The abrupt and forceful market correction resulting from geopolitical shockwaves acted as an unparalleled stress test for the cryptocurrency landscape, revealing significant disparities in network architecture. While the multi-billion-dollar liquidation event caused prices to plummet universally, Solana exhibited exceptional resilience, while the Ethereum network faced thinning liquidity amid peak volatility.

Why Solana’s High-Performance Design Continues To Stand Out

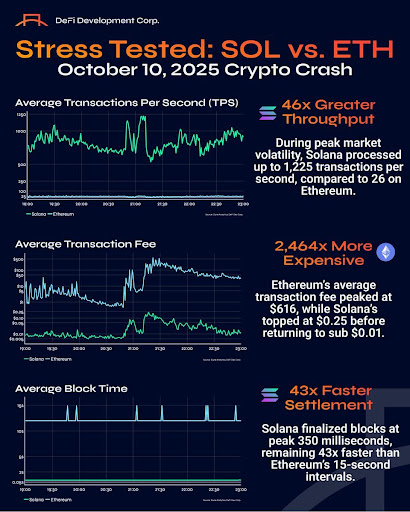

In a post on X DefDevCorp, a Nasdaq-listed Solana Digital Asset Treasury (DAT), revealed that during the largest liquidation event in crypto history last Friday, most of the market froze while Ethereum struggled. In contrast, Solana remained robust, navigating one of the most tumultuous trading sessions ever documented.

Related Reading

At the height of the volatility, Solana handled 1,225 transactions per second, finalized blocks in merely 350 milliseconds, and witnessed transaction fees briefly peak at $0.25 before settling below $0.01. On the other hand, ETH’s infrastructure faltered under demand, struggling to exceed 26 TPS. Its block times extended to 15 seconds, and average gas fees skyrocketed to $616, effectively excluding users and rendering the chain inoperable during the crisis. ETH became unreliable, impractical, and largely unusable amidst the turmoil.

As highlighted by DefiDevCorp, when users are priced out and transactions can’t clear, the network effectively becomes offline. In times of high demand, a blockchain’s core promise of being accessible, affordable, and reliable must hold firm. After nearly 20 months of continuous uptime, navigating its busiest periods, it’s clear that SOL’s ongoing upgrades and optimizations have significantly benefitted its performance.

DefiDevCorp concluded that no other chain presently comes close to managing global value transfer at this magnitude, under such extreme circumstances, with similar performance levels. The key takeaway from the firm’s post is that only SOL remains fast, affordable, and functional, even when global markets face turmoil.

Why SOL Price Doesn’t Reflect Its Reliability

A researcher at alphapleaseHQ and advisor at KaminoFinance, Aylo, also noted that he had assets and Decentralized Finance (DeFi) positions open on both Solana and Ethereum during the crypto market downturn last Friday. Throughout this period, he experienced no issues with the SOL network, while the ETH network became unusable due to excessive costs, often resulting in market crashes, and the Rabby wallet also failed.

Related Reading

Aylo further expressed that ETH maxis should be more critical of their L1’s performance. Consequently, SOL continues to demonstrate it’s the most efficient and reliable blockchain under actual market pressure present in the crypto sector. He emphasized that SOL’s valuation fails to reflect the resilience it is showcasing in the digital landscape.

Featured image from Adobe Stock, chart from Tradingview.com