New financial products come with known risks, and blockchain-based investment funds are no exception. Assets in blockchain funds have nearly tripled within a year – growing from $11.1 billion to almost $30 billion. New players like VanEck, Fidelity, BNP Paribas, and Apollo have recently rolled out on-chain investment funds, with more on the horizon.

Blockchain-oriented and digitally-native securities have the potential to become the next major investment trend, utilizing technology to create more affordable, quicker, and efficient financial products. However, as history indicates, investors must remain cautious and avert the same pitfalls that have characterized previous bubbles.

The SPAC frenzy, the non-traded REITs boom, and the crypto ICO surge all promised accessibility and financial inclusion but frequently left investors disadvantaged. These events highlight a crucial lesson: when emerging distribution channels meet hype, opportunists often exploit them with offerings that are riskier, more expensive, or less transparent than their traditional alternatives.

The challenge for investors in digital markets lies in the exploitation of new technology. Blockchain can reduce costs, enhance transparency, and unlock innovative investment opportunities. However, as blockchain funds gain mainstream traction, this very technology could be misused to recycle outdated strategies or impose high fees disguised as “digital progress.” The outcome may yield products that offer no genuine advantage over their traditional counterparts or, worse, impose greater costs and diminished safeguards on investors.

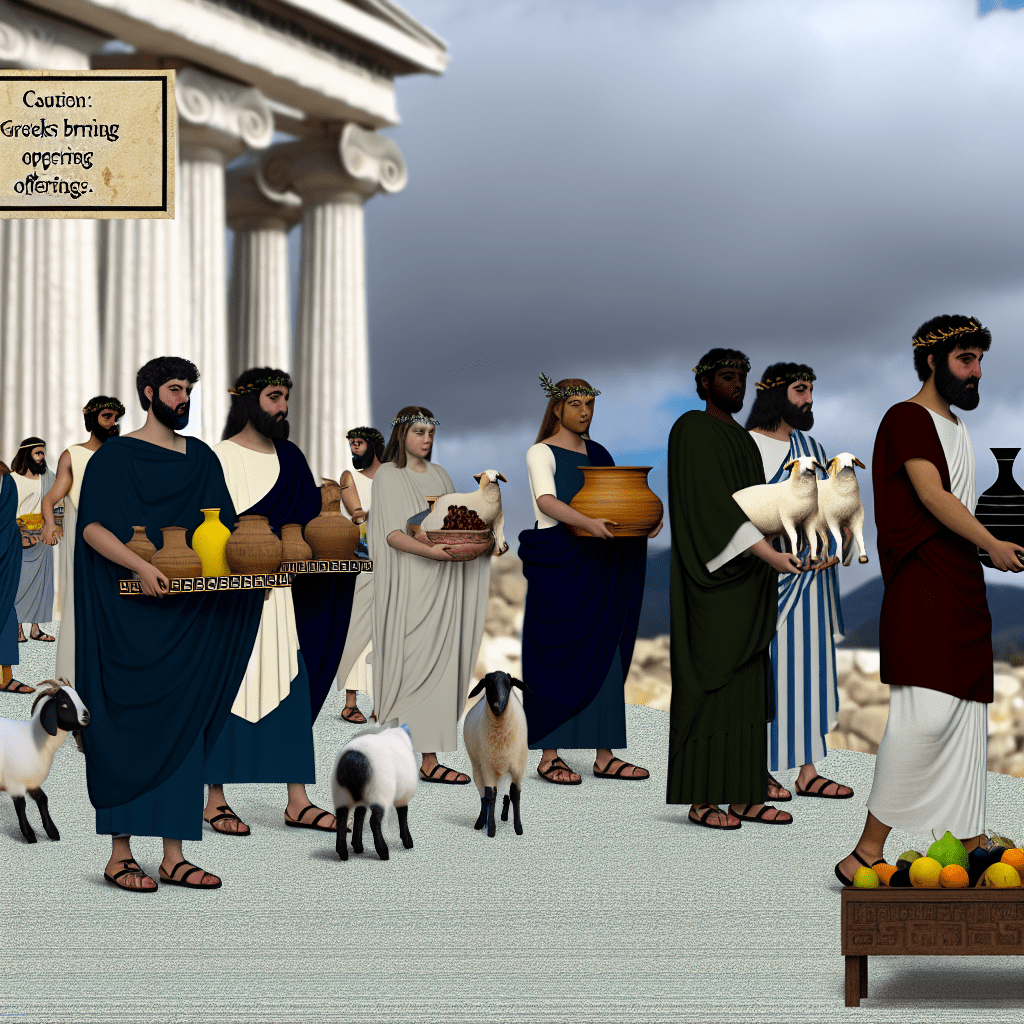

Investors should keep in mind this adage: Timeō Danaōs et dōna ferentēs – “Beware of Greeks Bearing Gifts.” Authentic blockchain-native products can yield potential benefits such as improved pricing efficiency and ongoing yield; still, investors must scrutinize offerings that leverage blockchain’s allure simply to repackage existing financial frameworks without real advantages.

The challenge for investors is to differentiate true advancement from Odysseus’ Trojan Horse.

A useful criterion is the fee arrangement. Post-trade processes performed on blockchain infrastructure should replace intermediaries to lower costs. If the total expense ratio exceeds that of traditional counterparts, proceed with caution. Renowned digital asset critic Stephen Diehl performed the calculation:

“BlackRock’s tokenized money market fund imposes management fees between 20 to 50 basis points. In contrast, the non-tokenized version charges only 0.12 basis points. This results in fees that can be up to 42 times higher.”

Investors shouldn’t pay premium prices for buzzwords.

