Bitcoin is showing signs of recovery following one of its most significant corrections this year, with on-chain analytics indicating that the recent crypto downturn may have set the groundwork for a more robust rebound.

Summary

- Bitcoin’s open interest dropped by $12 billion during Friday’s crypto sell-off, marking one of the largest leverage adjustments in recent times.

- Key on-chain indicators, such as funding rates and the Stablecoin Supply Ratio, suggest stabilizing sentiment and increasing liquidity.

- Digital asset investment products registered US$3.17 billion in inflows last week, with BTC leading the pack at US$2.67 billion, showing ongoing investor trust.

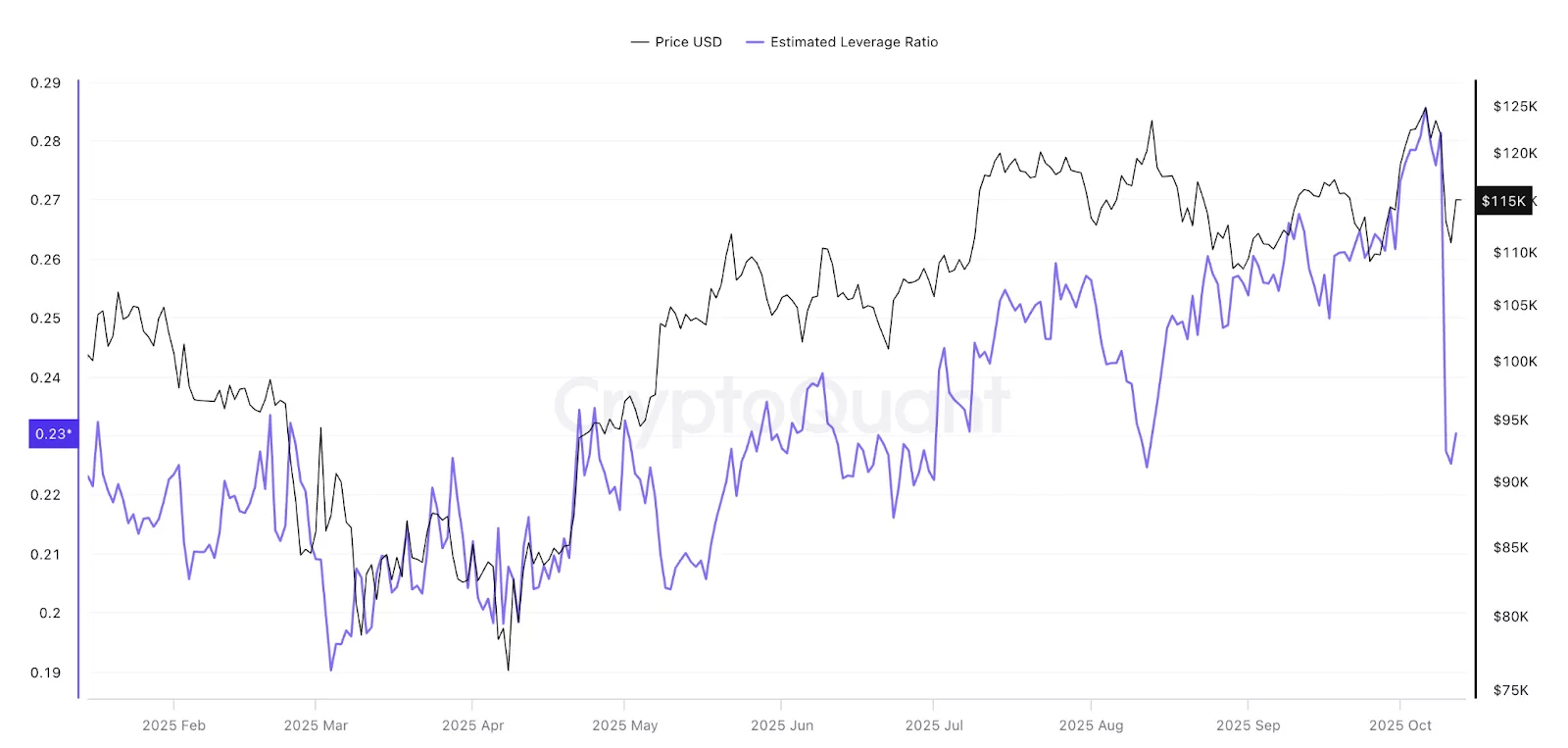

Bitcoin experienced one of its most dramatic corrections on Friday amidst a general market decline. A recent analysis by CryptoQuant indicates a $12 billion drop in open interest, falling from $47 billion to $35 billion.

The price of the asset plummeted to as low as $102,000, significantly under its recent peak above $126,000, before buyers stepped in over the weekend to aid its recovery. As of this writing, BTC (BTC) has bounced back to approximately $115,117, marking an increase of over 3% for the day.

Although the sell-off was challenging for numerous traders, it may have facilitated a much-needed reset conducive to longer-term gains. The analysis highlighted that funding rates, which turned negative during Friday’s capitulation, have since returned to slightly positive levels, suggesting normalizing sentiment as extreme bearish positions unwind.

Moreover, the BTC Estimated Leverage Ratio (ELR), which monitors how much leverage traders are employing relative to Bitcoin held on exchanges, also dropped sharply to its lowest since August. This decline indicates that excessive leverage has been cleared out, lowering the risk of further liquidations and highlighting broad deleveraging across the derivatives markets.

In addition, the indicator comparing Bitcoin’s market cap to that of stablecoins, known as the Stablecoin Supply Ratio (SSR), has fallen to its lowest point since April. A decreasing SSR implies that more stablecoin liquidity is available, potentially ready to be reinvested as confidence in the market returns.

Historically, extensive deleveraging events like these tend to precede significant price recoveries, indicating that the recent reset could signal a promising outlook for the upcoming months. Concurrently, robust capital inflows into the market bolster this perspective.

Bitcoin dominates $3b inflows amid Black Friday crypto downturn

Digital asset investment products experienced US$3.17 billion in inflows last week, elevating year-to-date inflows to a record US$48.7 billion. This indicates that, despite volatility caused by US-China tariff concerns, investors continue to channel funds into the crypto market.

Leading the inflows, BTC accounted for US$2.67 billion, raising year-to-date inflows to US$30.2 billion. Ethereum (ETH) followed with US$338 million, while SOL (SOL) and XRP (XRP) recorded comparatively smaller inflows of US$93.3 million and US$61.6 million, respectively. The drop on Friday resulted in limited outflows, suggesting that traders viewed the correction as an opportunity to buy, rather than a signal for panic selling.

Additionally, trading volumes reached unprecedented levels. Weekly volumes on digital asset ETPs hit US$53 billion, twice the 2025 weekly average, while Friday’s single-day volume reached a record-breaking US$15.3 billion.

The significant inflows and heightened trading volumes indicate that market participants maintain confidence in Bitcoin and the wider market despite short-term fluctuations. Coupled with substantial liquidity, this may support the ongoing rebound and lay the groundwork for a more sustained recovery in the future weeks.