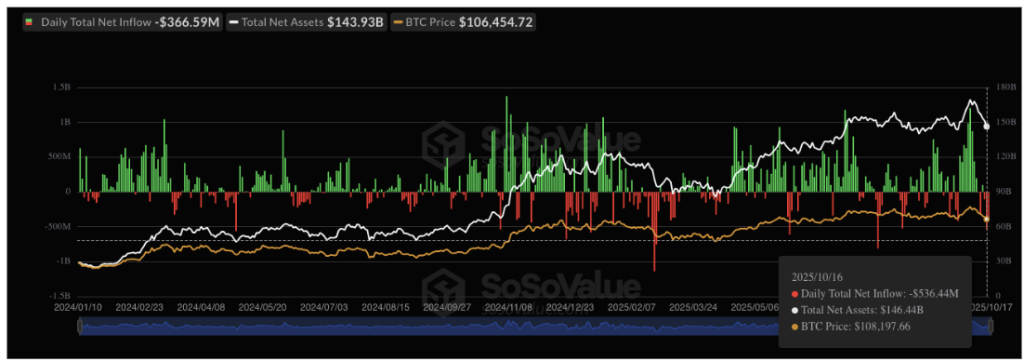

The cryptocurrency market is experiencing another surge of sell pressure, as both Bitcoin and Ethereum have seen substantial price declines, leading to widespread panic and uncertainty. With Spot Bitcoin ETFs experiencing over $536 million in outflows in a single day, this downturn has reignited fears of an extended bearish phase. Analysts are dubbing this correction as “Bloody Friday,” a milder yet still severe reflection of last week’s brutal selloff that erased billions from the market, resulting in significant declines for both BTC and ETH.

Related Reading

ETF Outflows Trigger Bitcoin And Ethereum Price Crash

The latest plunge in Bitcoin and Ethereum prices is linked to substantial outflows from US Spot Bitcoin ETFs. Crypto analyst Jana on X social media highlighted this event as one of the most severe weekly downturns of the quarter, with Bitcoin dropping 13.3% in seven days and Ethereum falling 17.8% over the past month. Currently, Bitcoin is trading just above $106,940 while Ethereum is around $3,870, both having suffered significant drops from their recent highs.

Data from SoSoValue indicates that Thursday, October 16, witnessed an enormous $536.4 million in daily net outflows from Spot Bitcoin ETFs, marking the largest single-day negative flow since August 1, when $812 million left the market. Among twelve US Bitcoin ETFs, eight experienced significant outflows, led by $275.15 million exiting Ark & 21Shares’ ARKB, followed by $132 million from Fidelity’s FBTC. Notably, funds managed by other major firms like Grayscale, BlackRock, Bitwise, VanEck, and Valkyrie also reported substantial withdrawals.

The outflows have continued for a third consecutive day, with October 17, just yesterday, recording a significant outflow of $366.5 million. The sustained negative ETF flows highlight decreasing investor confidence and suggest that the broader market downturn may persist soon. Coupled with the $19 billion liquidation event last Friday, increasing ETF outflows may amplify pressure on an already vulnerable market.

Experts Warn Of Deeper Market Pain Ahead

Numerous experts suggest that the crypto market still has potential for further decline. Information from Polymarket, one of the world’s largest prediction platforms, shows that 52% of participants anticipate Bitcoin will drop below $100,000 before the end of October. Veteran economist and Bitcoin critic Peter Schiff has also warned that the upcoming months could prove disastrous for the industry, predicting widespread bankruptcies, defaults, and layoffs as Bitcoin and Ethereum face another significant decline.

At the same time, technical analysts are pointing towards indications of profound weakness in Ethereum’s structure. According to Crypto Damus, Ethereum has breached significant weekly support and is showing a bearish configuration on the charts. He indicated that MACD is on the verge of “crossing red,” suggesting a considerable risk for a crash.

Other analysts, such as Marzell, have echoed similar concerns, stating that Ethereum is approaching a “crash zone.” However, he also pointed out the $3,690 – $3,750 range as a potential short-term demand area where buyers might re-enter and spark the next upward movement.

Related Reading

Featured image from Unsplash, chart from TradingView