Be discerning regarding which products are transitioning to on-chain structures and the reasoning behind it. Is the issuer tokenizing a product to offer real benefits to all stakeholders, or is blockchain merely a novel distribution path for overly convoluted and opaque products? Private funds that were previously off-limits to retail investors should not resurfacing as “exclusive blockchain options,” charging institutional prices for illiquid underlying assets. There’s a reason initial product innovation has centered on straightforward fund structures like money market funds.

Products claiming unusually high returns or obscured investment strategies warrant increased scrutiny.

Product architecture also conveys a narrative. A security issued natively on-chain from inception should be optimized and significantly reduce operational costs. Conversely, a tokenized security represents an existing asset replicated on a blockchain, frequently replicating conventional financial costs by retaining off-chain processes and characteristics. Issuers must clarify their on-chain product structures and the implications for costs, shareholder rights, and liquidity.

True democratization in capital markets signifies broader access and reduced barriers for investors without compromising protection. But one should not take the industry’s assurances at face value – watch for cost reductions and the involvement of respected, established institutions. A recent example of the latter is credit-rating agency Moody’s evaluating a proof-of-concept project to integrate its municipal bond ratings into tokenized assets. A simulated municipal bond was tokenized with a credit rating linked to the on-chain asset, showcasing how off-chain information can facilitate the scaling of on-chain securities products with enhanced clarity. Merging an industry-standard rating system with a new product suite gives investors a familiar and reliable reference point.

In April 2025, SEC Chair Paul Atkins emphasized the necessity of “leveraging blockchain technology to update aspects of our financial system” and underscored his expectation of “significant advantages from this market innovation for efficiency, cost reduction, transparency, and risk management.” Yet, this must operate within the SEC’s framework of maintaining investor safeguards. SIFMA reiterated the importance of sustaining investor protections amid market modernization in September.

While initial outcomes from blockchain technology promise these benefits and more efficient markets, it is not a panacea for all types of opportunists, ranging from run-of-the-mill exploiters to genuine bad actors. Investors must exercise the same diligence in digital markets that they apply in traditional settings: scrutinize fund prospectuses, question expense ratios, and insist on impartial third parties to provide the essential market data and trust that underpins traditional markets.

If issuers, investors, and other market players adhere to these standards as markets evolve, digital markets may realize the efficiency and authentic innovation that the term “democratization” has long promised.